The Canadian dollar/U.S. dollar exchange rate has traded within a broad range for over 60 years [and at this juncture] would appear to have a lot more upside than downside potential. This articles illustrates that point of view with charts and puts forth suggestions on how to play the coming upside.

years [and at this juncture] would appear to have a lot more upside than downside potential. This articles illustrates that point of view with charts and puts forth suggestions on how to play the coming upside.

The comments above and below are excerpts from an article by Geoffrey Caveney (DrStrangeMarket.squarespace.com) which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read. Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner.)

Short Term View

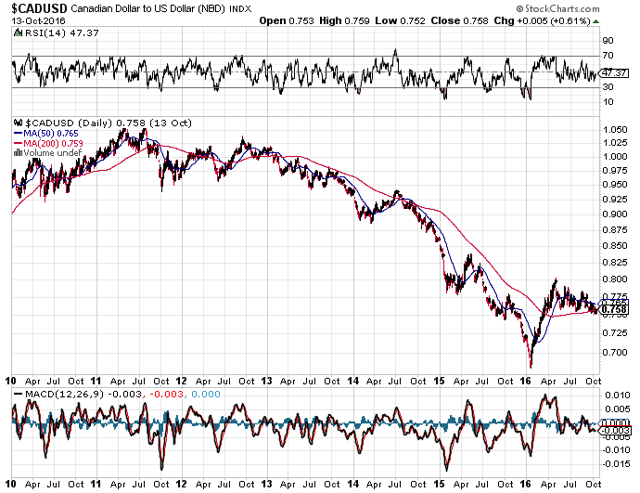

The Canadian dollar/U.S. dollar exchange rate has traded in a very tight range for many months now remaining in a tight 0.75-0.78 range…and it hasn’t made a really big move since the rally from January to April [as illustrated in the chart below]:

Medium Term View

A look at the CAD/USD exchange rate on a longer time frame gives us a broader perspective:

…Note in particular the capitulation selloff in January and the sharp rally off of that low…This strongly suggests January was the long-term bottom in the Canadian dollar. Breaking below $0.70 was simply too low, and the market reacted accordingly.

Long Term View

I always like to look at extremely long time frames whenever possible to gain historical perspective. The following chart shows the Canadian dollar to US dollar exchange rate going all the way back to 1953:

The point here is that the Canadian dollar has traded within a broad range for over 60 years. It has not been in a long-term historical downtrend like many weaker currencies.

- The highs of 2007-2008 and 2011-2012, when a Canadian dollar was worth more than a US dollar, were just as strong as the old highs of the 1950s and the early-mid 1970s.

- The low of this January looks very similar to the low of 1986 – both around $0.70, both occurring together with oil price crashes.

Conclusion

…[From the above analysis it appears that:]

- the $0.70-$1.00+ range is very likely to hold, which means that the Canadian dollar has a lot more upside than downside and,

- with gold in a new bull market and oil having already gone through its bottom in February and rallied, the fundamentals also point to much more upside than downside for the loonie.

How to Play the Coming Upside of the Canadian Dollar

My preferred way to play the upside of the Canadian dollar is to invest in quality gold mining stocks that trade on the Canadian exchanges…When you buy them in US dollars as an American investor, but they trade in Canadian dollars, you make gains as the Canadian dollar rises. That adds currency leverage to the already powerful leverage of miners to the gold price.

Follow the munKNEE – Your Key to Making Money!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money