Investing in small-cap stocks (i.e. with a market cap of $5 billion or less) is not for everyone but for those brave souls that are willing to assume a little more risk they can, under the right conditions, be a very profitable choice…Small caps offer both advantages and disadvantages that I believe should be clearly understood before utilizing this asset class [and to that end] I offer this brief introduction into small-cap investing.

Investing in small-cap stocks (i.e. with a market cap of $5 billion or less) is not for everyone but for those brave souls that are willing to assume a little more risk they can, under the right conditions, be a very profitable choice…Small caps offer both advantages and disadvantages that I believe should be clearly understood before utilizing this asset class [and to that end] I offer this brief introduction into small-cap investing.

This post is an enhanced version (i.e. not a duplicate) of the original by Chuck Carnevale (FastGraphs.com) in that it has been edited ([ ]), abridged (…) and reformatted (structure & font) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide you with a faster and easier read. Enjoy!

to provide you with a faster and easier read. Enjoy!

The Major Advantage of Investing in Small Caps

On the positive side, there is a theoretical mathematical advantage to investing in smaller enterprises. A small company operating in a growth industry can often grow much more easily and faster than its larger counterparts. Here is where the law of large numbers comes into play. In theory, it is easier for a $1 billion company to grow into a $2 billion company than it would be for a $100 billion company to grow into a $200 billion company.

The Major Disadvantage of Investing in Small Caps

On the other hand, small size can also be a great disadvantage.

- Smaller companies generally do not possess the financial strength and/or flexibility that their larger counterparts do. Consequently, they are often faced with capital restraints that can inhibit their ability to maximize their growth. Additionally, being small can also jeopardize their survival in a weak economy or market.

- Furthermore, from the perspective of a passive shareholder, liquidity can also be a problem. Small caps typically have fewer shares trading, which often causes both liquidity and higher volatility issues.

- In the same context, smaller companies rarely pay a dividend because they generally need to keep and reinvest all or the majority of their available capital in order to fund future growth.

For these reasons, and many more, small companies are clearly riskier investments than large blue-chip enterprises.

Not All Small Caps Are the Same

What I have written thus far about small caps has been very general in nature. However, as I have often written in the past, generalities do not universally apply. Consequently, I contend that the only thing that small caps truly have in common is smaller size. Just as it is with their larger counterparts, there are many more differences between individual small companies than there are similarities… Investing in small caps should be no different than investing in larger companies. In other words, the same prudent investing rules apply.

When investing in small caps, comprehensive research and due diligence becomes even of greater importance. Furthermore, when looking for a small-cap investment, selectivity is crucial. The central idea is to find the very best small company you can, with attractive growth prospects that is also available at a sound valuation.

10 Interesting Small-Cap Research Candidates

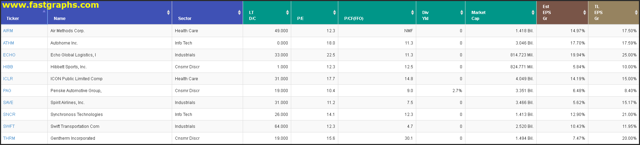

In preparation for this article…I literally conducted an earnings and price correlated review of all 600 constituents in the S&P 500 Small Cap index…[and have] come up with 10 rather intriguing-looking small companies that are also attractive from a valuation perspective… listed in alphabetical order below. The portfolio review lists them by ticker, name, sector, debt to capital, P/E ratio, price to cash flow, dividend yield, market cap, near-term estimated earnings per share growth and longer-term trend line estimated EPS growth.

Since many readers may not be familiar with each of these small-cap selections:

- I offer…[an] overview of each of the 10 research candidates HERE.

- Courtesy of S&P Capital IQ, I include

- a short business description on each,

- a few slide excerpts from each company’s corporate presentations and a link to the full presentation and

- earnings and price correlated historical F.A.S.T. Graphs™ on each with a calculated return forecast out to 2017 based on what I considered the most appropriate valuation reference line…

Summary and Conclusions

…This article represents just a brief introduction into small-cap investing. With that said, I feel compelled to warn the reader against holding over-generalized views on small-cap stocks as the only thing that all small caps have in common is size. Consequently, I reject common refrains such as small caps outperform or recently outperformed large caps. Sometimes they do, or have, and sometimes they don’t. There are really good small-cap investments, and there are really bad small-cap investments. It’s not size that makes the business nor is it size that ensures growth.

Just as it is with all stocks, there are many factors that need to be considered, evaluated and analyzed [but]… comprehensive research and due diligence can be even more challenging because it is very difficult to find quality research on small companies…Therefore, if you choose to invest in small caps, be prepared to put in some extra work.

For some, the potential rewards may be worth it…

Want more such articles? “Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner of page).

Get engaged: Have your say regarding the above article in the Comment section at the bottom of the page.

Wanted! Contributors of original articles & links to other informative articles that deserve a wider read. Send to editor(at)munKNEE(dot)com.

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

Related Articles From the munKNEE Vault:

1. My Silver Stock Picks Are Up 95% YTD & the Best Is Yet to Come

In December I listed my top 5 overall silver stocks to buy in 2016 and, since almost 4 months have passed since that article was published, here’s an update on how each of the picks have performed (up 94.55% on average in the 1st quarter compared to “only” 51.2% performance for the SIL)

While gold has increased 19% year-to-date, mining stocks are up 56% on average over the same time but, interestingly, the extent of the average increase in price depends on the market cap of the stock.

Resource stock returns during the past few years have been downright lousy but that’s not to say investors should neglect the sector. It offers tremendous value currently and has historically produced some eye-popping gains. Here is a portfolio of 10 stocks we think will outperform long-term during both good and not-so-good times.

4. Any 1 Of These 20 Stocks Could Be A 10-Bagger At Higher Gold & Silver Prices

The list of stocks provided in this post are what I consider “must own” stocks if you want big returns. Why? Because most of them are potential 10-baggers at higher gold & silver prices. These are the cream of crop when it comes to risk/reward for large returns. They all have solid projects and growth potential. They all have the “goods” and are extremely undervalued. Take a look.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money