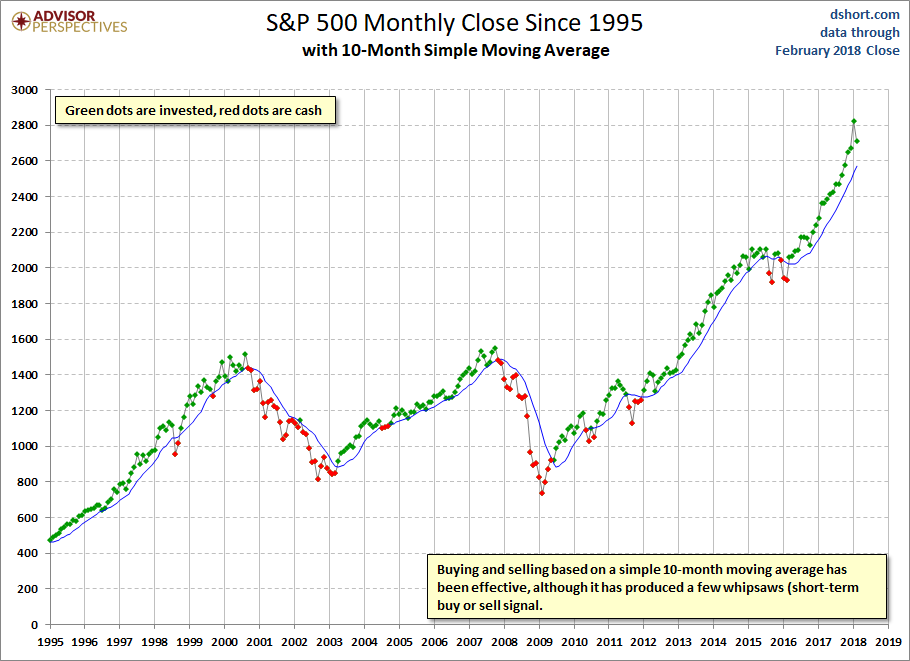

Buying and selling based on a moving average of monthly closes can be an effective strategy for managing the risk of severe loss from major bear markets. In essence,

managing the risk of severe loss from major bear markets. In essence,

- when the monthly close of the index is above the moving average value, you hold the index,

- when the index closes below, you move to cash but

- the disadvantage is that it never gets you out at the top or back in at the bottom and

- it can produce the occasional whipsaw (short-term buy or sell signal), which we’ve seen most recently in 2016.

Nevertheless, a chart of the S&P 500 monthly closes since 1995 [see below] shows that a 10- or 12-month simple moving average (SMA) strategy would have ensured participation in most of the upside price movement while dramatically reducing losses.

The original article has been edited here for length (…) and clarity ([ ]) by munKNEE.com – A Site For Sore Eyes & Inquisitive Minds – to provide a fast & easy read.

10 and 12-month Simple Moving Average (SMA) Monthly Closes Since 1995

(Click on image to enlarge)

Here is the 12-month variant:

(Click on image to enlarge)

The 10-month Exponential Moving Average (EMA)

The 10-month exponential moving average (EMA) is a slight variant on the simple moving average. This version mathematically increases the weighting of newer data in the 10-month sequence. Since 1995 it has produced fewer whipsaws than the equivalent simple moving average, although it was a month slower to signal a sell after these two market tops.

(Click on image to enlarge)

10- and 12-month Moving Averages in the Dow From 1928 to 1940

A look back at the 10- and 12-month moving averages in the Dow during the Crash of 1929 and Great Depression shows the effectiveness of these strategies during those dangerous times.

(Click on image to enlarge)

The Psychology of Momentum Signals

Timing works because of a basic human trait. People imitate successful behavior. When they hear of others making money in the market, they buy in. Eventually, the trend reverses…[and] when the trend reverses, successful investors sell early…

Implementing the Strategy

The strategy is most effective in a tax-advantaged account with a low-cost brokerage service. You want the gains for yourself, not your broker or your Uncle Sam.

Related Articles From the munKNEE Vault:

1. The Advance-Decline (A-D) Line Shows Market Action BEFORE Significant Declines – Check It Out

Many of us think Wall Street is using sophisticated tools to make money. It is…but big Wall Street firms also use simple tools to make money. One tool many large firms use is the advance-decline line.

2. Candle Charts Anticipate A Bounce Or Break In Price Allowing Us To Take Appropriate Action

People seem to think that since they hear that so few people are successful in trading, that there must be a complicated process to complete in order to make money. The truth is that the simpler we make trading, the more profitable it seems to be…so this week I decided to discuss a simple technique that is often overlooked when traders are reading charts, specifically candle charts.

3. Yes, You Can Time the Market – Use These Trend Indicators

Remember, the trend is your friend and now you have an arsenal of such indicators to make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it.

4. Ride the Market Waves With These 6 Momentum Indicators

It is hard to know what to buy or sell let alone just when to prudently do so. Thank goodness there are indicators available that provide information of stock and index movement of a more immediate nature to help you make such important decisions. This article describes the 6 most popular Momentum Indicators. If ever there was a “cut and save” investment advisory this is it!

5. Make Money! Time the Market Using Market Strength Indicators- Here’s How

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on!

6. Technically Speaking: What Exactly Is “RSI?”

Exactly what is RSI and how is it calculated?

7. Portfolio Diversification: Do You Need It?

Do you really need portfolio diversification?…Everyone assumes that broad asset class portfolio diversification is advantageous…[as it] reduces the risk associated with events that can trigger a decline in any one asset class…[and makes] financial planning more reliable and predictable by reducing the variations in portfolio performance from year to year. Simply put, portfolio diversification is a sound investment practice but, [that said,] exactly how much risk reduction, in actual numbers, is obtained through application of this philosophy? [Bottom line, is] asset class diversification all that it’s cracked up to be? This article…addresses…the benefits of diversification among various classes.

8. Averaging Down: Bad Strategy?

Whenever some financial “pundit” says that the best way to get into a stock is by averaging down, we sometimes cringe. Why? Because, at best, you’ll be getting into a stock at a lower average price…but more importantly, you can be getting into a stock that’s poised to sink much, much lower and that’s a risk no one wants to take.

9. Use the “Graham Formula” To Determine the Fair Price of a Stock – Here’s How

Knowing how to properly value a stock is probably the most important skill for a value investor to develop and over the last fifty years one of the most popular methods to discover the fair price of a stock has been the Benjamin Graham formula.

10. Use Beta To Get the Level Of Risk In Your Portfolio Just Right For You – Here’s How

Using beta to build a portfolio is a smart and easy thing to do. All you have to do is make sure you understand your risk tolerance and not build a portfolio that is overweight in one sector of the stock market…

For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money