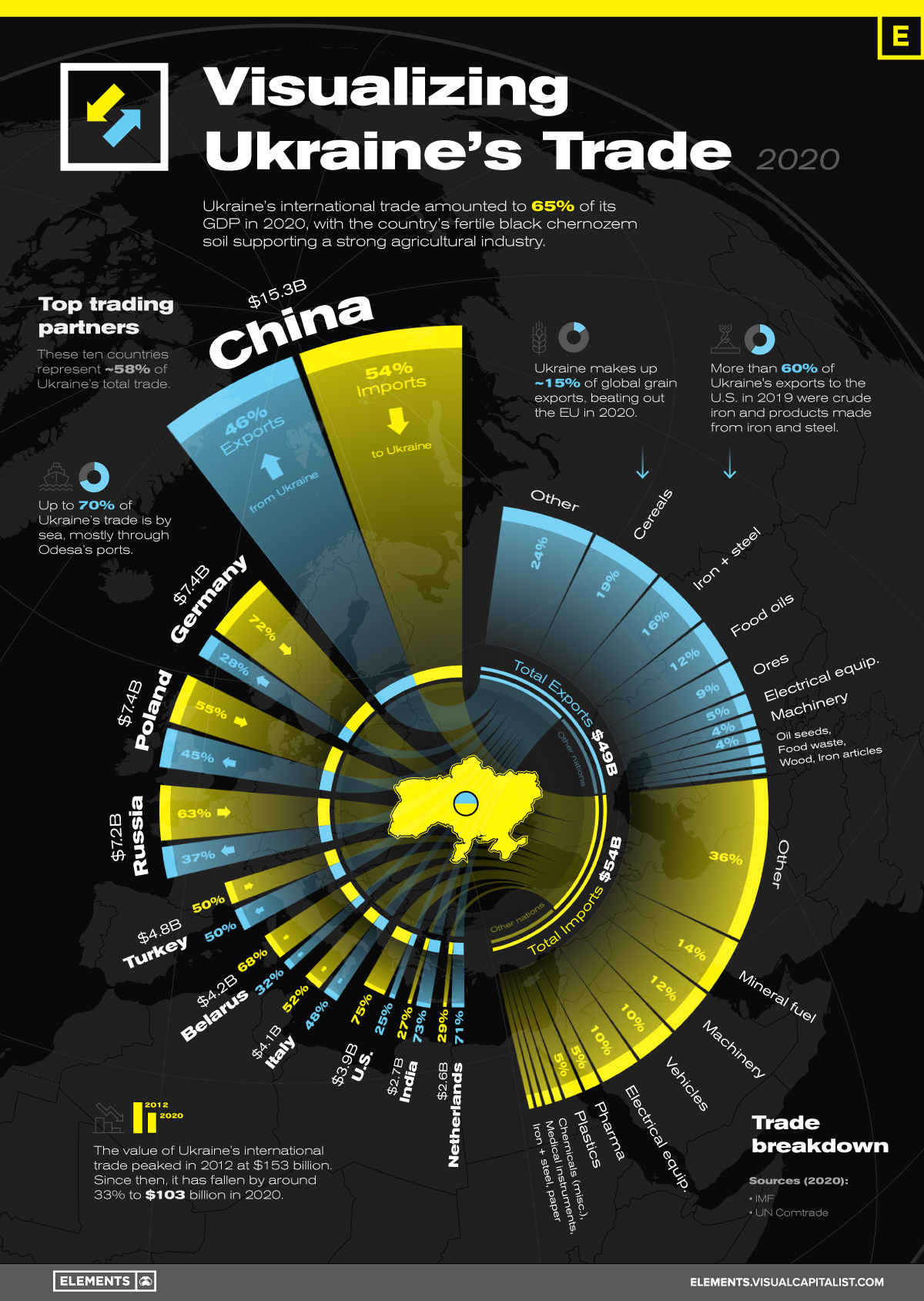

…The current Russia-Ukraine conflict continues to reshape geopolitical relations and international trade and to give context to the situation, we’ve created this graphic using IMF and UN Comtrade data to showcase Ukraine’s largest trading partners and goods traded in 2020.

This article is sponsored by Chris Oswald. Go HERE to sponsor your own.

International trade was equal to 65% of Ukraine’s GDP in 2020, totaling $102.9 billion of goods exchanged with countries around the world but that was down 33% from its peak back in 2012 and will now be irreversibly disrupted as a result of Russia’s full-scale invasion on February 24th, 2022.

The above version of the original article by Niccolo Conte (visualcapitalist.com) was edited [ ] and abridged (…) to provide you with a faster and easier read. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

Sponsor an article for $10; Receive a 258-page book as a thank you. Click here

Related Article on Ukraine From the munKNEE Vault:

1. Ukraine: A MAJOR Source Of World’s Natural Resources (+3K Views)

This article points out the MAJOR role the country has in industrial metals, agriculture and industry in Europe and the world. It begs the question: “To what extent would an invasion of Ukraine disrupt the world’s supply and drive the stock prices of companies supplying these products dramatically higher?”

Russia’s invasion of Ukraine is an effort by a relatively small country trying to use military action and threats, backed up by a nuclear arsenal, that can in no way compare in terms of resources to those it is threatening and, as such, the combined impacts of the imposed sanctions on its small economy will likely be significant and widely felt.

3. Why SWIFT Matters To Russia

There are 862 individual SWIFT codes of Russian origin, belonging to somewhere around 300 financial institutions out of a total in the bank network of 11,000 and removing them from the network would prevent those banks from using the network to facilitate transfers.

4. Why Is Russia Stockpiling Gold?

What should we make of the fact that the Central Bank of Russia has been steadily amassing vast gold reserves since 2015?

5. Would Major Sanctions Against Russia Hasten End of USD As World’s Reserve Currency?

Russia is a huge supplier of oil and gas — traded in US dollars — which gives it both leverage over near-term energy flows and, far more ominous for the U.S., the ability to threaten the dollar’s reign as the world’s reserve currency – and it’s taking some big, active steps towards that goal.

6. Russian Economy Entering Into A Death Spiral – Here’s Why (+2K Views)

A prominent European think tank contends that the Russian economy may be entering into a death spiral, driven by a combination of factors, including low energy prices, government mismanagement, a collapse in the Russian ruble’s value and Western sanctions.

7. Financial Warfare: What Would Russia’s Sale of US Treasury Holdings Mean for U.S.? (+2K Views)

News events from the Crimean Peninsula have increased paranoia in the mainstream financial press and certain corners of the internet [that Russia, in response to any economic sanctions implemented by the West, might engage in some form of retaliatory financial warfare.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

2 comments

Pingback: Ukraine-Russia War: Implications For Ukraine, the World & Your Investments - munKNEE.com

Pingback: Ukraine: Its Geography, Population Make-up and Economy - munKNEE.com