…With government spending likely to increase, particularly if Democrats are able to take control of the Senate too, the stage is set for a continued increase in the price of gold. [Here’s why.]

Here are four factors to look at when considering how and why gold will benefit from rising government spending.

1. More Government Debt

…[Given that] the government feels the need to resort to more stimulus spending to boost the economy, that will result in more government debt issuance…[and,] with the Federal Reserve highly likely to monetize much of that debt and increase the size of its balance sheet, the dollar will continue to weaken as a result of this debt issuance, increasing the relative value of gold.

2. Rising Debt to GDP Ratio

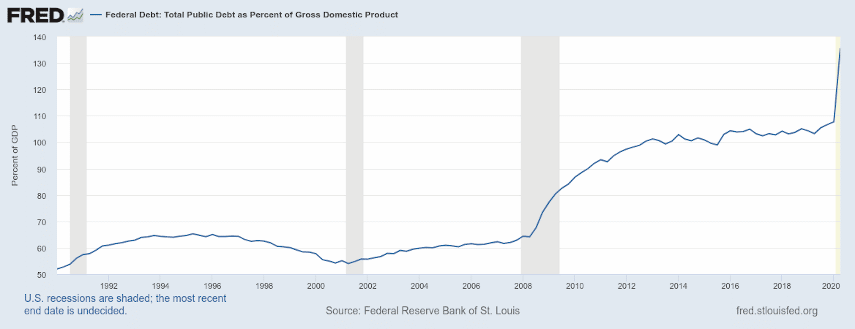

Debt-to-GDP ratio has often been used as a measure of the fiscal stability of a country. The U.S. had a high but manageable debt-to-GDP ratio of around 60-65% before the 2008 financial crisis and, after the crisis, the debt-to-GDP ratio exploded, reaching over 100% in 2013. As a result of the COVID-19 stimulus spending in early 2020, the debt to GDP ratio has skyrocketed yet again, to over 135%…

Debt-to-GDP ratio has often been used as a measure of the fiscal stability of a country. The U.S. had a high but manageable debt-to-GDP ratio of around 60-65% before the 2008 financial crisis and, after the crisis, the debt-to-GDP ratio exploded, reaching over 100% in 2013. As a result of the COVID-19 stimulus spending in early 2020, the debt to GDP ratio has skyrocketed yet again, to over 135%…

If the United States government’s debt-to-GDP ratio continues to spiral out of control there’s a very real risk of economic stagnation and that would likely mean poor returns for stock and bond investments, and an increasingly important role for gold in many investors’ portfolios.

3. Inflating Debt Bubble

It isn’t just governments who are heavily indebted in the United States – corporations and households are carrying record amounts of debt as well. With a worsening economy and rising unemployment, that leaves them liable to severe financial difficulty if the economy gets any worse.

- Corporations currently hold 50% more debt than they did during the 2008 financial crisis and, should the economy worsen they may find that…they won’t be able to continue doing so….

- With millions of Americans still out of work, unemployment benefits expiring at the end of the year, and the prospect of higher taxes in 2021, American households are on the edge and next year could tip many of them over the edge.

4. Increased Stimulus Boosts Gold

Monetary stimulus in the aftermath of the 2008 financial crisis, in the form of quantitative easing, flowed into the financial system and from there into gold investments causing…the gold price to nearly tripled from its 2008 lows to its 2011 highs….The stimulus in early 2020 similarly helped lead to a spike in the gold price, and we’re witnessing a lull in gold’s growth as markets pause to see which way the government will go.

Every indication is that the government wants to continue spending money, and that the Federal Reserve wants to continue pursuing accommodative monetary policy. If that ends up being the case, and trillions more dollars enter the financial system, that should provide a significant boost to the gold price.

Now Is the Time to Invest in Gold

…With the current drop in the gold price…[now is the time] to get into gold before it really takes off. Once…the new Congress begins its spending negotiations in earnest, things will start to move quickly.

…Act now…so that when push comes to shove, you won’t be bemoaning your lost assets [but, instead] benefiting from the peace of mind you’ll get from making gold a part of your investment portfolio.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money