…An alarming number of Americans aren’t saving for retirement. They may have “predicted the rain,” but for whatever reason—and there are many we could point to—they haven’t gotten around to “building the ark.”

Predicting a major economic or financial event—whether that’s a recession, market downturn or even your own retirement—requires that you also take action. Otherwise your prediction was meaningless. This is why I’m always recommending that investors:

- have a 10% weighting in gold, split evenly between physical bullion and gold mining equities, which have historically performed well in times of great volatility and

- save and invest every single month, particularly in high-quality companies that are not only paying dividends but also growing those dividends and this should be as automatic, consistent and pain free as brushing your teeth. After all, what prevents us from getting a mouth full of cavities is not the one or two visits to the dentist every year—it’s the everyday, “boring” act of brushing and flossing. Growing your wealth should be just as incremental and steady…

Alarming Number of Americans Unprepared for Retirement

Unfortunately, an alarming number of Americans aren’t saving for retirement. They may have “predicted the rain,” but for whatever reason—and there are many we could point to—they haven’t gotten around to “building the ark.”

- 20% of working Americans have nothing saved for retirement and

- 40% of Americans are so short on cash right now that they wouldn’t be able to afford a $400 “emergency expense” despite a stellar jobs market and booming stock market.

So who’s saving in America, and who isn’t?

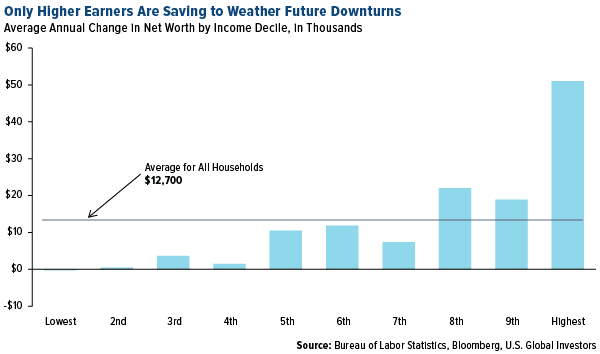

A recent report by Bloomberg’s Aaron Brown tackles this very question by breaking down U.S. households into 10 separate income brackets.

- Unsurprisingly, it’s the earners at the top who are able to save the most, with the very highest earners’ net worth growing an average $51,000 on an annual basis.

- Households in the bottom decile, meanwhile, end up losing an average $300 year-over-year, as they must borrow or sell assets to support spending. This group is most vulnerable and “will face problems in the next recession,” Brown writes, adding that “they may find it difficult to climb to financial security.”

What can be done to ensure more people are able to save and invest for when the “rain” starts to fall?

Interestingly, Brown makes the case that:

- neither expanding entitlement programs

- nor a wealth tax

…is the answer as “the U.S. already redistributes enough income to allow low-income households to spend more per earner on average” than many higher-income households…Instead, a “better path to reducing economic insecurity” would be to shore up government pensions and Social Security, among other strategies.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money