We’re all aware that this country owes a lot of money, but no one cares because we’re leading pretty good lives here. We have yet to feel the consequences of being broke, but that won’t last long. This article shares some details on this bankruptcy, and offer some actions that might help…

Some things are already breaking, and an ultimate breakdown is on the way:

- Tax receipts won’t pay for Social Security and Medicare benefits.

- We will have spent all of the Social Security Trust by 2034.

- Medicare monies will only last until 2026.

- Some large pension funds are broke, and are likely to renege on their promised benefits.

The above might sound like we have time, but we don’t, especially since nothing is being done to head off these catastrophes. It’s full speed

ahead into the reckoning.

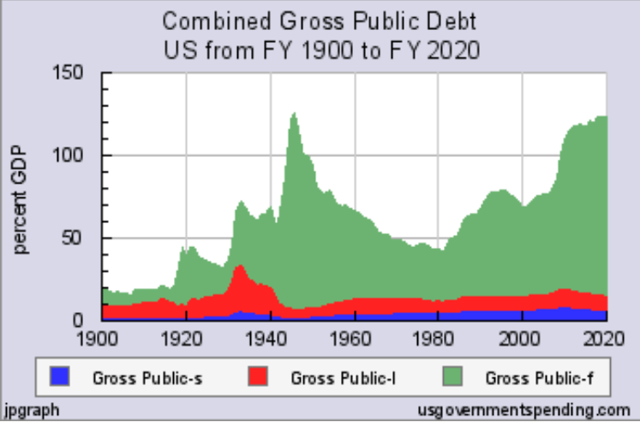

The National Debt

As shown in the following graph, the reported national debt of $34 trillion is currently 120% of GDP, a level only seen before in the wake of World War II… We use a percentage of GDP to convey our ability to pay and, if every dollar of output our country generates this year were used to pay our debt, it would not be enough. Of course we’re not obligated to pay right away and therein lies our ho hum attitude; we trust some miracle will solve the problem some day.

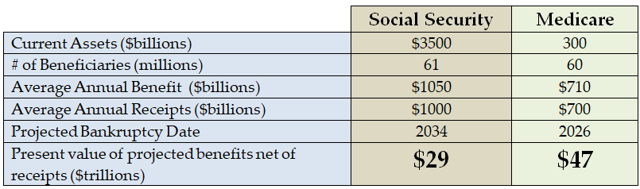

That’s not the whole story. We’ve made promises to older people that simply can’t be kept unless the promises are changed (broken) and we burden today’s young people with much higher taxes; the fixes are not pretty. As shown in the last row of the following table,

- the present value of the promise to pay Social Security benefits is $29 trillion more than projected receipts,

- and adding Medicare’s $47 trillion promise brings our off-the-books liability to $76 trillion, more than twice the published liability.

- Our all-in national debt is an astronomical 390% of GDP.

What you should know about Social Security and Medicare

Source: Compiled by PPCA Inc. from various sources

Source: Compiled by PPCA Inc. from various sources

What Can Congress Do?

According to Professor Laurence Kotlikoff in his The US is dead broke and the tax bill does nothing to help matters Congress can address these problems by:

- reducing spending – a 47% permanent spending cut

- or increasing taxes – a 60% permanent tax hike

- or a combination of both

- or it can print money, i.e. debase the currency…

Time will tell what Congress decides, but in the meantime, we can prepare for what is likely to be very tough times.

What Can We Do?

Our best response is:

- to not rely on Social Security and Medicare,

- and if we think debasing is a possibility, we should save in a “currency” other than the U.S. dollar…[and] those other forms include:

- precious metals,

- real assets like real estate,

- and perhaps foreign and crypto currencies. I say “perhaps” because foreign and cryptos can be volatile, and might not hold up in a U.S. hyperinflation.

Those with defined benefit pension plans are more fortunate than those without because they have a presumed annual benefit from a viable company or union rather than the government but, they too, would suffer from debasing, plus

- some pension plans are broke, and the insurance behind them from the Pension Benefit Guarantee Corporation (PBGC) is on the brink of bankruptcy…The PBGC is going to break unless taxpayers pick up the slack, which is totally unfair.

Conclusion

We are broke and have decided to ignore it. The implied hope is that the repercussions will be in someone else’s lifetime and that they won’t be too painful. This is simply wishful thinking.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money