The idea of maintaining a certain standard of living has become a foundation in our society today. Americans, in general, have come to believe they are entitled to a certain type of house, car, and general lifestyle which includes NOT just the basic necessities of living…but also the latest mobile phone, computer, and high-speed internet connection….Like most economic data, you have to dig behind the numbers to reveal the true story and this article does just that.

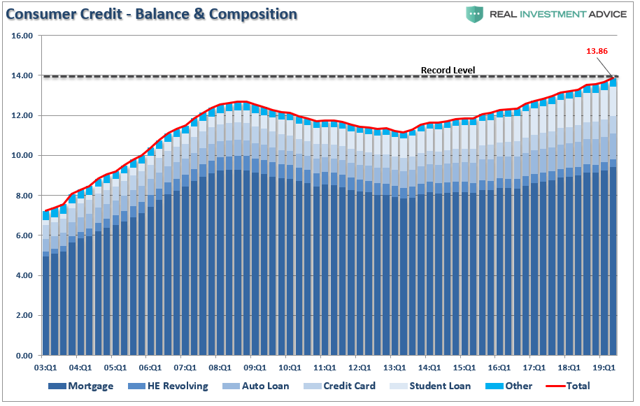

[Below are the findings of the latest] quarterly survey of the composition and balances of consumer debt…[from] the Federal Reserve Bank of New York. Note that consumers are at record debt levels with roughly $1 trillion more than in 2008.

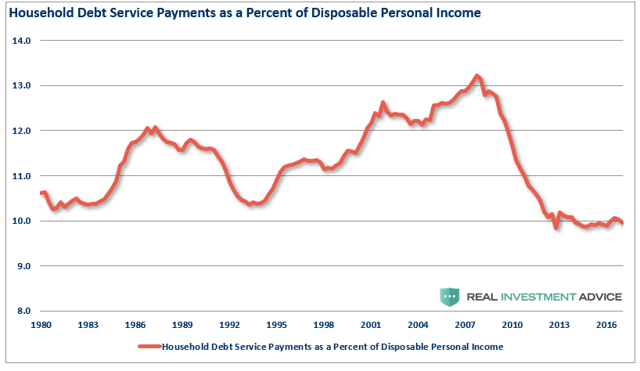

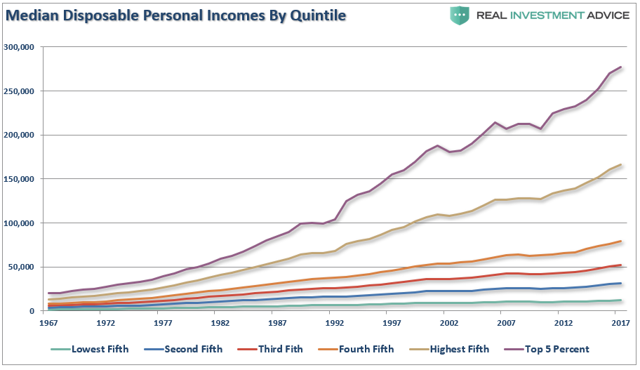

[It is said] that record levels of debt are irrelevant because of the rise in disposable personal incomes and the following chart is given as evidence to support that claim [but] the calculation of disposable personal income, which is income less taxes, is largely a guess, and very inaccurate, due to the variability of income taxes paid by households. More importantly, the measure is heavily skewed by the top 20% of income earners, needless to say, the top 5%.

As shown in the chart below, those in the top 20% have seen substantially larger median wage growth versus the bottom 80%. (Note: all data used below is from the Census Bureau and the IRS.)

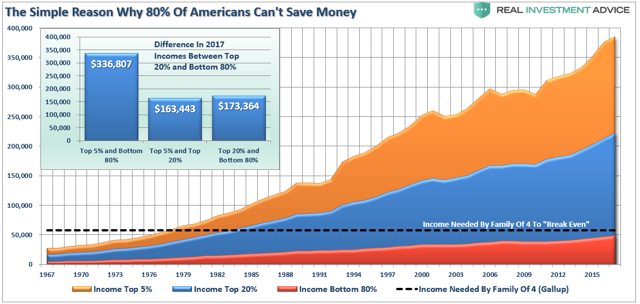

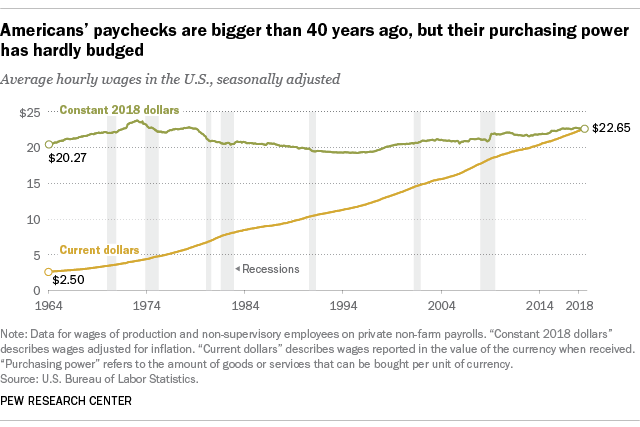

Furthermore, disposable and discretionary incomes are two very different animals. Discretionary income is what is left of disposable incomes after you pay for all of the mandatory spending like rent, food, utilities, healthcare premiums, insurance, etc. From this view, the “cost of living” has risen much more dramatically than incomes [but,] according to Pew Research, today’s real average wage (that is, the wage after accounting for inflation) has about the same purchasing power it did 40 years ago…

…The problem isn’t just the cost of living due to inflation, but [the fact that] the real cost of raising a family in the U.S. has grown incredibly more expensive with surging food, energy, health, and housing costs…Gallup surveyed to find out what the “average” family required to support a family of four in the U.S….[and] that number turned out to be $58,000 so, while the median income has broken out to highs, the reality for the vast majority of Americans is there has been little improvement.

…[As such, it] becomes problematic for the bottom 80% of the population whose wage growth has fallen far short of what is required to support their standard of living…

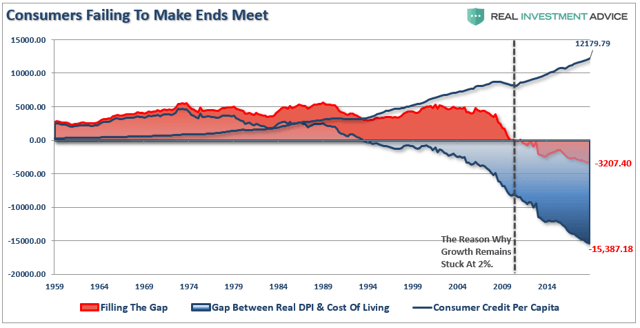

…Beginning in 1990, incomes alone were no longer able to meet the standard of living so consumers turned to debt to fill the gap. However, following the financial crisis, even the combined levels of income and debt no longer fill the gap. Currently, there is almost a $3,200 annual deficit that cannot be filled.

The gap between the standard of living and real disposable incomes is…clearly shown [in the chart] below.

Record levels of consumer debt is a problem. There is simply a limit to how much debt each household can carry even at historically low interest rates.

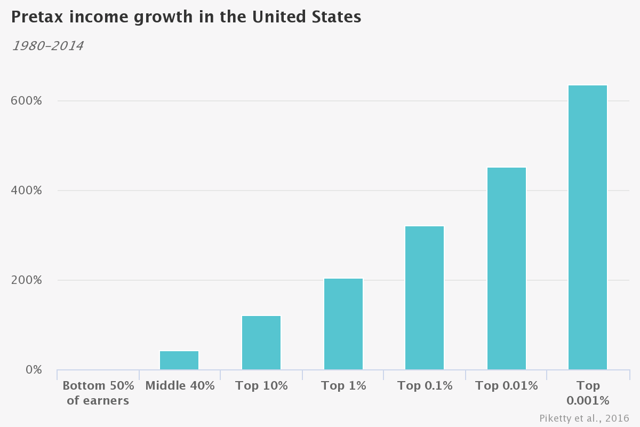

…A study from the Chicago Booth Review points out that, since 1980, there has been a sharp divergence in the growth experienced by the bottom 50% versus the top 20% of the population.

- The average pretax income of the bottom 50% of US adults has stagnated since 1980, while the share of income of US adults in the bottom half of the distribution collapsed from 20% in 1980 to 12% in 2014.

- In a mirror-image move, the top 1% commanded 12% of income in 1980 but 20% in 2014.

- The top 1% of US adults now earns on average 81 times more than the bottom 50% of adults; in 1981, they earned 27 times what the lower half earned.

Given the above information, it should not be surprising that personal consumption expenditures, which make up roughly 70% of the economic equation, have had to be supported by surging debt levels to offset the lack of wage growth in the bottom 80% of the economy.

More importantly, despite:

- economic reports of rising employment,

- low jobless claims,

- surging corporate profitability

- and continuing economic expansion,

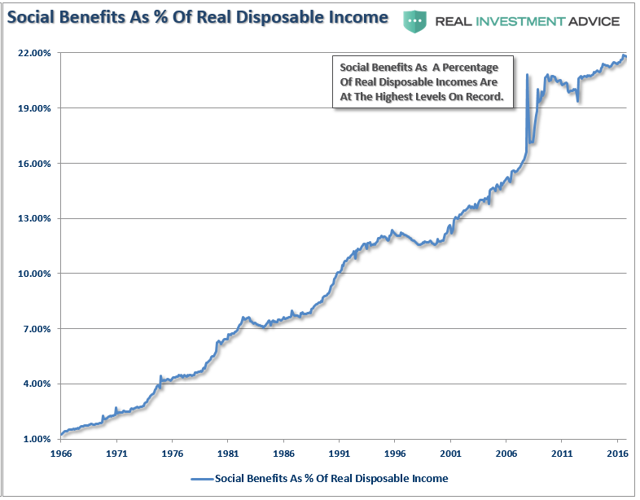

the percentage of government transfer payments (social benefits) as compared to disposable incomes has surged to the highest level on record.

This anomaly was also in the [above mentioned Chicago Booth Review] study [which noted that:]

- Government transfer payments have offset only a small fraction of the increase in pre-tax inequality…and fail to bridge the gap for the bottom 50% because they go mostly to the middle class and the elderly.

- Pretax income of the middle class (adults between the median and the 90th percentile) has grown 40% since 1980…[but] for the working-age population, post-tax bottom 50% income has hardly increased at all since 1980.

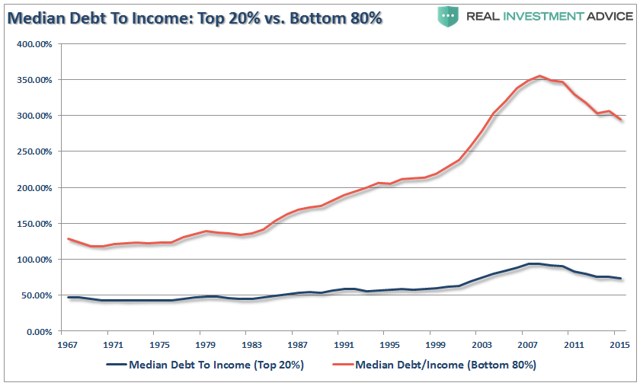

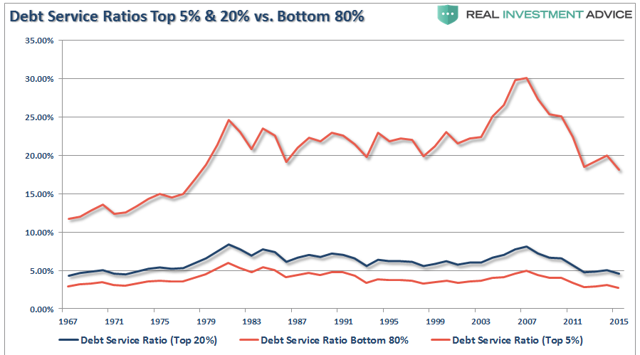

…There is a vast difference between the level of household indebtedness for those in the bottom 80%, versus those in the top 20%.

Of course, the only saving grace for many American households is that artificially low interest rates have reduced the average debt service levels. Unfortunately, those in the bottom 80% are still having a large chunk of their median disposable income eaten up by debt payments. This reduces discretionary spending capacity even further.

The problem is quite clear:

- With interest rates already at historic lows,

- the consumer already heavily leveraged,

- and wage growth stagnant,

the capability to increase consumption to foster higher rates of economic growth is limited…

The Next Crisis Will Be The Last

For the Federal Reserve, the next financial crisis is already in the works. All it takes now is a significant decline in asset prices to spark a cascade of events that even monetary interventions may be unable to stem…

- …the next decline in the markets will likely spur the fear that pension benefits will be lost entirely…[which will] require a massive government bailout to resolve it and that will cause a debacle of mass proportions.

- …Consumers will [also] contribute their fair share [to the debacle as] they are once again heavily leveraged with sub-prime auto loans, mortgages, and student debt.

- When the recession hits, the reduction in employment will further damage what remains of personal savings and consumption ability.

- The downturn will increase the strain on an already burdened government welfare system as an insufficient number of individuals paying into the scheme is being absorbed by a swelling pool of aging baby-boomers now forced to draw on it…

As debts and deficits swell in coming years, the negative impact to economic growth will continue [and,] at some point, there will be a realization…[that] it isn’t a crash in the financial markets that is the real problem, but, [rather,]

- the ongoing structural shift in the economy – a redistribution of wealth – that is depressing the living standards of the average American family,

The good news is that the problem can all be solved by the issuance of more debt but the bad news comes when there are no buyers willing to continue to fund fiscal irresponsibility.

The next crisis will be the great reset which will also make it the last crisis.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money