“Tracking every dollar you spend, save, and make, sounds like a lot of work but…come on, it’s so easy! [As a result,] you’ll be able to highlight your spending habits, target cuts where appropriate, and better plan for future spending…”

Prepared by Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money!

[Editor’s Note: This version* of the original article by Chris Reining has been edited ([ ]), restructured and abridged (…) by 31% for a FASTER – and easier – read. Please note: This complete paragraph must be included in any re-posting to avoid copyright infringement.]

“I used to be surprised when I found out a friend or family member didn’t track the money they had coming in and leaving…and, because they didn’t, they had no idea how much they spent in a month or in a year. They had no way to tell what their take home pay was for a year. [They had] no clue what they spent on utilities, their car, or new socks…[They were] flying blind…

Here’s how to organize your income and expenses:

1. Establish A Baseline Of Expenses

…If you’re not tracking how you spend your everyday dollars then you have no idea where to make improvements – you’re not conscious of your money so, first off, we need a baseline.

- Get a writing utensil and a notebook and start tracking every dollar you spend and every dollar you earn, down to the cent. If you have a smartphone, use something like Pennies.

- Just make sure to capture everything: the coffee and muffin in the morning, the lunchtime burrito at Chipotle, the two beers at happy hour, the movie Saturday night, new spark plugs for your car, your paycheck on Friday, and the $20 you made selling those unused toys on Craigslist.

At the end of the month tally up your expenses and tally up your income. What do you think? Warning: the results may shock you!

You may want to break your expenses down into different categories or even subcategories. I think you should feel free to make these categories unique to you and your situation:

- Car

- Entertainment

- Food

- Health

- Household

- Shelter

- Utilities

2. Track, Categorize & Record Your Expenses

I have tracked my expenses and income since 2006 using a spreadsheet with 3 columns.

- The 1st column is what I’m tracking along with the date.

- The 2nd column is the dollar amount of that item.

- The 3rd column is my savings account total and either a deduction or addition of that item depending if it’s an expense or income, respectively.

This is brain dead simple…[It’s] easy and fast…to use…For example, here’s what I track every single month:

- paycheck

- mortgage/condo fee

- brokerage (pay myself first)

- cash (the $100 a week I give myself for food and entertainment, tallied for the month)

- utility bill

- credit card bill…

I can build this out for a whole year which takes minimal time and then I simply plug the numbers in every month…Do what works best for you. If it’s simpler than what I do great. If you use more categorizes, all the better.

3. Track & Record the Monthly Return on Your Investments

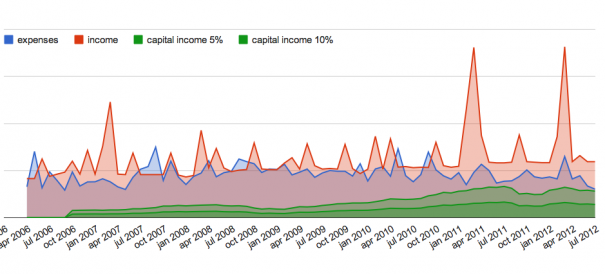

At the end of every month I add up my expenses…and…my income and I plug those numbers into another spreadsheet [along with] a third column with what my taxable investment account is worth. Based on the value of this investment account, it automatically calculates how much income my investments could throw off at either a 5% or 10% return.

4. Plot Your Monthly Income/Expenses/Investment Returns To Determine When You Can Retire

…Plot the figures every month…You will [then] be able to see yourself getting closer and closer to the crossover point. This is the most important point for early retirement because it is when your monthly investment income crosses above your monthly expenses and, when this point happens…you can seriously consider retiring because you are officially financially independent! No more income is needed from a job.

Plotting this is an exciting way to realize the dream of financial independence because it’s visual. It drives home the point that you can, in fact, retire early and the graph easily shows that these things help accelerate it:

- making more money so you can invest more (income),

- spending less money to make the crossover point lower (expenses)

- and investing what you save to reach the crossover point faster.

My Experience

I started getting serious in late 2010 about retiring early…I made changes where I could like getting rid of TV, brewing coffee at home, and brown bagging it for lunch. I can see from the graph that in early 2011 my expenses started to decrease and since then I have never had a month where my expenses exceeded my income. I also started to ratchet up how much money I was committing to my brokerage account in order to accelerate my nest egg, therefore decreasing the time it will take to reach the crossover point.

I have yet to have a month where my expenses fall in between the 5%-10% investment income line – the crossover point – but I am damn close. Last month I was short only a couple hundred dollars! Once my expense line consistently starts to fall squarely in between that 5%-10% investment income line is when I will start to seriously plan for early retirement.

A final note on budgeting

Budgets don’t work. I don’t believe in them mostly because people can’t stick to them…Reaching financial independence, like dieting, is about being conscious, making changes slowly, setting yourself up for success with measurable and attainable goals and making this your lifestyle.

If you believe you need budgeting to reduce your spending I like the idea of using the following tactic:

- After a few months of tracking your dollars you will have a pretty good handle on how much you’re spending [on specific categories of expenses.

- Then] put the cash [to meet those expenses] in an envelope with…[the category name] written on it….When the money is gone from the envelope, that’s it, and no cheating!…

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

Want your very own financial site? munKNEE.com is being GIVEN away – Check it out!A note from Lorimer Wilson, owner/editor of munKNEE.com – Your KEY to Making Money!:

“Illness necessitates that I spend less time on this unique & successful site so:

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money