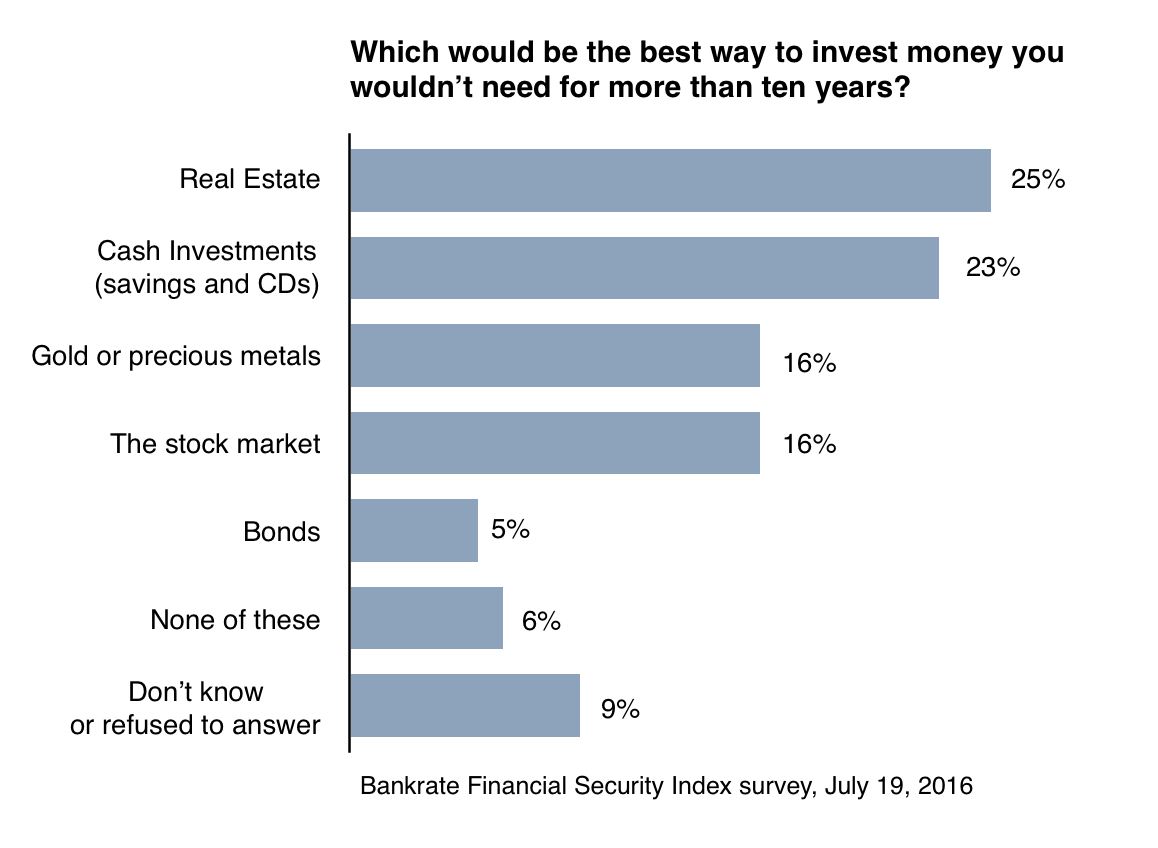

16% of investors chose gold as the best place to park money they wouldn’t need for more than ten years – the same number that chose stocks, according to a recent Bankrate survey. Another 6% chose bonds, while 25% chose real estate, and 23% said they would simply bank the money.

16% of investors chose gold as the best place to park money they wouldn’t need for more than ten years – the same number that chose stocks, according to a recent Bankrate survey. Another 6% chose bonds, while 25% chose real estate, and 23% said they would simply bank the money.

The comments above and below are excerpts from an article by Michael J. Kosares (usaGold.com) which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

To the typical Wall Streeter, these results represent a world turned upside down. CNBC’s Jim Cramer took one look at the results and lamented, “As someone who has lived and breathed stocks for most of my life, this is a horrendous finding but it’s not surprising.”

Data source: Bankrate/Claes Bell

In a recent Financial Times column titled appropriately, Brexit and the power of wishful thinking, Tim Hartford, the Underground Economist, sheds some light on the psychological transformation now taking place among investors:

“Perhaps the most important lesson is that we spend too much energy trying to foretell the future, and too little trying to be resilient whatever happens. . . Because scenarios are persuasive stories, they can help us face up to uncomfortable prospects and think clearly about possibilities we would rather ignore and, because scenarios contradict each other, they force us to acknowledge that, in the end, we cannot actually see into the future. As a result we move from ‘What will happen?’ to ‘What will we do if it does?'”

To become “resilient whatever happens” requires acting before, not after, the next financial crisis headlines the evening news.

- Many now reject the old financial religion that diversification amounts to the proper blend of stocks and bonds and little else. That formulation was acceptable when the money was sound and the federal government had not buried itself under a $19 trillion pile of debt. It held sway when confidence was running high and considerably more of the population than 17% were satisfied with the direction of the country (a polling number recently reported by Gallup).

- Now investors are looking to add safety and liquidity to their portfolios to augment the pursuit of capital gain and, as the Bankrate survey shows, are now turning to the preeminent safe haven – precious metals.

Even Willem Buiter, chief economist for Citigroup and a long-time critic of gold, now says he would own the metal. “Gold, in times of uncertainty and especially in days of uncertainty laced with negative rates, looks pretty good,” he concedes. At the same time, he sees stocks as in a bubble. He believes investors are “pinning their hopes on a long-term growth of corporate earnings which bear no relationship to underlying economic growth.”

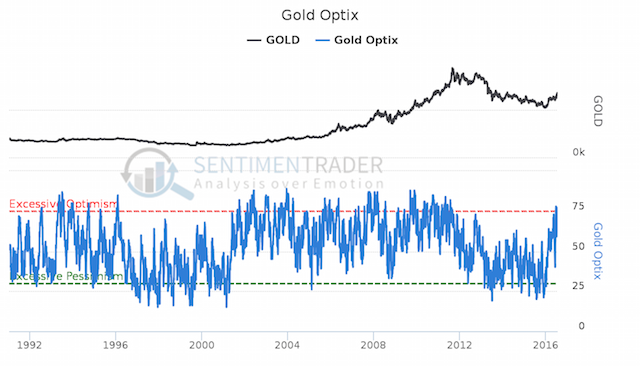

Buiter’s change of heart is symptomatic of the trend charted below by our friends at SentimentTrader which depicts the ebb and flow of sentiment towards gold. The Bankrate chart shows its cumulative effect. Note particularly that the positive change in sentiment toward gold began in the early 2000s and did not retreat below the excessive pessismism line until 2013-2015, when gold fell from its all-time highs.

Now, since January, gold sentiment has returned to positive territory mostly driven by the low-to-negative rate environment, but also because gold once again looks to be under-valued.

If Buiter is correct, and I think he is, in the months ahead we might anticipate another significant flow of capital out of stocks, bonds and cash savings and into gold and silver…

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money