From my vantage point the judicious course right now is to reduce one’s overall percentage  exposure to stocks as well as one’s exposure to riskier types of stocks…. Here’s why.

exposure to stocks as well as one’s exposure to riskier types of stocks…. Here’s why.

The comments above and below are excerpts from an article by Gary Gordon which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

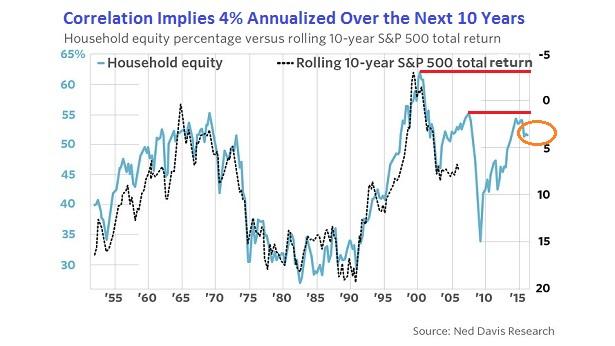

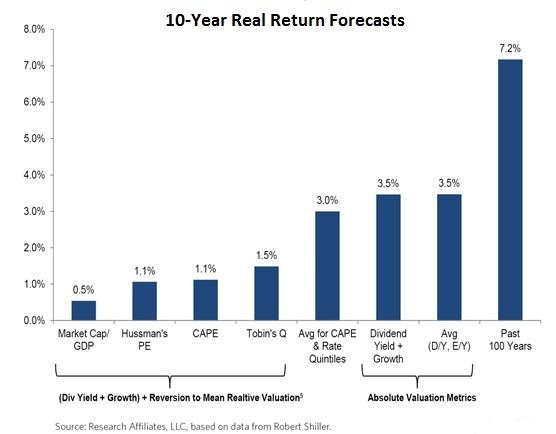

…An indicators that possess a long history of high correlations with future returns is the percentage of household financial assets invested in stocks – the higher the percentage, the lower the stock market’s subsequent 10-year return…and this predictor has an astonishing track record…possessing a .91 correlation with subsequent 10-year results. That is even more efficacious than market-capitalization-to-GDP (0.76) – a stock valuation tool that many refer to as the “Warren Buffett Indicator.”

The percentage of household financial assets invested in equities currently rests at 52%. According to Ned Davis Research, allocation percentages at these heights historically correspond to 10-year annualized total returns around 4%…

To be sure, an astute observer would proclaim that the path to 4% annualized between June of 2016 and June of 2026 tells us very little about when a bear market will transpire…[but] history regularly shows that listless 10-year rolling results often include one or more bear maulings along the way.

None of the data may be relevant to a devout buy-n-holder…[but] from my vantage point, however, the judicious course right now is to reduce one’s overall percentage exposure to stock as well as one’s exposure to riskier types of stock.

- Perhaps a moderate growth investor reduces 70% diversified stock (e.g., large, small, foreign, emerging, etc.) to 45% high quality large-cap stock. You do so because the reward of maintaining the higher allocation across the stock landscape is not worth the risk of a fire decimating the bulk of your portfolio.

- I prefer ETFs like the iShares MSCI USA Quality Factor ETF (NYSEARCA:QUAL), the ProShares S&P 500 Dividend Aristocrats ETF (NYSEARCA:NOBL), the PowerShares S&P 500 Quality Portfolio ETF (NYSEARCA:SPHQ) and/or the Vanguard Dividend Appreciation ETF (NYSEARCA:VIG).

Another reason why a tactical downshift today is sensible is having cash on hand. A 25%-33% cash buffer when valuations are hitting extremes and/or when the percentage of household financial assets invested in equities becomes excessive provides a measure of comfort during bouts of volatility. Cash also gives one the flexibility to re-acquire “risk-on” assets at more favorable prices.

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money