With interest rates so low, it has become more challenging to generate enough income in retirement. With some research, however, you can still find great companies that pay out a steady and growing dividend over time [which would] help many people plug the income gap that could cause them to outlive their money. [Below is an analysis of the past and present retirement scenarios and specific ways to offset the income gap of today.]

enough income in retirement. With some research, however, you can still find great companies that pay out a steady and growing dividend over time [which would] help many people plug the income gap that could cause them to outlive their money. [Below is an analysis of the past and present retirement scenarios and specific ways to offset the income gap of today.]

A guest article by Doug Carey (mywealthtrace.com) which has been slightly edited ([ ]) and abridged (…) to provide a fast and easy read.

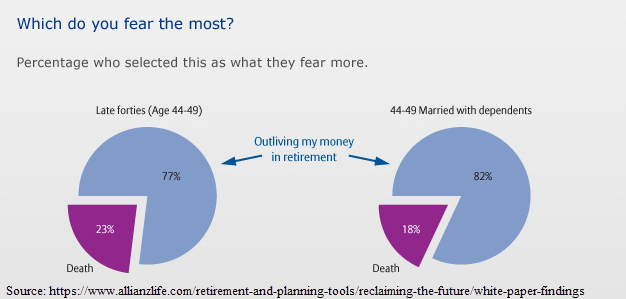

More people fear outliving their money than they fear death itself. What has brought us to this state of affairs?

For one, low interest rates have pummeled retirement plans. Before interest rates plummeted, many investors in or approaching retirement would move at least half of their money into treasury and high quality bonds. They could earn 4% to 6% income on these bonds and cover their expenses every year in retirement – but those days are gone.

The Past And The Present

In case some readers have forgotten, just nine years ago people could indeed do quite well in retirement even if they moved every penny to treasury bonds. I used our publicly available WealthTrace Financial Planner to run this scenario.

Let’s take a look at how a couple that is 55 years old would have done in 2007 if interest rates would not have plunged. My assumptions for this scenario are below:

|

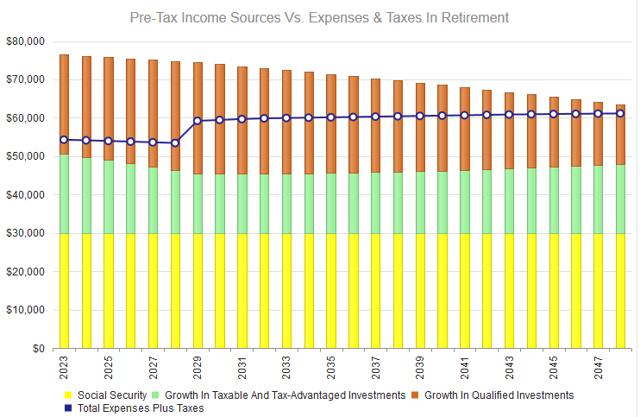

Looking at the chart below, you can see that this couple can completely support itself in retirement with treasuries alone. Think about how impossible that is today. Do you know anybody that is 100% invested in treasury bonds for retirement today? But just a decade ago, many people followed this strategy.

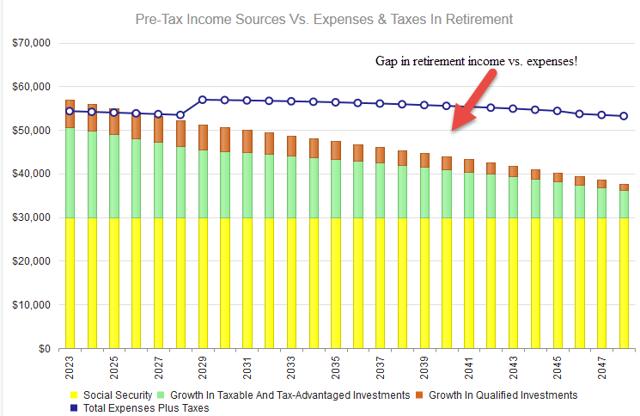

Now let’s take a look at today’s reality. With 10-year treasury yields below 2%, anybody attempting to live off treasury income is in for a rude awakening.

Use Dividend-Growth Stocks In Place Of Treasuries

I propose using both high quality dividend growth stocks and treasury bonds to generate the income most people will need in retirement. The types of dividend payers I look for are those that can consistently raise their dividends over time. One of my favorites is Altria (NYSE:MO). Some other companies that fit this bill are Procter & Gamble (NYSE:PG), Coca-Cola (NYSE:KO), Exxon (NYSE:XOM), Chevron (NYSE:CVX), Intel (NASDAQ:INTC), and Wal-Mart (NYSE:WMT)…

Let’s take a look at what makes companies such as Altria such a good income generator in retirement…

| Div. Yield | Div. Growth Rate (3 Year Annualized) |

Div. Growth Rate (5 Year Annualized) |

| 3.50% | 8.50% | 8.20% |

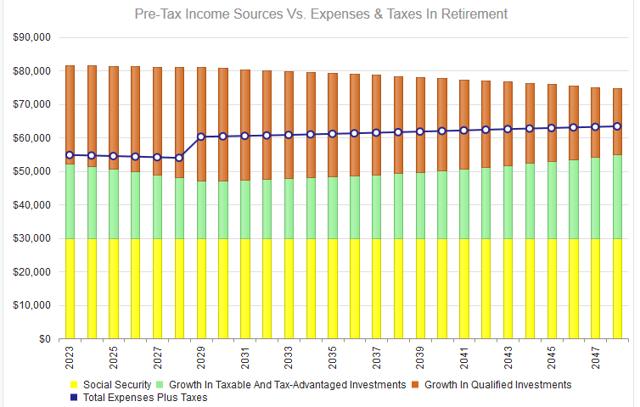

Now let’s run the analysis where this couple takes half of their treasury investments and moves it into a basket of dividend-growth stocks that are similar to Altria.

Thanks to the steady flow of dividend income, this couple can now cover their retirement expenses every single year. They will never outlive their money in this scenario.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money