…[On April 19th China introduced a yuan-denominated gold benchmark on the Shanghai Gold Exchange in a move] to become an even bigger player in the global gold market…(it is already both the largest consumer and producer of the precious metal) by allowing…gold transactions to be conducted without dollars, separate from the New York and London metals exchanges that have dominated the gold market for decades…[Will that be bullish for gold as so many analysts think?]

Exchange in a move] to become an even bigger player in the global gold market…(it is already both the largest consumer and producer of the precious metal) by allowing…gold transactions to be conducted without dollars, separate from the New York and London metals exchanges that have dominated the gold market for decades…[Will that be bullish for gold as so many analysts think?]

Could the yuan-denominated gold fix be one of the first signs that the world is abandoning the dollar?

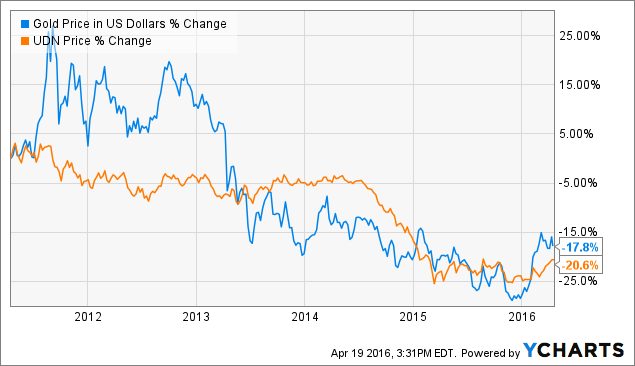

If the dollar weakens or loses its reserve status, that would almost certainly be bullish for gold because gold generally rallies when the dollar is weak, and is seen by many as an alternate global currency that can replace the dollar. However, I do not see how China benefits from a weak dollar [when you] consider the fact that China is the world’s top holder of U.S Treasuries and depends on a strong dollar for its favorable trade balance with the U.S.

Where will this development take the price of gold?

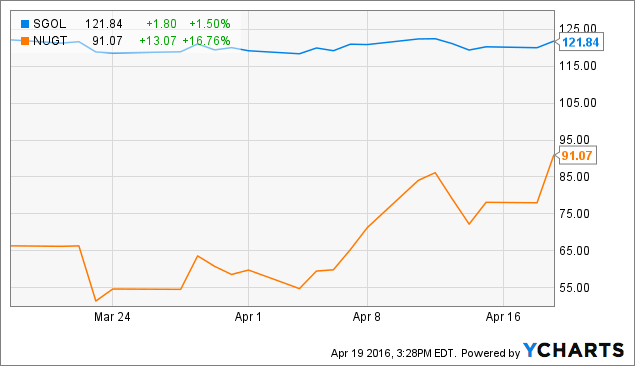

I do not have the information to provide a confident prediction on where this development will take the price of gold in the long term [but,] in the short term, the market interprets this information as bullish so it has provided a healthy spike in prices.

What will be the long-term ramifications of increased Chinese influence over gold?

For now, this question is a coin toss.

1. The only thing that is certain is that the dollar, and U.S speculative markets will lose influence over gold prices, and this may reduce the use of gold as a hedge against dollar decline. [as such,] I expect gold prices to correlate even less with a weakening dollar – a relationship that is already weakening:

2. This development may also result in more efficient free market price discovery as the retail Chinese and Indian markets begin to exert influence over prices via their demand for investment in physical gold and jewelry. A key thing to note is that while the U.S retail physical market is not a significant driver of gold prices, the Chinese and Indian ones are.

Stop clicking around! #Follow the munKNEE instead

Conclusion

The Shanghai Gold exchange may put gold price determining power in the hands of regular people for the first time in history. Alternatively, it may lead to even more manipulation and less transparency. It also may be the first sign that the world is abandoning the dollar.

Disclosure: The original article, by “Gold Bug”, was edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money