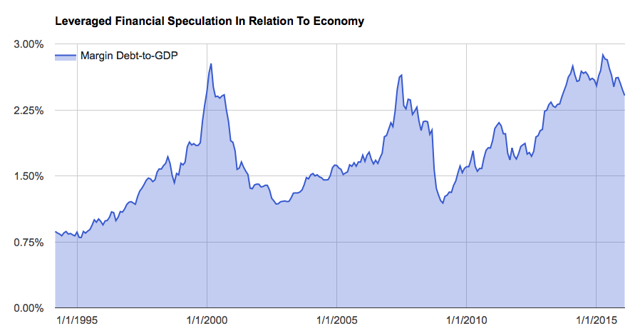

…When leveraged financial speculation becomes large relative to the economy (i.e. margin debt relative to overall economic activity), it’s usually a sign investors have become far too greedy. Not only did margin debt recently hit nominal record-highs, it hit new record-highs in relation to GDP, as well. In other words, over the past several decades, investors have never become so greedy as they did recently – and yes, this includes the dot-com bubble!

relative to overall economic activity), it’s usually a sign investors have become far too greedy. Not only did margin debt recently hit nominal record-highs, it hit new record-highs in relation to GDP, as well. In other words, over the past several decades, investors have never become so greedy as they did recently – and yes, this includes the dot-com bubble!

This post is an enhanced version (i.e. not a duplicate) of the original by Jesse Felder (TheFelderReport.com) in that it has been edited ([ ]), abridged (…) and reformatted (structure & font) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide you with a faster and easier read. Enjoy!

to provide you with a faster and easier read. Enjoy!

One reason I prefer this measure is that it has a fairly high negative correlation with forward 3-year returns in the stock market. When investors become too greedy, returns over the subsequent 3 years are poor and vice versa. As of the end of February, the latest forecast implied by this measure is for a loss of about 35% over the next three years.

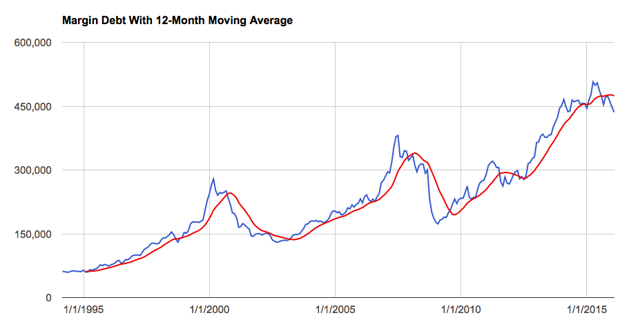

While this measure is pretty good at forecasting 3-year returns, that doesn’t help much for investors concerned with the next year or so. In this regard, it may be helpful to observe the trend of margin debt. Where is the nominal level of margin debt relative to its 12-month moving average or simply its level from one year ago? Historically, when these indicators turn negative from such lofty levels, a bear market, as defined by at least a 20% drawdown, is already underway. Right now both of these measures are, in fact, negative.

Conclusion

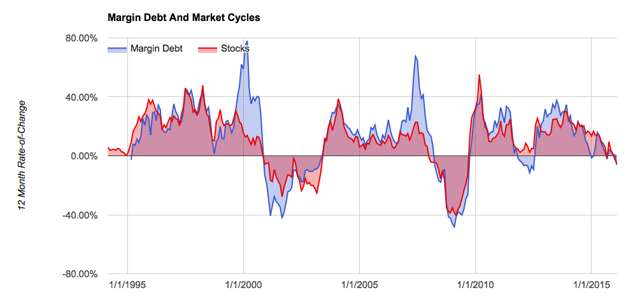

- Margin debt right now is sending a very clear signal that investors have recently become very greedy suggesting that returns over the next several years should be very poor….

- [In addition], the trend in margin debt also suggests that a new bear market is likely underway [and] if history is to rhyme, that means a decline of at least 20% in the S&P 500 is very likely to occur sometime soon and, because of the sheer size of the potential forced supply, that could come to market in this sort of environment, that could easily be just the beginning.

Want more such articles? “Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner of page).

Get engaged: Have your say regarding the above article in the Comment section at the bottom of the page.

Wanted! Contributors of original articles & links to other informative articles that deserve a wider read. Send to editor(at)munKNEE(dot)com.

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money