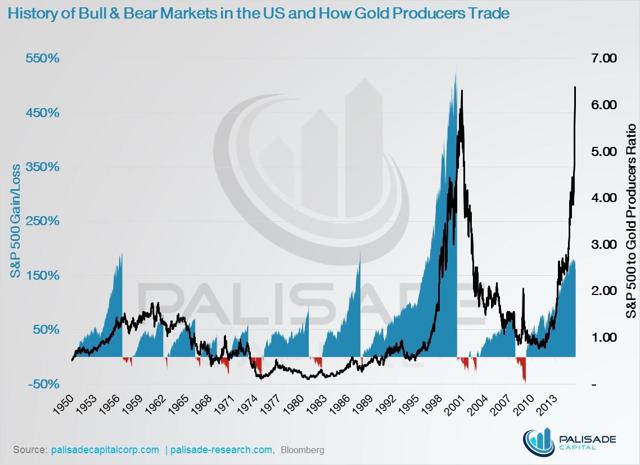

When comparing the S&P 500 to the Barron’s Gold Mining Index (BGMI), the ratio reached a high of 6.32 during the 1987-2000 bull market. The ratio today is 6.39. The higher the ratio, the cheaper gold companies are which means…we are seeing the cheapest gold stocks ever!

The above comments, and those below, have been edited by Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here) for the sake of clarity ([ ]) and brevity (…) to provide a fast and easy read. The contents of this post have been excerpted from an article* from palisade-research.com originally entitled The Bulls and Bears of the S&P 500: Just Another Chart Showing How Cheap Gold Stocks Are and which can be read in its unabridged format HERE. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

Will gold companies become even cheaper? No one knows, but buying at unprecedented lows is not a bad idea.

*http://palisade-research.com/the-bulls-and-bears-of-the-sp-500-just-another-chart-showing-how-cheap-gold-stocks-are/

Related Articles from the munKNEE Vault:

1. It’s Time To Buy Gold & Silver Stocks – Here’s Why

The bear market for gold is long in the tooth…and gold stocks are the most undervalued they have been in decades.

2. It’s Time To Start Thinking About Buying Gold Mining Stocks – Here’s Why

Is this the time to be buying gold mining stocks? Maybe, maybe not, but if you don’t own any at all, this is a good time to start thinking about them. Here’s why.

3. How to Play the Beaten Down Precious Metals Sector With Less Risk

Investors are faced with a serious challenge: how exactly to play the beaten down precious metals sector? If anything, investors must avoid too much risk when putting capital at work so here are 4 rules on how to go about doing so in…a disciplined way.

4. 3 Signs That Gold, Silver & PM Stocks Have Finally Bottomed

Gold, silver and precious metals mining stocks are still nowhere near long-term or secular bottoms but I believe they could be approaching short-term tradable bottoms in the coming days or weeks based on the following 3 signals:

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money