History strongly suggests that, rather than a return to a nice, placid world of “normal” interest rates, we are likely to see a continuation of the borrowing binge/asset bubble until real rates spike as a result of either soaring nominal rates or plummeting inflation. Here’s why that is the case.

“normal” interest rates, we are likely to see a continuation of the borrowing binge/asset bubble until real rates spike as a result of either soaring nominal rates or plummeting inflation. Here’s why that is the case.

Rubino goes on to say in further edited excerpts:

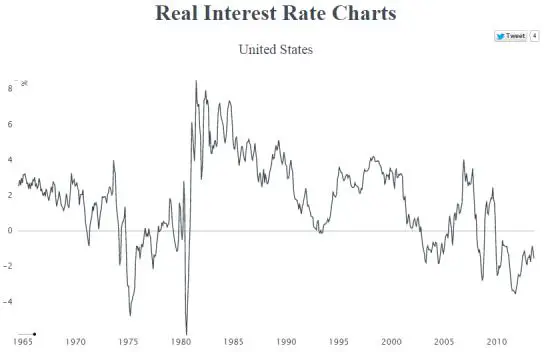

The folks at Gresham’s Law just published a nifty interactive chart of real (i.e., inflation-adjusted) interest rates since the 1960s that explains a lot about today’s world.

To make sense of the above chart, let’s start with a a little background:

Interest rates are the rental cost of money, but to figure out the true cost you have to adjust the nominal (or numerical) interest rate for inflation, which is the rate at which the currency being borrowed is falling in value.

- If the nominal interest rate is higher than inflation, then the real interest rate is positive.

- If the real rate is both positive and high, that’s a signal that money is expensive and that one is better off being a lender (to reap those high returns) than a borrower (who has to pay the high true cost of money).

- If the nominal cost of money is lower than the rate at which the currency is being depreciated then the real interest rate is negative and, in this case, a borrower actually gets paid to borrow because the true cost of the loan falls as the currency loses value. As such, negative real rates tell market participants to borrow as much as possible. Given these incentives one might expect the following:

1) Slightly positive real rates should be the norm in a properly-functioning economy, since that’s the way a healthy market works for most other things, where sellers reap a reasonable real profit and buyers pay a manageable price.

2) Periods of very high real rates should cause borrowing to plummet and economic growth to slow.

3) Periods of sharply negative real rates should produce a burst of borrowing that leads to destabilizing booms, either in hot asset classes or across the board. As Automatic Earth’s Raúl Ilargi Meijer put it:

“The simple truth about ultra low interest rates is so simple it’s embarrassing, at least for those who claim they benefit society. That is, ultra low rates make borrowing accessible to the wrong people, and to the right people for the wrong reasons:

- the former are people who shouldn’t be able to borrow a dime, because they have no credit credibility,

- the latter borrow only for unproductive or counter-productive reasons.“

The above chart bears all this out:

- back in the 1960s when growth was relatively steady and the dollar was still linked to gold, real interest rates fluctuated between 1 & 3 % but

- after the U.S. broke the link between the dollar and gold in 1971 and embarked on its epic debt binge, real interest rates started to gyrate

- plunging to -5% in 1975, leading to an inflation spike and dollar crisis a few years later

- then jumping to 8%, producing the severe recession of 1982,

- then falling to zero in 1994, setting off the tech stock bubble,

- then turning negative in 2004, inflating the housing bubble,

- then they spiked, producing the Great Recession and,

- since the 2008 crisis the real rate of interest has been mostly negative, which accounts for the global boom in real assets.

- For someone with access to borrowed money it now makes sense to use it to buy fine art, trophy real estate, farmland, and other things that governments can’t create more of.

- All of these things are in raging bull markets, implying that the smart money is responding to negative interest rates exactly as you’d expect.

So what now?

History as depicted here (looking at 1975, 1980 and the volatility since 2007) says:

- the borrowing binge/asset bubble continues until real rates spike, either because nominal rates soar or inflation plummets. It also implies that

- the phase change, when it comes, will be sudden, and that

- a financial system based on fiat currencies is inherently unstable — i.e., incapable of finding a stable price for money – so the least likely scenario is a return to a nice, placid world of “normal” interest rates.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://dollarcollapse.com/interest-rates-2/real-interest-rates-and-future-chaos/(Copyright © DollarCollapse.com)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Article:

It’s Imperative That You Know ALL About Interest Rates! Here’s Why & How To Do So

I read hundreds of financial articles every week and most are nothing more than “financial entertainment” – unfounded forecasts, fear mongering or cheer-leading. That being said, there are a number of articles that are absolutely MUST READS if you are to become an informed investor and be in position to understand what is evolving in the financial environment and act accordingly. Introductory paragraphs and links to a number of them are provided in this post. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money