The Fed, together with other central banks from around the world, have created the perfect crescendo of  worldwide credit bubbles and asset bubbles leading to the excesses and decadence which are the normal finale to a secular trend. They have totally destroyed all major world currencies and left the world with debts that cannot and will not be repaid with normal money. As such, there are only two alternative outcomes, debt default or hyperinflation. Both will have disastrous consequences for the world economy.

worldwide credit bubbles and asset bubbles leading to the excesses and decadence which are the normal finale to a secular trend. They have totally destroyed all major world currencies and left the world with debts that cannot and will not be repaid with normal money. As such, there are only two alternative outcomes, debt default or hyperinflation. Both will have disastrous consequences for the world economy.

So says Egon von Greyerz (goldswitzerland.com) in edited excerpts from his original article* entitled The lost Century.

[The following is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

von Greyerz goes on to say in further edited excerpts:

The world financial system almost collapsed in 2008 but with the help of $25 trillion in printed money, loans and guarantees the world got a temporary stay of execution.

Lessons of 2008 Forgotten – Debt Threatens to Undo the World Again

[Unfortunately, however,] none of the underlying problems have been solved…and the risks are currently greater than ever. The world has never before been in a situation when most countries are bankrupt and with a financial system which is also insolvent.- Japan is a basket case,

- China’s financial system is under massive pressure,

- Europe is a failed experiment in socialism and a common currency with Spain, Portugal, Italy, Greece and France all on the verge of collapse,

- the U.K. is having a temporary bounce but is probably not far behind these countries and

- the U.S. is the most indebted nation in the world and is borrowing and printing money at an exponential rate

Ben Bernanke has been the most productive chairman of the Fed ever. During his reign:

- U.S. debt went from $8 trillion to $ 17 trillion…up $9 trillion and

- the Fed balance sheet went from $800 billion to $4 trillion…up more than $3 trillion

in just 8 years. Not a mean feat! In total Bernanke has managed to create a total of $12 trillion during his rule which is a 133% increase in total debt including the Fed. These amounts can of course never be repaid in today’s money – never! [As such,] there are only two alternative outcomes, debt default or hyperinflation. Both will have disastrous consequences for the world economy. In addition to the extremely precarious situation in the developed world, we are now seeing a crisis in many Emerging Markets worldwide with falling currencies, bond markets and stock markets. This could easily lead to contagion.

These 21 Countries Have Experienced Hyperinflation In Last 25 Years

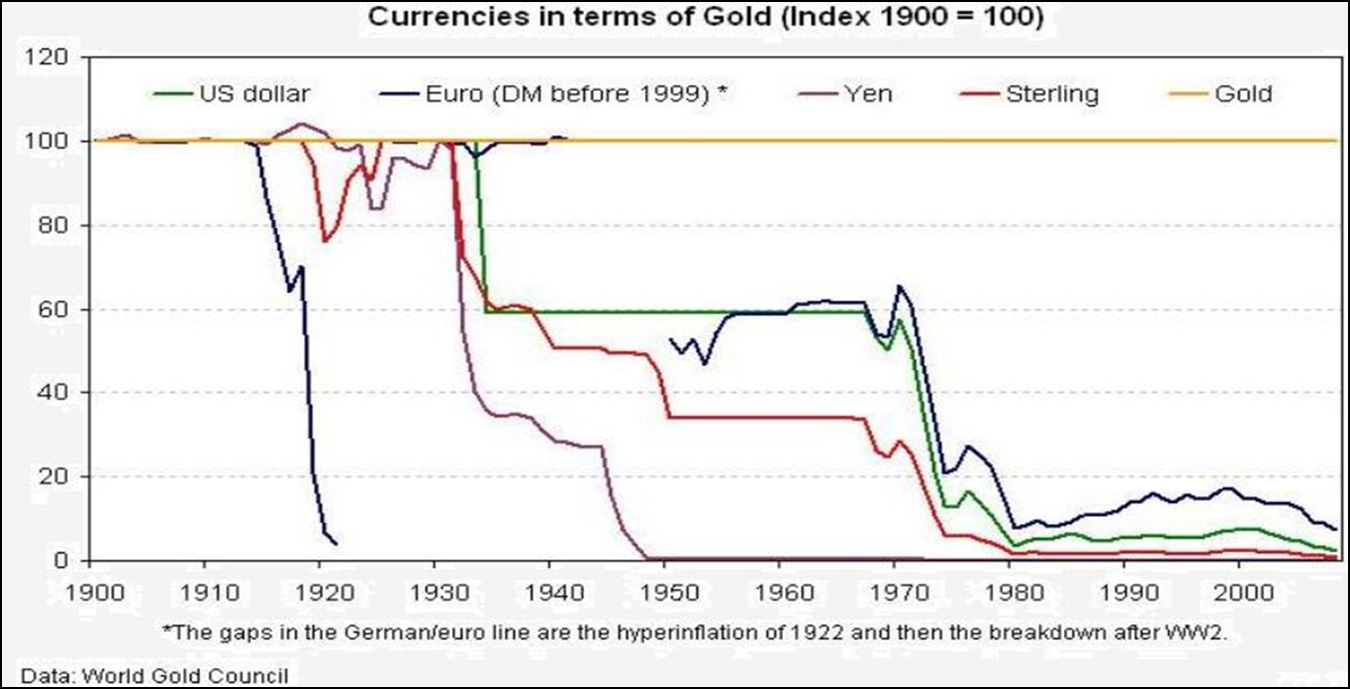

A lot has been written about the centenary of the Fed so rather than adding to this, I am showing a couple of graphs that tell the story very well. The first chart (courtesy World Gold Council) shows the destruction of paper money since 1913. This is what the Fed and other central banks have achieved. All major currencies have declined between 97% and 99% including the dollar which is down 98% in real terms which of course is measured in gold.

The destruction of paper money

Click chart to enlarge

Click chart to enlarge

As we all know, gold is the only real money and cannot be destroyed. What is absolutely guaranteed is that many currencies, and especially the U.S. dollar, will go down the remaining 2-3% and reach their intrinsic value of ZERO in the next few years. The dollar does not deserve to be the world’s reserve currency and will soon lose that role – and gold will reflect this decline of the dollar and go to heights which are unthinkable today.

What Would USD Collapse Mean for the World?

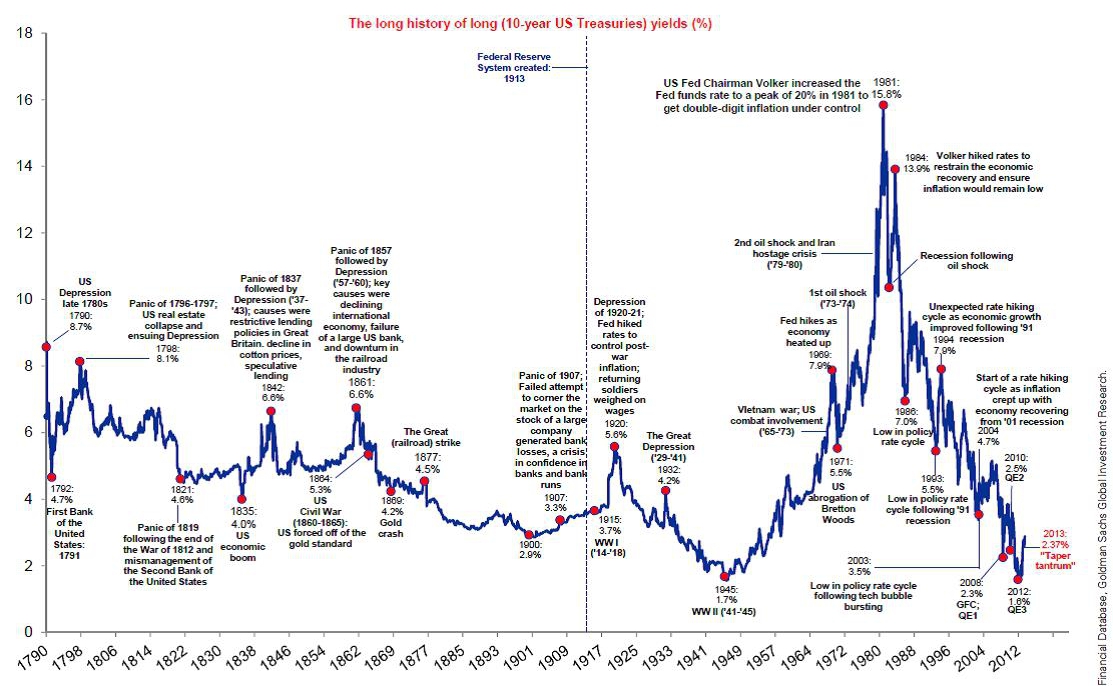

The next chart (courtesy Goldman Sachs) shows the total failure of central bank intervention in trying to eliminate peaks and troughs in the economy. The chart shows 10 year US Treasury yield from 1790 to 2013. Between 1790 and 1913 interest rates fluctuated between 3% and 8% with very few violent swings. Since 1913 we have seen swings in the 10 year rate of incredible proportions going from a low in 1945 of 1.7% to 15.8% in 1981 (with Fed Funds at 20%) and down to 1.6% in 2012.

The Fed’s creation of boom and bust

Click chart to enlarge

Click chart to enlarge

So as the chart shows, rather than eliminating booms and busts, the Fed actually creates them and makes the situation exponentially worse than it would have been in a free market without interference. I would expect rates to reach the 16% level at least in the next few years as investors dump worthless government bonds.

Conclusion

The Fed and other central banks have created a time bomb over the last 100 years and any single one of the crisis areas that I have outlined above could be the catalyst to make the world economy implode…They have totally destroyed all major world currencies and left the world with debts that cannot and will not be repaid with normal money. It will lead to misery and famine for a lot of people in the world, and empty stomachs are likely to lead to social unrest in many countries.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

Related Articles:

1. Lessons of 2008 Forgotten – Debt Threatens to Undo the World Again

Little has been done in the past six years to restructure economies and cut debt i.e. learn the lessons of 2008. Because we’ve partially recovered from that traumatic period, that’s led to complacency. All the while, the debt that caused the bust in the first place has compounded and threatens to undo the world again. Let’s hope it doesn’t come to that. Read More »

2. Where Does U.S. Credit-worthiness Rank Among Other Countries?

Leading up to the short term resolution of the debt ceiling crisis there were many articles about the extent of the national debt of the U.S.. the likelihood of default and, as such, the overall credit-worthiness of the once proud U.S. of A. The fact is, however, that while the U.S. does not rank in the top 10, it is far more financially sound than most other countries. Take a look at where it ranks compared to 47 other countries. Read More »

3. Which Is the World’s Safest Major Currency – You’ll Be Surprised

The term ‘safe fiat currency’ is as intellectually disingenuous as terms like ‘fair tax’ or ‘government innovation’ but, as we’ve been exploring recently why modern central banking is completely dysfunctional, it does beg the question– is any currency ‘safe’? Let’s look at the numbers for some data-driven analysis. Words: 575 Read More »

4. Why All the Hullabaloo About U.S. Debt?

Is the debt issue phony? It sure sounds like a lot, doesn’t it? $17 trillion in federal government debt. Wow. It’s a big, scary number, no doubt about it, …and it’s a lot bigger than in years past, but is it really that bad? Could it be that our debt profile has been grossly exaggerated? I think so. Let me explain why I think that is the case. Read More »

5. Debt Clocks Tell the Story: Vicious Upward Debt Spiral Gaining Momentum – Take a Look

A vicious upward debt spiral is gaining momentum. The budgets of most advanced economies, excluding interest payments, need 20 consecutive years of surpluses exceeding 2% of gross domestic product – starting now – just to bring the debt-to-GDP ratio back to its pre-crisis level. Read More »

6. When the Debt Bubble Bursts We’re Going to See Economic Chaos So Get Ready – NOW!

Never before has the world faced such a serious debt crisis. Yes, in the past there have certainly been nations that have gotten into trouble with debt, but we have never had a situation where virtually all of the major powers around the globe were all drowning in debt at the same time. Right now, confidence is being shaken as debt levels skyrocket to extremely dangerous levels. Many are openly wondering how much longer this can possibly go on. [Here’s my take on the situation.] Read More »

7. U.S. Economy: Reduce Spending (Future Depression) OR Keep Spending (Future Hyperinflation)

The U.S. government is in what is known as a “debt death spiral”. They must borrow money to repay prior debts. It is as if they are using their Visa Card to make an American Express payment. The rate of new debt additions dwarf any rate of growth the economy can possibly achieve. The end is certain, only its timing is unknown, and, once interest rates begin to rise, and they will, it’s game over. Read More »

8. Economics Can’t Trump Mathematics & the Math Says US In a Debt Death Spiral

The madmen who are responsible for the coming economic disaster continue to behave as if they can manage to avoid it. Violating Einstein’s definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. We are bigger fools for providing them the authority to indulge their hubris and wreak such damage. Read More »

Anyone that thinks that the U.S. economy can keep going along like this is absolutely crazy. We are in the terminal phase of an unprecedented debt spiral which has allowed us to live far, far beyond our means for the last several decades. Unfortunately, all debt spirals eventually end, and they usually do so in a very disorderly manner. Read More »

10. These 21 Countries Have Experienced Hyperinflation In Last 25 Years

Hyperinflation is not an unusual phenomenon. 32 countries have experienced hyperinflation over the last 100 years of which no less than 21 have experienced it in the past 25 years and 3 in the past 10 years. The United States is one of the few countries to have experienced two currency collapses during its history (1812-1814 and 1861-1865). Could it happen again? Words: 1450 Read More »

11. These 5 Events Will Lead to Higher Gold & Silver Prices

It is my contention that the move in precious metals…[from] late 2008 through 2011 was largely a result of the expansion in central bank balance sheets and the perceived threat of runaway inflation. Since 2011, [however,] we’ve seen economic growth improve and inflation rates across the globe subside. As a result, investment banks and market strategists are arguing against owning gold, and making the case that, with a lack of inflation and an improved economy, the need for owning gold as an insurance hedge against inflation and currency debasement is no longer present. I strongly disagree. Read More »

12. A Hypothetical Look At What Could Possibly Be In Store for the U.S.

The economic condition of the country continues to decline toward its rendezvous with an, as yet, unknowable catastrophe. As economic and political matters become more desperate, so will what the government considers acceptable. If a debt default cannot be engineered via continuous inflation, it will occur via a direct repudiation of obligations or a quasi-surreptitious one like the hypothetical one presented in this article…a look (not a prediction) at a series of not improbable events that could develop [and which] would change our economic world overnight. Viewed from this perspective, I don’t think such a move or something approximating it is out of the question. Words: 1300 Read More »

13. What Would USD Collapse Mean for the World?

I came to the conclusion several years ago that it was just a matter of time before the world realized that the relative functionality of the U.S. dollar was about to go belly up – to collapse. [Below is an explanation as to why I have come to that conclusion and what I think it would mean for the well-being of the world.] Words: 881 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

They will never default as long as they can just go down into the basement and print off a fresh roll.

All these other countries that are debasing their own currency to save the US Dollar will be bankrupt before the US is.

So that just leaves…..

The comment I posted on another munKNEE.com blog also apples to this article:

https://gos.ixm.mybluehost.me/noonan-gold-silver-will-rally-sky-2014-heres/#comment-82094

Mr. Noonan and I seem to be thinking alike these days but I would go a bit farther in suggesting that regarding his above statement:

“the most reliable source for what the market will do comes from the market itself”

Really only applies when the market is operating in what I would call “normal situations” and these days we are not in what I would call “normal situations”. Because of the on-going international battle being waged against the continued use of the US$ as the World’s preeminent currency, I believe that the market is now at the mercy of a small group of decision makers which are doing everything they can to WIN, what I refer to as Financial World War I (FWWI).

Because of this, I’m suggesting that this is yet another reason to have a percentage of every portfolio invested in physical PM’s, especially since PM’s current values makes buying them painless! With global computer ready to make record numbers of trades nearly instantaneously, by the time small investors learn of any big changes, it is far to late to react in time to protect your own positions, so having some sort of physical backup is just as important for your portfolio as it is for your computer records!