The “Dogs of the Dow” is a widely-known passive investment strategy that says to simply buy the 10 highest yielding Dow 30 stocks at the start of each year. Below is a look at how 2013’s Dogs of the Dow have fared thus far. You’ll be pleasantly surprised. Words: 289

simply buy the 10 highest yielding Dow 30 stocks at the start of each year. Below is a look at how 2013’s Dogs of the Dow have fared thus far. You’ll be pleasantly surprised. Words: 289

So say edited excerpts from the introduction to an article entitled Checking Up On The Dogs Of The Dow posted by the team at bespokeinvest.com.

[The following is presented by Lorimer Wilson, editor of www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

The article goes on to say in further edited excerpts to ensure you a fast and easy read:

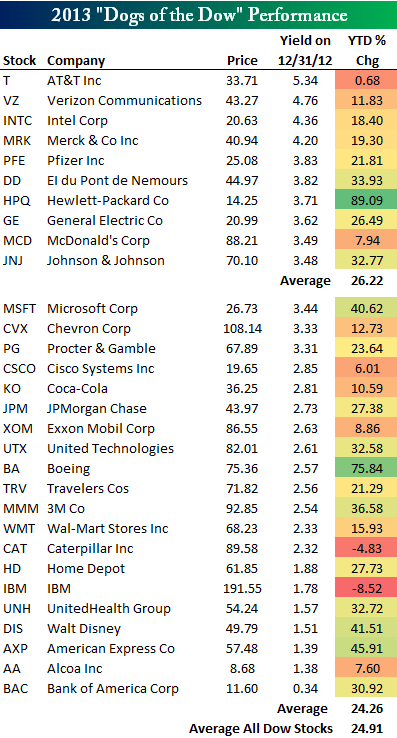

As shown below, the 10 highest yielding Dow stocks at the start of the year are up an average of 26.22% year-to-date…outperforming the average gain of 24.26% for the 20 other stocks that were in the Dow at the start of the year. Outperformance is outperformance, though, and if it holds it will be a winning year for the strategy.

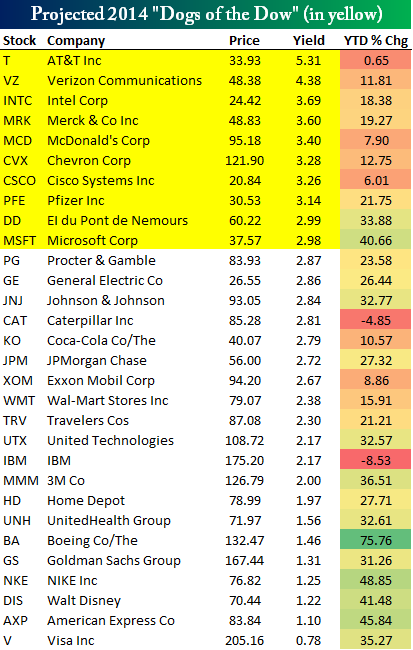

…[B]elow is a look at the 10 Dow stocks (highlighted in yellow) that would currently gain entry to the “Dogs of the Dow” portfolio in 2014. 7 stocks would rollover from last year’s portfolio, and there would be 3 newcomers to this year’s list — Cisco, Microsoft and Chevron. Who would have thought a dozen years ago that Cisco and Microsoft, along with Intel, would be part of the Dogs of the Dow??

One other thing to note is that the 3 stocks added to the Dow in September of this year, Goldman Sachs, Visa and Nike, are all at the bottom of the index in terms of dividend yield. Visa is actually the lowest yielding stock in the index at just 0.78%.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://www.bespokeinvest.com/thinkbig/2013/12/11/checking-up-on-the-dogs-of-the-dow.html (This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.)

Related Articles:

1. Go With the Flow: Buy & Sell Using a “Momentum” Approach – Here’s Why & How

Whether it is called “systematic trend-following”, “momentum trading” or “turtle trading”, it all comes down to entering trades on the basis of markets breaking out from previously established ranges and following some basic rules thereafter. It requires no special understanding of any given market – just a healthy respect for the price action – and can make you a lot of money in the process. Here are the details. Read More »

2. Ride the Market Waves With These 6 Momentum Indicators

It is hard to know what to buy or sell let alone just when to prudently do so. Thank goodness there are indicators available that provide information of stock and index movement of a more immediate nature to help you make such important decisions. This article describes the 6 most popular Momentum Indicators. If ever there was a “cut and save” investment advisory this is it! Words: 1234

3. Make Money! Time the Market Using Market Strength Indicators- Here’s How

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on! Words: 974

4. Yes, You Can Time the Market – Use These Trend Indicators

The trend is your friend and this article reviews the 7 most popular trend indicators to help you make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it. Words: 1579

5. Which of These 10 Behavioral Biases Adversely Affect How You Invest?

Cognitive biases plague us and make it difficult for us undertake adequate analysis and make good choices so knowing about them is imperative if we are going to deal with them. This article identifies 10 such biases and how they impede us making the right investment choices. Read More »

Here’s my list of the most common errors investors make and some related maxims. Read More »

There is a crucial component of the investment process that gets surprisingly little attention: our investment default settings. We can use them when we aren’t sure what to do, when we’re deciding what to do, when our circumstances have changed but our plan hasn’t (yet), or when we’re just starting out. Here they are. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money