“Follow the munKNEE” via Facebook or Register to receive articles via our Intelligence Report newsletter (Recipients restricted to only 1,000 active subscribers)

I am not married to my ideas and neither should you be. While I have covered the long-term bullish argument in the past, I believe there are some indications that gold is richly valued in the interim. Caution is warranted.

long-term bullish argument in the past, I believe there are some indications that gold is richly valued in the interim. Caution is warranted.

So say edited excerpts from an article from www.planbeconomics.com as posted on SeekingAlpha.com under the title Gold May Be Richly Valued.

This article is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say in further edited excerpts:

While gold is priced in US dollars, one way to attribute value to gold is by looking at its purchasing power. To do this, one must separate price from value. Gold may be rising or falling in price, but that doesn’t necessarily mean that its value is following suit. For example, if gold prices have risen but the amount of goods and services an ounce of gold buys has fallen, one might argue that gold has fallen in value.

By comparing the gold price against a sample of prices including:

- housing,

- medical,

- food and beverages,

- oil and

- the S&P 500

I was able to analyze the purchasing power of gold over time. Obviously, this is not an exhaustive comparison, but it does provide a perspective relative to several key goods and services.

Enjoying this article?

Then stop surfing the net looking for more informative articles.

The best of the best are posted on munKNEE.com!

Sign up here to receive them all via our Intelligence Report newsletter.

The mailing is free and restricted to only 1,000 active subscribers.

Act now!

(Note that the data for all the charts below begins at a common inception in 1986 for comparison purposes. As my fellow analysts already know, conclusions are often start/end-date sensitive, but for the purpose of this comparison I felt the benefits of using a common start date outweighed the drawbacks.)

The following charts illustrate the point:

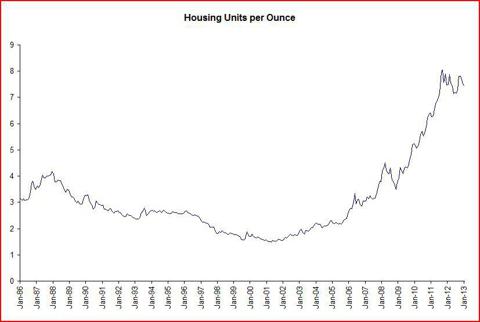

1. How Much Housing a Troy Ounce of Gold Can Buy

The above chart shows how much housing an ounce of gold can buy. The ratio is based on housing inflation rather than the median home price, which is why housing has been unitized. (Same goes for other measures below.) This line has risen partly because housing prices have collapsed and partly because gold prices have risen. Nevertheless, the ratio appears to favor selling gold to buy real estate.

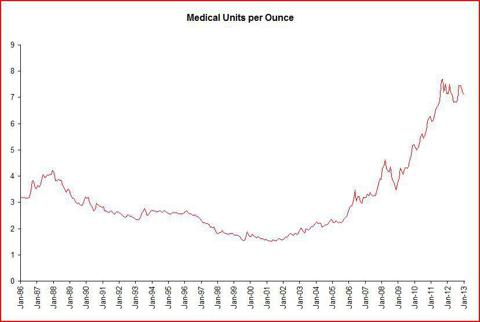

2. Cost of Medical Care In Ounces of Gold

Anyone who has paid a hospital bill lately knows that medical costs have risen relentlessly. Despite this, gold has risen faster and looks overvalued relative to the cost of medical care.

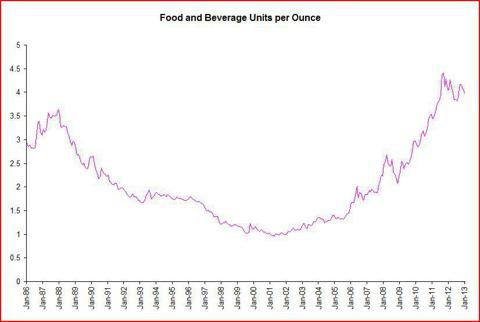

3. Food & Beverage Units Per Ounce of Gold

Food prices have also risen considerably over the past few years. Again, however, gold prices have risen faster. This chart is bearish for gold’s valuation.

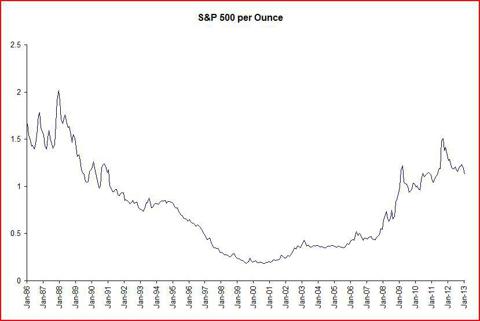

4. Gold’s Performance Compared to the S&P 500

When comparing gold against financial assets the story becomes a little less bearish. In comparison to financial assets (i.e. equities) gold has risen substantially since the early 2000s. Despite gold’s relative performance, based on this metric it is still below its 1988 high and may have room to advance further before one might consider gold overvalued relative to stocks.

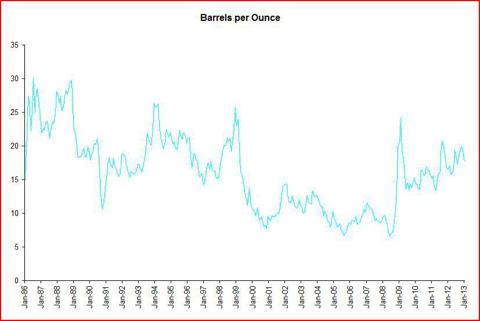

5. Barrles of Oil Per Ounce of Gold

Perhaps the least bearish chart, the above illustration shows how many barrels of oil an ounce of gold will buy. While the amount has risen over the past few years, it is still far from the high of the late 1980s. Of course, one must consider the dynamics in the oil market when looking at the barrels per ounce metric. Oil price momentum over the past decade has been driven by a tightening global supply-demand environment and this has helped temper gold’s valuation rise relative to oil.

Conclusion

As an asset that doesn’t pay a cash flow, gold can be quite difficult to value. Gold’s value is derived in relation to other variables: money supply, prices of other goods and services, supply and demand. Clearly valuing gold is not an exact science, and this is why investors should consider both bullish and bearish arguments for the metal.

While I have covered the long-term bullish argument in the past, I believe there are some indications that gold is richly valued in the interim. Caution is warranted.

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://static.seekingalpha.com/article/1277211-gold-may-be-richly-valued

Advertisement

China Calling!

We can establish your products there – we’ve already done it for others

Chinese market is 4x bigger than those of the U.S. and Canada combined

MAJOR need for:

– pollution treatment/prevention equipment (water & air),

– disease detection/treatments (diabetes & cancers),

– green energy products (heating & power).

Visit Global Linkages and then contact us to discuss opportunities

We’re off to Beijing & Shanghai again this month

Contact us today

Related Articles:

1. What Does a “Troy” Ounce of Gold Mean? What Does 18 or 24 “Karat” Gold Mean?

When the price of gold is mentioned as costing “x dollars per troy ounce” do you fully appreciate the signifance of the term “troy”? When looking to buy gold jewellery do you fully understand what the difference is between an item that is 10 “karat” gold and another item stamped 18 “karat” gold (other than that it is much more expensive)? Let me explain. Words: 587

2. The Good News – and Bad – Regarding Gold, Silver & PM Stocks Going Forward

As we begin 2013, there has been an important shift in regards to precious metals…the decoupling that has taken place between the equity market and the precious metals complex…[which] began nearly 17 months ago (decouplings of three or six months are not significant). Since the Euro crisis in summer 2011, the equity market has rallied nearly 30% and reached a five-year high, but gold stocks are down by more than 30%…[and, as such,] precious metals cannot begin an impulsive sustained bull move if the equity market continues to move higher. The equity market has to struggle with resistance and begin a mild cyclical bear move. While over the near-term precious metals can confirm a higher low, the 2013 success of the sector depends on the struggles of conventional stocks. [This article explains why that is the case and uses several charts to illustrate the point.] Words: 899

3. Gold Is Looking Increasingly Vulnerable – Here’s Why

The threats of global recession, insurmountable debt, terrible government policy, central bank support, and many other very persuasive arguments present gold as a very appealing investment or safe haven but all of this is an illusion. Gold was a sensible investment in the early part of the bull market (1999-07), but has now become a false sense of security for many investors who will soon learn the hard way. Not only are the fundamentals already priced in, the technicals severely weakened, and the extremes in gold optimism easily apparent, but the bad news for gold could soon get much worse. The next weeks or few months will hopefully give us a lot more clarity. Words: 1170

4. The Charts Tell ALL and THIS Is What They’re Saying About Gold & Silver for 2013

It is impossible not to read some source…touting the “fact” that the price of gold and silver will be…[“$x”, “$y”, etc.] in the “coming months” or in the “next year or two,” etc. The market, however, does not echo those…sentiments because that is exactly what they are, sentiments. When it comes to sentiments or opinions, regardless of how close to source or how well reasoned, the market does not care. The charts are all-knowing, and they present everything known about the price, sans any opinion(s). Just deal with the facts and plan accordingly. Trust the markets – they never lie – [and this is what they are saying about the price of gold and silver in 2013]. Words: 1889; Charts: 6

5. Goldbugs, Here’s Why Gold’s Long Bull Run Could Be Over

Gold is sought after and saved when its price is rising in anticipation of rising inflation, or on concerns created by the collapse of currencies and in the final stage of long bull markets in any asset, prices often continue to rise further for no other reason than that they have been rising so dramatically for so long, making investors confident they can extend expectations for more gains in a straight line into the future, rather than thinking cycles. [That begs the question no gold bug wants to contemplate “Could gold’s long bull run be over?” Let’s try and answer that question.] Words: 814; Charts: 3

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money