The six charts I provide in this article illustrate why the hyper-inflationary pressure in America is growing. This is not necessarily a forecast for hyper-inflation – this is simply a demonstration that some of the precursors to a hyper-inflationary cliff are building. (Words: 1001; Charts: 6)

pressure in America is growing. This is not necessarily a forecast for hyper-inflation – this is simply a demonstration that some of the precursors to a hyper-inflationary cliff are building. (Words: 1001; Charts: 6)

So says Plan B Economics (www.planbeconomics.com) in edited excerpts from an article* posted on Seeking Alpha entitled 6 Scary Charts On The Hyper-inflationary Cliff.

This article is presented compliments of www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

In a nutshell the ‘fiscal cliff’ debate is made of two high level arguments:

- Automatic budget cuts that begin in 2013 will thrust the US economy into recession.

- Budgets are out of control and will drive the economy towards an economic abyss.

Both arguments are, unfortunately, correct. Forget the fiscal cliff – the current budget quagmire is precisely what could eventually lead to a hyperinflationary cliff.

You see, hyperinflation is almost always a political problem. Decisions are made over a number of years (or decades) that benefit the immediate ruling class but put off tough choices to a future administration. As tough choices are delayed, the tradeoff becomes increasingly painful as society adapts to an unrealistic status quo. As the tradeoff becomes increasingly painful, the incentive to delay the day of reckoning grows stronger. Nobody wants to be known as the guy that brought the U.S. economy to its knees – even if it was for its own good.

Talk about hyperinflation may sound like the ravings of an extremist, however, this is precisely why hyperinflations are so devastating. The masses (including main stream media) simply aren’t built to foresee extreme events (aka black swans) and can’t adequately prepare. Of course, when such an extreme event does occur the main stream media claims that it came out of nowhere and that nobody could foresee it. In reality, the pressure that leads to black swan events – such as hyperinflations – often builds over years and years.

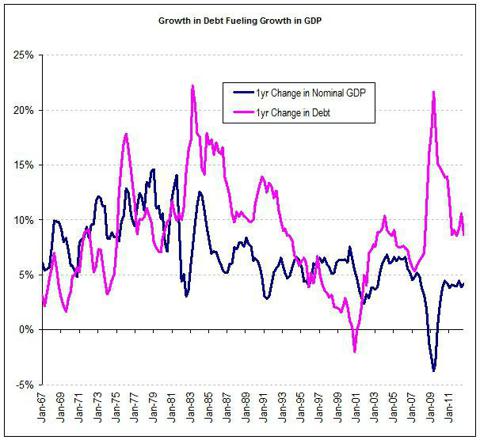

1. The first chart below shows how the growth in US nominal GDP has clearly been driven by growth in US government debt. In recent years the amount of debt growth needed to sustain fairly moderate nominal GDP growth has risen. In other words, the effectiveness of debt growth is diminishing and in the future it may take even faster debt growth to maintain moderate levels of economic activity.

(Note: all graphs created by Plan B Economics using data from St. Louis Fed and USDA.)

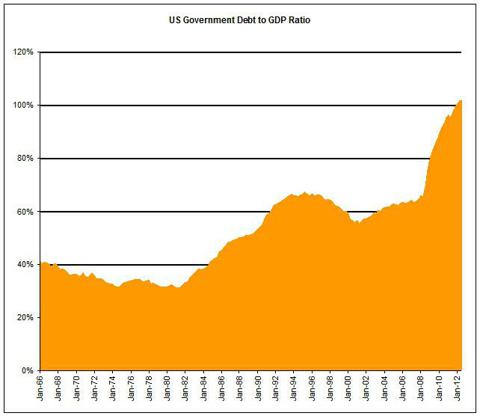

2. This next chart shows the results of the above relationship between US government debt growth and US GDP growth. Debt has grown very rapidly over the past several years and is now 100%+ of GDP. Again, this shows that the U.S. economy is becoming increasingly dependent on borrowed money to keep moving forward.

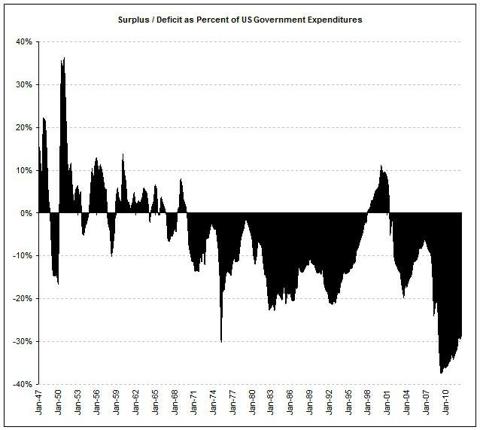

3. When governments borrow money it means they are spending more than they take in. It is often this overspending that keeps the economy afloat, however, the extra money needs to come from somewhere. As you can see in the chart below, for every dollar spent by the U.S. government about $0.30 must be borrowed. While this is a slight improvement from the depths of the Great Recession the dependence on the generosity of creditors is still scary. If creditors ever stopped lending to the U.S., greater money printing would have to take their place.

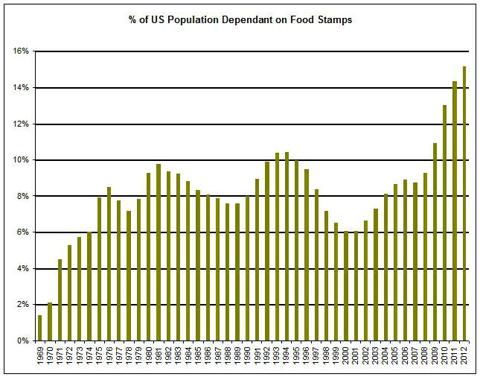

4. The next chart summarizes why the American government is forced to spend more than it takes in. If it didn’t there would be riots in the streets. The U.S. government is providing the basic needs for a large proportion of its population. 15% of the US population is on food stamps!

While the food stamp program isn’t the only evidence of social dependency, it is probably the most acute. Take the food away and we would see riots in the street within 3 days. Perhaps even revolution within a couple weeks. The U.S. government simply cannot take away some of these benefits.

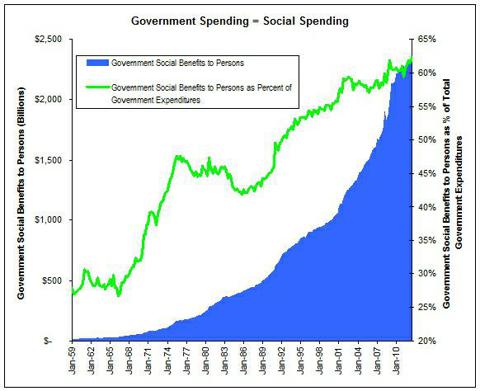

5. As it turns out, almost 2/3rds of government spending is going to social benefits to persons (green line in chart below) so, not only is the government unable to withdraw food stamp support, it is unable to withdraw from hundreds of support programs that make up the majority of government spending. Again, withdraw the support and at best you don’t get re-elected and, at worst, citizens overthrow the government.

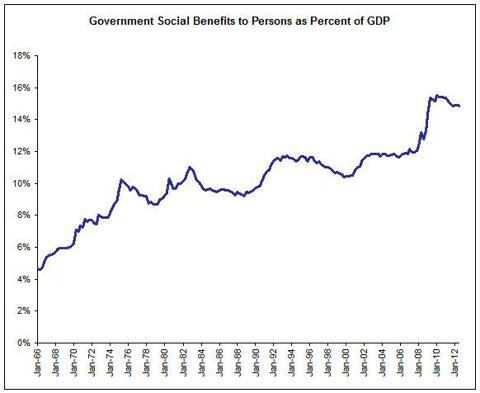

6. It’s not just the special interest groups that will suffer if spending on social programs is cut. The entire US economy will suffer. The chart below shows that social benefit spending makes up about 15% of US GDP. The entire economy is being propped up by spending on social programs. Take away the support and the economy tanks.

(click to enlarge) The Link to Hyperinflation

The Link to Hyperinflation

At this point, it almost doesn’t matter what the ‘right’ thing to do is. There is no right or wrong anymore. The time for the altruistic decisions was years ago before the U.S. chose a path of dependence. Today, it is almost impossible to cut spending because the population and economy is dependent on it. Worse, as the effects of spending shrink more spending is needed to maintain the status quo.

Today the U.S. government can borrow at ultra low rates – tomorrow, creditors may withdraw and interest rates may skyrocket. If that were to happen the government could choose to print (more) money to pay for social lubrication and keep the population sanguine for a few more months. It is this sort of trapping that can eventually lead to a hyperinflationary cliff….

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- FREE

- The “best of the best” financial, economic and investment articles to be found on the internet

- An “edited excerpts” format to provide brevity & clarity to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you!

- Sign up HERE and begin receiving your newsletter starting tomorrow

- You can also follow the “munKNEE” on Facebook

*http://seekingalpha.com/article/1066721-6-scary-charts-on-the-hyperinflationary-cliff

Related Articles:

1. If You Are Not Preparing For a US Debt Collapse, NOW Is the Time to Do So! Here’s Why

Timing the U.S. debt implosion in advance is virtually impossible. Thus far, we’ve managed to [avoid such an event], however, this will not always be the case. If the U.S. does not deal with its debt problems now, we’re guaranteed to go the way of the PIIGS, along with an episode of hyperinflation. That is THE issue for the U.S., as this situation would affect every man woman and child living in this country. [Let me explain further.] Words: 495

2. Runaway Inflation That Would Devastate USD Seems Unlikely – Here’s Why

Many investors are treating inflation as a certainty because the Fed has expanded its balance sheet to unheard of levels through its quantitative easing strategy. Some have even gone so far as to say that this program will utterly destroy the U.S. currency. To demystify this conclusion, I’m going to explain quantitative easing and why the Fed is using this monetary strategy. Afterward, I’ll explain why gold is still positioned to rise even if inflation continues to be low. Words: 786

3. We Are On the Precipice of Enormous Financial & Economic Change

We are on the precipice of enormous financial and economic change. It is not change for the good, especially for the United States. Excesses and mis-allocated resources of several generations are about to be exposed as modern industrial nations sink deeper into the economic hole they have dug for themselves. The purging of these economic mistakes will be painful, could create new wars as politicians attempt to deflect blame and may end up changing the political form of government in some countries. (Words: 364; Charts: 1)

4. Coming Currency Superstorm Will Be Absolutely Catastrophic for U.S. Economy

What would happen if someday the rest of the world decides to reject the U.S. dollar and that process suddenly reversed and a tsunami of U.S. dollars come flooding back to this country? It is frightening to think about. Just take a moment and think of the worst superstorm that you can possibly imagine, and then replace every drop of rain with a dollar bill. The giant currency superstorm that will eventually hit this nation will be far worse than that.

NOone is expecting rampant inflation. After all, the CPI is low with nothing happening in spite of all this money printing. While there has been no fallout I think that is the critical point. You cannot do these kinds of things we are doing forever and not experience any consequences. Sooner or later there are going to be consequences to what we are doing, and my fear is that it is going to be nasty, catch a lot of people off guard, and really hurt our society. That is the bottom line and why I am buying gold and silver, still, to this day. Words: 795

6. What is the Best Way to Inflation-Proof Your Portfolio? Here are the Options and Recommendations

With investors concerned about inflation it begs the following questions: “What is the best way to attempt to inflation-proof ones’ portfolios? Buy TIPS? Short Treasury bonds? Stocks? Real Estate? Commodities? Gold? Currencies?…[In this article we review each option and come to a conclusion as to how best to hedge the risk of inflation.] Words: 1672

7. Once Inflation Starts There Will Be NO Stopping It!

If inflation starts to head towards 5%, you can be sure it’s headed for 10% because they don’t have the ability to stop it now. The only antidote they have to the mess we are in, which is massively excessive debt reinforced by derivatives, is unlimited money printing. The idea that you can withdraw the punch bowl or sharply raise interest rates, it just doesn’t exist, unless you want to take a complete deflationary collapse.

8. James Turk Interviews Robert Prechter: Which Will It Be – Hyperinflation or Massive Deflation?

James Turk believes hyperinflation is ahead. Bob Prechter believes massive deflation is coming. An interesting discussion between the two takes place in this audio. Ultimately, both lead to Depression. Only the route taken differs, but that is important.

9. Major Inflation is Inescapable and the Forerunner of an Unavoidable Depression – Here’s Why

Whether our current economic crisis will end with massive inflation or in a deflationary spiral (ultimately, either one results in a Depression) is more than an academic one. It is the single most important variable for near and intermediate term investing success. It is also important in regard to taking actions which can prepare and protect you and your family. [Here is my assessment of what the future outcome will likely be and why.] Words: 1441

10. Major Price Inflation Is Coming – It’s Just a Matter of Time! Here’s Why

The developed economies of the world have opened the money spigots…[and this] massive money and credit creation is sitting in the banking system like dry tinder just waiting for a spark to set it ablaze. How quickly it happens is anyone’s guess, but once it does we are likely to be enveloped in a worldwide inflation unlike anything before ever witnessed. [Let me explain further.] Words: 625

11. High Inflation is Coming but Hyperinflation is Highly Unlikely – Why is That?

People get confused about the nature of mass inflation, hyperinflation, and what causes both. [Let me clarify the nature and causes of each.] Words: 930

12. A Hyperinflationary Great Depression Is Coming to America by 2014! Here’s Why

The U.S. economic and systemic-solvency crises of the last four years only have been precursors to the coming Great Collapse: a hyperinflationary great depression. Outside timing on the hyperinflation remains 2014, but there is strong risk of a currency catastrophe beginning to unfold in the months ahead…moving into a full blown hyperinflation [in a few] months to a year… depending on the developing global view of the dollar and reactions of the U.S. government and the Federal Reserve. [Let me go into more detail.] Words: 2726

13. This Will NOT End Well – Enjoy It While It Lasts – Here’s Why

…The US Government and its catastrophic fiscal morass are now viewed by the world as a ‘safe haven’. This would easily qualify for a comedy shtick if it weren’t so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media. [Let me explain what they are.] Words: 1150

14. Events Accelerating Towards an Ultimate Dollar Catastrophe! Here’s Why

With the U.S. election just months off, political pressures will mount to favor fiscal stimulus measures instead of restraint. Such action can only accelerate higher domestic inflation and intensified dollar debasement culminating in a Great Collapse – a hyperinflationary great depression – by 2014. [Let me explain why that is the inevitable outcome.] Words: 2766

15. An Inflation Inferno is Expected – but When?

Daniel Thornton, an economist at the Federal Reserve Bank of St. Louis, argues that the Fed’s policy of providing liquidity has “enormous potential to increase the money supply,” resulting in what The Wall Street Journal’s Real Time Economics blog calls “an inflation inferno.” [Personally,] I think it’s too soon to make significant changes to a portfolio based on inflation fears. Here’s why. Words: 550

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money