Many investors are treating inflation as a certainty because the Fed has  expanded its balance sheet to unheard of levels through its quantitative easing strategy. Some have even gone so far as to say that this program will utterly destroy the U.S. currency. To demystify this conclusion, I’m going to explain quantitative easing and why the Fed is using this monetary strategy. Afterward, I’ll explain why gold is still positioned to rise even if inflation continues to be low. Words: 786

expanded its balance sheet to unheard of levels through its quantitative easing strategy. Some have even gone so far as to say that this program will utterly destroy the U.S. currency. To demystify this conclusion, I’m going to explain quantitative easing and why the Fed is using this monetary strategy. Afterward, I’ll explain why gold is still positioned to rise even if inflation continues to be low. Words: 786

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Cimpl goes on to say, in part:

Inflation

Many investors are treating inflation as a certainty because the Fed has expanded its balance sheet to unheard of levels through its quantitative easing strategy….Though I can agree that CPI will increase, it’s unlikely to show [even] a gain of 5% in the near term. Despite the astronomical rise in the Fed’s balance sheet, CPI has been below 4% every month since September 2008. In fact, monthly CPI hasn’t ticked above 3% this year.

Runaway inflation that would devastate the dollar seems unlikely given those official statistics….

Interest Rates

Though his policies have been controversial, Ben Bernanke has had to take drastic measures to support the economy. That’s because the 2008 recession was no ordinary recession so typical Fed techniques were useless. Let me explain.

Like it or not, the U.S. is a credit economy. Consumers borrow money to buy goods. Growth is limited only by the willingness of borrowers and lenders to receive and extend money.

However, on occasion, the system breaks and it’s up to the Federal Reserve to police it when that happens.

Who in the world is currently reading this article along with you? Click here

Occasionally, economic growth slows and a recession occurs but recessions are relatively straightforward for the Fed to fix. Typically, interest rates drop, increasing the incentive to borrow money, which results in increased spending, investment and production.

Deleveragings

Though lowering interest rates usually gets the economy pumping again, it has problems during deleveragings. There is simply too much debt in the system. In deleveraging, the demand for new loans completely falls apart because people are paying their debt down. Those with debt have too much of it, and no desire to take on more – even at extremely accommodative rates. A credit-based economy only functions when debt is being acquired and it’s up to the Fed to make this happen.

Deleveragings are nasty beasts compared to recessions and require a number of tools to fix. Throughout history, deleveragings have ended with a mix of:

- debt restructurings,

- wealth distributions,

- austerity,

- increasing money supply,

- businesses lowering breakeven basis and by

- keeping nominal interest rates near zero.

Much like baking a cake, all these ingredients are necessary in order to beat deleveraging and prosper. Of them, wealth distribution (higher taxes), austerity (spending cutbacks) and lowering breakeven basis (decreasing costs and firing workers) cannot be controlled by the Fed. Additionally, the Fed’s ability to assist debt restructurings (via lowering interest rates on obligations) is limited by the 0% threshold. Enter quantitative easing.

Don’t Delay!

– Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com

– It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time

– Join the informed! 100,000 articles are read every month at munKNEE.com

– All articles are posted in edited form for the sake of clarity and brevity to ensure a fast and easy read

– Get newly posted articles delivered automatically to your inbox

– Sign up here

Quantitative Easing

Quantitative easing is one of the more recent unusual policies implemented by central banks. It’s distinguishing feature is the buying of assets from commercial banks. The Fed’s asset purchases increase excess reserves at banks while raising the prices of the assets purchased (lowers interest rates for bonds). Banks should be more encouraged to lend cash as their reserves increase and become more liquid.

To boost lending, the Fed purchased more than $2.1 trillion in non-governmental assets from banks. More recently, Ben Bernanke announced an extension of this buying program. In the latest extension, the Fed will buy $40 billion in additional assets per month.

Since the Fed is creating money to pay for these purchases, many believe that inflation will spiral out of control. However, the money supply hasn’t changed much, making runaway inflation unlikely.

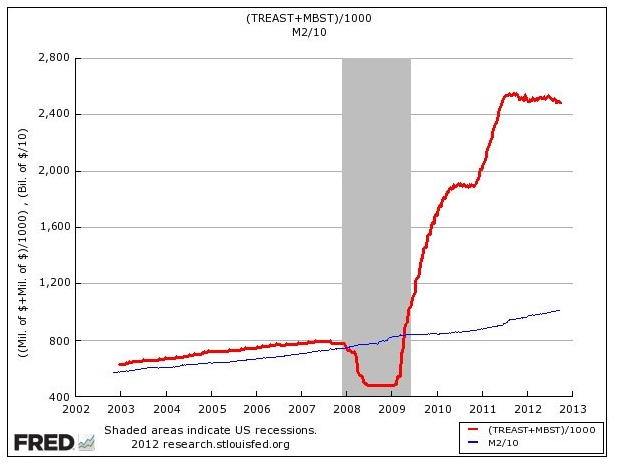

The red line [in the chart above] is the Fed balance sheet, including all the Treasuries and mortgage backed securities, it has purchased. The blue line is M2 (divided by 10), which is a measure of money supply. This line has increased at the same rate since 2003 and we haven’t had any episodes of heightened inflation.

An increase to the money supply can cause inflation. In fact, a large increase to the money supply in a short amount of time is likely to cause a large increase to inflation simply because more money is chasing the same amount of goods, resulting in higher prices paid. However, the money supply hasn’t spiked. The balance sheet explosion did not result in any abnormal rise in the money supply.

Conclusion

Though inflation is subdued, gold prices have moved higher during the past four years. Moreover, this bullish trend should continue….

*Source of original post: http://www.wyattresearch.com/article/hyperinflation-wont-happen-/28781

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. QE 3 Will Actually SUPPRESS the Economy! Here’s Why

The Fed professes that QE 3 or as I call it, QE Infinity (QEI), will create jobs but I am not sure how they can expect anybody to buy their rationale. As we know, QE 1 and QE 2 did very little in the way of creating jobs. Might the Fed realize that QE Infinity could actually be counter-productive to economic growth?

2. Peter Schiff: QEternity Has Its Limits – Here’s Why

The latest round of quantitative easing (an additional $40 billion a month until conditions improve) has been dubbed as “QEternity” or “QE-Infinity” by its critics but it will end much before that. We are witnessing a massive bubble in US government debt, and we’ve reached the point where no one in charge believes it will ever end – an excellent contra-indicator. [Let me explain.] Words: 720

3. QE3 Will Be More Effective Than Previous Versions – Here’s Why

The analysis of current Fed policy has included the usual parade of mistaken pundits [whose views have] been obscured by… an agenda based upon their politics or their business models [and then there]…are the correct answers which are pretty obvious to anyone with any training in economics. Here is that reality. Words: 734

4. World’s Largest Economies Have NO Choice But to Engage in Massive Money Printing – Here’s Why

The choice facing the leaders of the world’s largest economies is a simple one: Either they engage in massive money printing, or they let the world slip into another great depression. This article examines why they have no choice but to print money, something which will have significant consequences for everyone. Words: 560

I keep wondering to myself, do our money-printing central banks and their cheerleaders understand the full consequences of the monetary debasement they continue to engineer? [Below is what I think awaits us.] Words: 1013

6. QE3: Impact on Gold & Silver Returns Should Outshine Impact on Economic Growth – Here’s Why

While the Fed’s third round of quantitative easing is fairly aggressive it is unlikely to have a significant impact on the economy – especially if policymakers in Washington lead us over the fiscal cliff. Where QE3 may have an impact, however, is in the commodities market, and in particular gold. Here’s why. Words: 400

7. This Will NOT End Well – Enjoy It While It Lasts – Here’s Why

…The US Government and its catastrophic fiscal morass are now viewed by the world as a ‘safe haven’. This would easily qualify for a comedy shtick if it weren’t so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media. [Let me explain what they are.] Words: 1150

8. Events Accelerating Towards an Ultimate Dollar Catastrophe! Here’s Why

With the U.S. election just months off, political pressures will mount to favor fiscal stimulus measures instead of restraint. Such action can only accelerate higher domestic inflation and intensified dollar debasement culminating in a Great Collapse – a hyperinflationary great depression – by 2014. [Let me explain why that is the inevitable outcome.] Words: 2766

9. Major Inflation is Inescapable and the Forerunner of an Unavoidable Depression – Here’s Why

Whether our current economic crisis will end with massive inflation or in a deflationary spiral (ultimately, either one results in a Depression) is more than an academic one. It is the single most important variable for near and intermediate term investing success. It is also important in regard to taking actions which can prepare and protect you and your family. [Here is my assessment of what the future outcome will likely be and why.] Words: 1441

10. An Inflation Inferno is Expected – but When?

Daniel Thornton, an economist at the Federal Reserve Bank of St. Louis, argues that the Fed’s policy of providing liquidity has “enormous potential to increase the money supply,” resulting in what The Wall Street Journal’s Real Time Economics blog calls “an inflation inferno.” [Personally,] I think it’s too soon to make significant changes to a portfolio based on inflation fears. Here’s why. Words: 550

11. Major Price Inflation Is Coming – It’s Just a Matter of Time! Here’s Why

The developed economies of the world have opened the money spigots…[and this] massive money and credit creation is sitting in the banking system like dry tinder just waiting for a spark to set it ablaze. How quickly it happens is anyone’s guess, but once it does we are likely to be enveloped in a worldwide inflation unlike anything before ever witnessed. [Let me explain further.] Words: 625

Evidence shows that the U.S. money supply trend is in the early stages of hyperbolic growth coupled with a similar move in the price of gold. All sign point to a further escalation of money-printing in 2012…followed by unexpected and accelerating price inflation, followed by a rise in nominal interest rates that will bring a sovereign debt crisis for the U. S. dollar with it as the cost of borrowing for the government escalates…[Let me show you the evidence.] Words: 660

13. The U.S. Debt Spiral: When Will it End? More Importantly, HOW Will it End?

The U.S. already has more government debt per capita than the PIIGS (Portugal, Italy, Ireland, Greece and Spain) do and it just keeps getting worse and worse thanks to both political parties. We are on the road to national financial oblivion yet most Americans don’t seem to care. They don’t realize that we have enjoyed the greatest prosperity we will ever see…and that when the debt bubble bursts there is going to be an immense amount of pain. That is a very painful truth, but it is better to come to grips with it now than be blindsided by it later. [Let me explain.] Words: 1140

In the US the Fed announced Q-Eternity, a $40 billion per month injection of funds with no end date other than “as long as it takes.” If economic recovery is meant by “as long as it takes” there will be no ending because no economic recovery is possible from such policies. Very high inflation will eventually stop the Fed, although it will further impoverish the middle class. If they wait until hyperinflation, the economy will collapse and fixed incomes and savings will be wiped out.

“… all Ponzi schemes eventually fail under their own weight. The US debt scheme is no different.” Sprott Asset Management

Belief in the economic recovery story is akin to belief in Santa Claus. Both make us feel better, but both are unlikely. We may have another quarter or two of government-driven GDP growth, but we will not have a recovery, at least not with the next several years. Government spending may be able to raise GDP, but the ability to continue spending is near an end.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money