Relative to gold, gold stocks are now +30% cheaper than they were at the bottom of [the previous] 20 year long bear market [and that, in addition to the current negative sentiment for the PM sector, suggests that now might be an ideal time to get your fair share of PM stocks and/or their associated warrants (1 & 2). Let’s take a look at some charts that support my point of view]. Words: 908

So says Pater Tenebrarum (http://www.acting-man.com/) in an article*which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Tenebrarum goes on to say:

HUI vs. Gold Performance

The gap between the price of gold and the value of the gold shares of the HUI has widened even further [as can be seen in the chart below]. [The HUI is] back below its 200-day moving average, after having briefly touched the 50% fibonacci retracement level of the preceding decline…

Silver Stocks:Silver Ratio

The chart below is a recent example of how valuation gaps between metals and metals producer stocks are usually closed: first silver stocks began to underperform the metal during April and shortly thereafter, in early May, the silver price crashed.

The HUI:Gold Ratio

In the course of these recent developments, the HUI:gold ratio has broken below a line of weekly support... There is another support line just beneath the one that has been broken, defined by the 2009 low in the ratio.

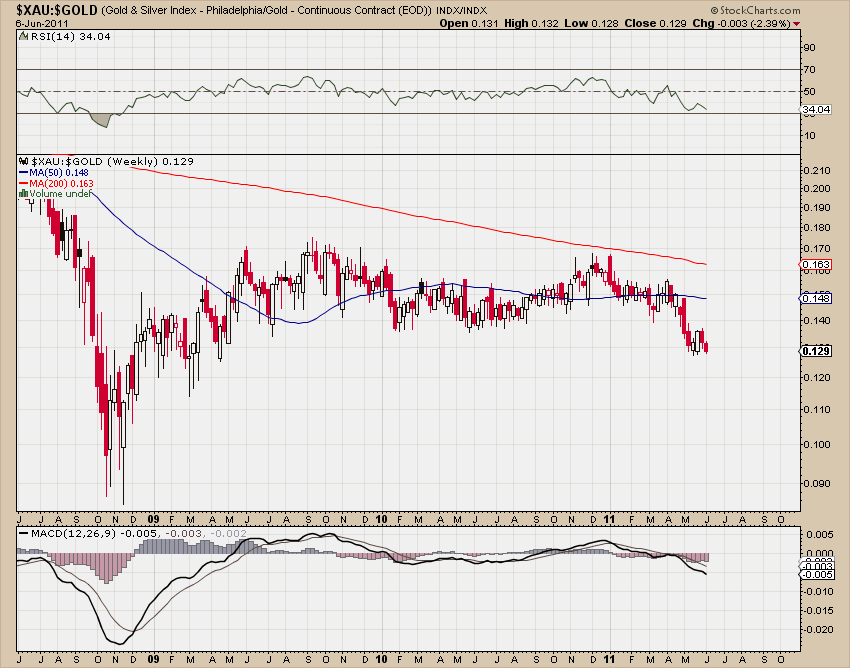

XAU:Gold Ratio

Gold stocks have been weakening vs. gold for many years, but recently their relative strength has broken slightly below an important support level. As one indication of how extreme the weakness of gold stocks vs. gold has become, consider the XAU:gold ratio chart below:

At a mere 12.9, the XAU:gold ratio is breaking to a two year low, and trades a full 4.6 points below the low it reached at the depth of the gold bear market in the year 2000. In other words, relative to gold, gold stocks are now about one third cheaper than they were at the bottom of a 20 year long bear market!

Sign up for FREE weekly “Top 100 Stock Index, Asset Ratio & Economic Indicators in Review” report

Normally we would…term these recent developments as…short to intermediate term bearish for gold. Should a new liquidity crisis engulf the markets – which is well within the realm of the possible given the simmering crisis in euro land and the global economic slowdown that has been under way for most of this year – then this may well turn out to be the case.

Gold’s Performance

Gold’s chart [see below] continues to look quite constructive:

Gold, daily – what’s not to like?

Who in the world is currently reading this article along with you? Click here to find out.

Gold Sentiment

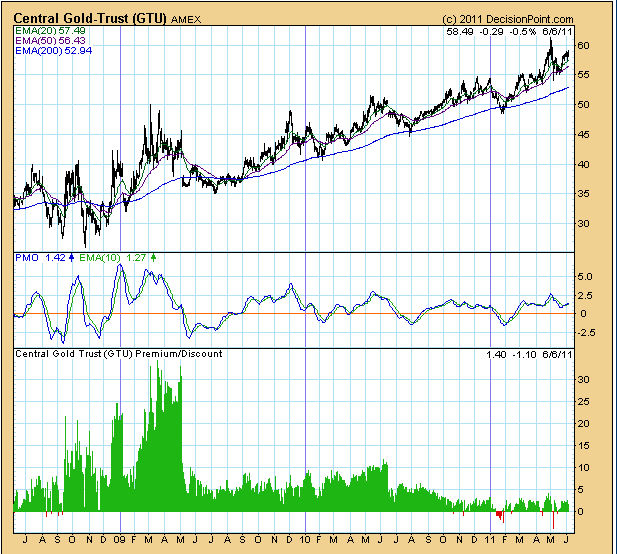

There is one reason…[to] refrain from getting too bearish and that is the sentiment backdrop accompanying this recent activity. Closed-end funds holding gold and silver bullion continue to trade at either tiny premiums to NAV (net asset value) or even discounts to their NAV – a historically very rare condition as can be seen [in the chart] below.

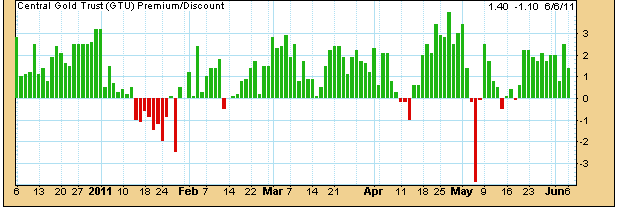

The premium to NAV of the Central Gold Trust has shrunk to a tiny 1.4% [see graph below] which is one of the lowest premiums ever. This year even discounts to NAV could be observed on several occasions.

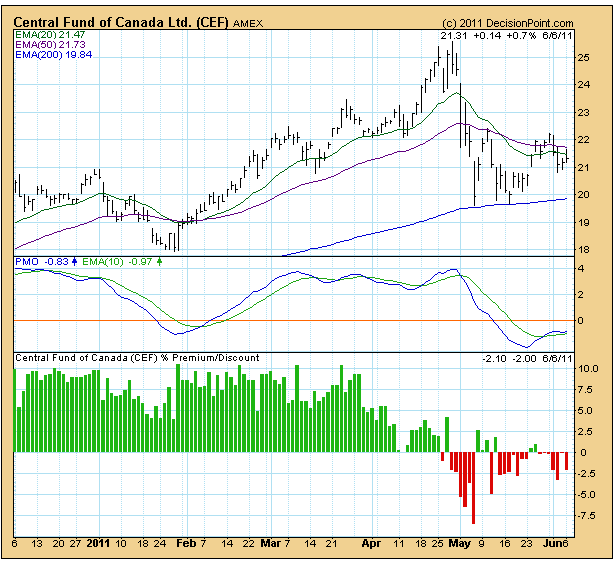

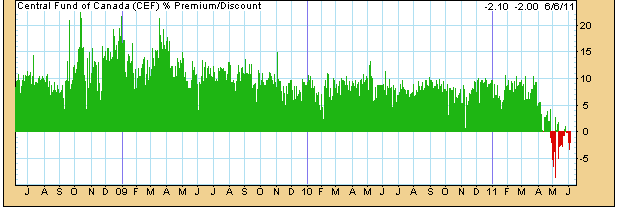

The Central Fund of Canada [see chart below] trades at a very rare discount to its NAV.

A longer term view of CEF’s premium-discount to NAV history [below shows that] a discount to NAV hasn’t been in place for quite some time.

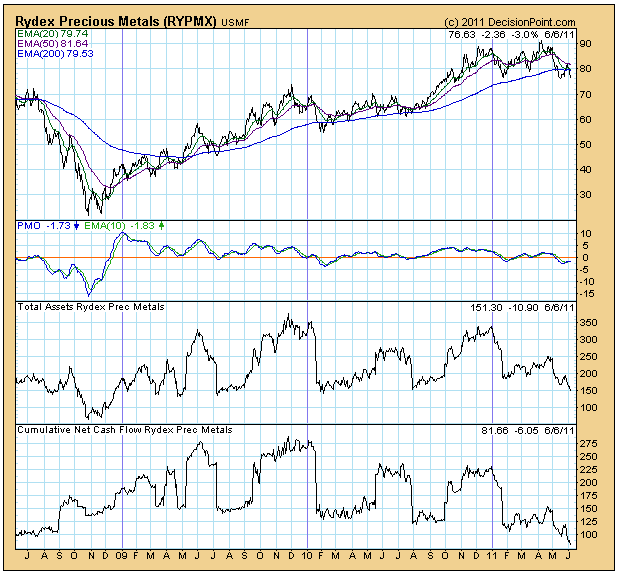

The cumulative cash flow ratio of the Rydex precious metals fund has collapsed to a multi-year low. This is actually quite a contrast to the fund’s performance which, in spite of the recent pullback, is not too bad.

‘Public Opinion’ Sentiment

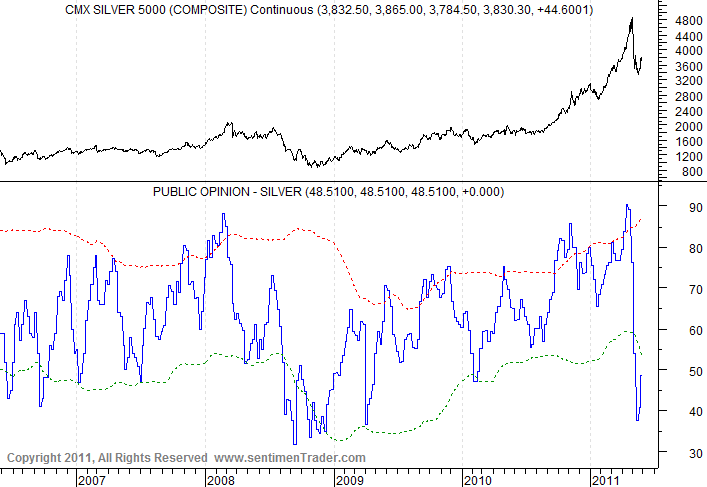

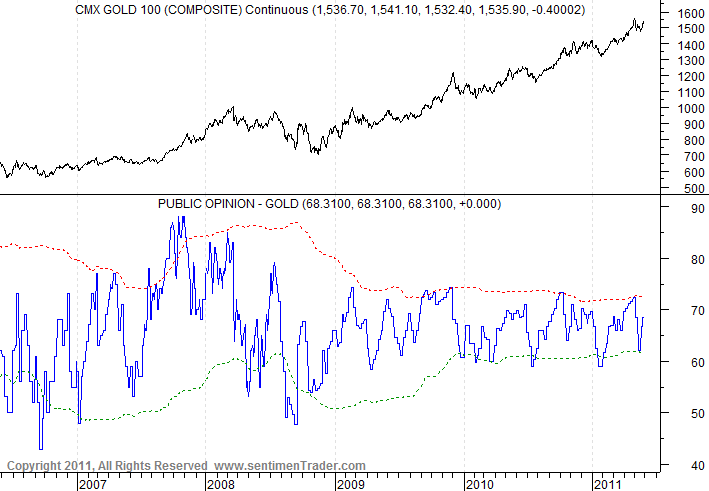

The ‘public opinion’ charts on gold and silver published by sentimentrader.com suggest that there is currently little speculative froth in the metals themselves – in spite of gold’s quite credible performance. Public opinion on silver (an amalgamation of various quantitative sentiment indicators) is currently well into ‘oversold’ territory.

Public opinion on gold is obviously more bullish, but far from an extreme.

Conclusion

Precious metals related sentiment indicators would suggest that once a change in trend occurs, a new uptrend could be sustained for quite a while as the extremely negative sentiment unwinds.

*http://seekingalpha.com/article/273817-gold-stocks-continue-to-diverge-from-gold

Links and Titles of Articles Referenced Above:

-

Gold & Silver Warrants Index (GSWI) Update https://gos.ixm.mybluehost.me/2011/06/gold-silver-warrants-index-gswi-update/

-

Buying Gold & Silver Company Warrants is Easy & Profitable – Here’s How (and Why!) https://gos.ixm.mybluehost.me/2011/05/buying-gold-silver-company-warrants-is-easy-profitable-%e2%80%93-here%e2%80%99s-how-and-why/

-

NOW is the Best Time to Buy Gold Stocks! Here’s Why https://gos.ixm.mybluehost.me/2011/06/now-is-the-best-time-to-buy-gold-stocks-heres-why/

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

- Sign up to receive every article posted via Twitter, Facebook, RSS Feed or our FREE Weekly Newsletter.

Gold Stocks

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money