Countries Can Default and Subsequently Recover and Prosper

While there can be little doubt that a default on the U.S. debt would lead to a financial crisis and would likely permanently reduce the role of the U.S. financial industry in world markets, it is also likely the case that the United States would rebound and possible rebound quickly from a default. [It most certainly is not] an end of the world scenario. [Let me explain.] Words: 478

So says Dean Baker (www.cepr.net) in an article* which Lorimer Wilson, editor of www.munKNEE.com, has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Baker goes on to say:

The Argentine Example

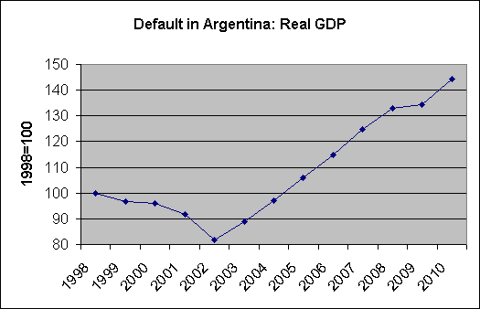

Argentina was in default on its debt at the end of 2001. Its economy fell sharply in the first quarter of 2002 but had stabilized by the summer and was growing strongly by the end of the year. By the end of 2003 it had recovered its lost output. Its economy continued to grow strongly until the world recession in 2009 brought it to a near standstill.

Source: IMF.

While there can be no guarantee that the U.S. economy would bounce back from the financial crisis following a default as quickly as did Argentina, it’s unlikely that U.S. policymakers are too much less competent than those in Argentina. Readers should be made aware of the fact that countries do sometimes default and they can subsequently recover and prosper.

Sign up for your FREE weekly “Top 100 Stock Index, Asset Ratio & Economic Indicators in Review”

Debt Default May Be Preferable Way to Go

[In fact,] many people may consider the short-term pain stemming from a debt default to be preferable to the long-term costs that might come from policies adopted to prevent default. If Congress were to approve a Medicare plan along the lines proposed by House Budget Committee Chairman Paul Ryan, tens of millions of middle class retirees would be subjected to a retirement without adequate health care insurance and potentially devastating medical bills. Plans being put forward to cut Social Security could have similar consequences.Compared to the above outcomes debt default and the subsequent slump that would follow might seem like a relatively small price to pay. [As I said in the opening paragraph, it most certainly would not be] an end of the world scenario.

*http://www.cepr.net/index.php/blogs/beat-the-press/defaulting-on-the-debt-is-not-the-end-of-the-world

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

- Sign up to receive every article posted via Twitter, Facebook, RSS Feed or our FREE Weekly Newsletter.

Default

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money