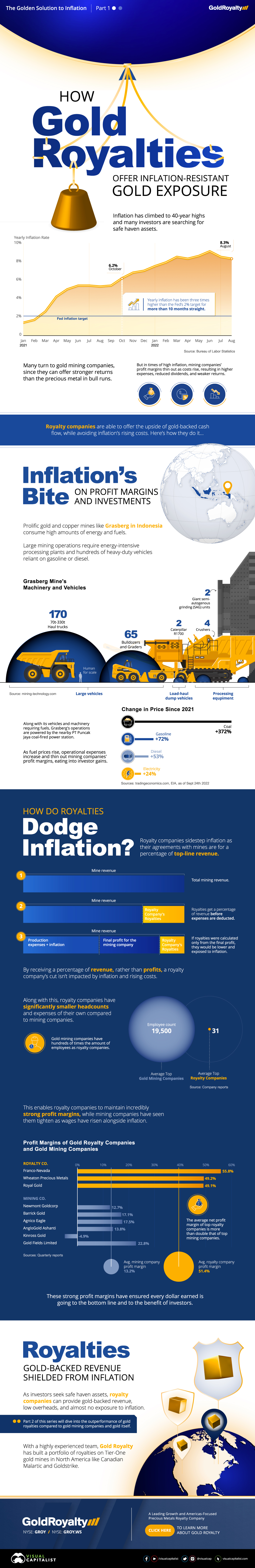

As rising inflation has increased the operational expenses of gold mining companies, gold royalty companies have emerged as an inflation-resistant alternative for investors seeking exposure to the precious metal.

Without exposure to rising wages, fuel, and energy costs, gold royalty companies are able to maintain strong profit margins that are often more than double those of gold mining companies.

This infographic sponsored by Gold Royalty is the first in a two-part series and showcases exactly how royalty companies naturally avoid inflation, along with the superior profit margins that come as a result.

How Gold Royalty Companies Avoid Inflation

With no large fleets of vehicles to fuel, refining plants to power, along with significantly smaller headcounts and wage bills, royalty companies barely suffer from rising inflation. Compared to gold mining companies with tens of thousands of employees across the world, gold royalty companies rarely employ more than 50 people.

Along with this, while royalty companies’ revenue comes from royalty and streaming agreements with mining companies, these agreements are structured to ensure royalty companies face none of the operational expenses (and inflation) that miners do.

This is because royalty agreements calculate royalties (which royalty companies receive) as a percentage of the mine’s top-line revenue rather than from the mine’s final profits after expenses, meaning royalty companies get their cut before operational costs and other expenses are deducted.

The original article/infographic by Niccolo Conte has been edited ([ ]) and abridged (…) for the sake of clarity and brevity to provide the reader with a fast and easy read.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money