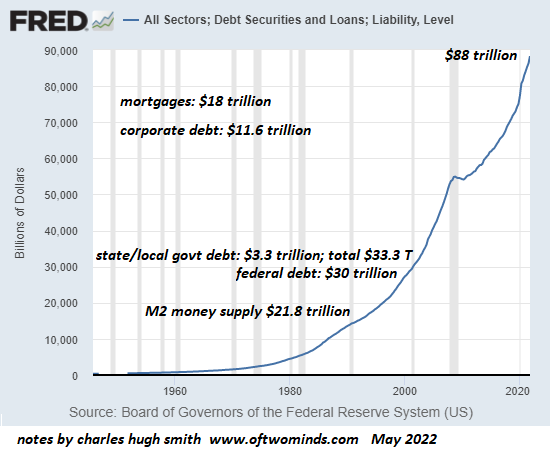

…The illusion that the global economy could effortlessly add trillions in debt to fund living large forever was based on a brief historical anomaly of zero interest rates enabled by low inflation that was never sustainable…and the eventual consequences on supply, demand, risk and price discovery…are finally visible…

This version of the original article by Charles Hugh Smith (oftwominds.com) has been edited ([ ]) and abridged (…) for the sake of clarity and brevity to provide the reader with a faster and easier read.

The favored solutions of the state–printing money or transferring the losses to the public–are no longer viable. Now that inflation has emerged from its slumber, printing trillions to bail out the wealthy is no longer an option. The public, so easily conned into accepting the bailout of the wealthy in 2008, has wised up and so that particular con won’t work again…The only equitable solution is to force the losses on those who bought the debt as a rentier income stream…

…Ordinary households may own other people’s debts as assets through pension plans or ownership of mutual funds but, by and large, debt is a favored asset of the rentier class – i.e. the wealthiest few who own most of the student loans, vehicle loans, mortgages, government and corporation bonds, etc. – …who have been greatly enriched by the global expansion of debt.

The only real solution to over-indebtedness since the beginning of finance is default. There are pretty names for variations on default that sound much less gut-wrenching–debt jubilees, refinancing, etc.– but the bottom line is the debts that can’t be paid won’t be paid and whomever owns the debt as an asset absorbs the loss.

- Every default is a debt jubilee for the borrower…

- Every debt jubilee is a default that forces the owner of the debt to write the value down to zero and absorb the loss…

- Every default is a refinancing–to zero…

The destruction of phantom wealth via default has always been the only way to clear the financial system of unpayable debt burdens and extremes of rentier / wealth dominance…The only question is who will absorb the…losses. Choose wisely, as defaults of debt that are transferred to the public end up bringing down the entire system via political overthrow or currency collapse.

Living within one’s means–i.e. net income–is the only solution there has ever been to the end-game of over-indebtedness, i.e. default. Those with relatively secure, diversified net incomes (i.e. the Core) will do much better than those with unstable, limited income.

Related Article from the munKNEE Vault:

A Debt Jubilee: It Sounds Like A Good Idea BUT…

Americans, and governments across the world, have more debt than they can ever hope to repay and that’s why a number of public figures are suggesting a radical and ancient solution; a debt jubilee…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money