One of the challenges of analyzing trends in the gold price and the gold market is the effect of fluctuating currency exchange rates on the price. What we think of as the “gold price” is really just the gold price measured in U.S. dollars. [What is needed is a]…single metric to look at for a currency-neutral measure of the gold price that removes the effect of the U.S. dollar [and I have identified a ratio that does just that and it reveals that one should] maintain confidence that the gold bull market will continue, and not to be overly worried by the recent correction in the price of gold and mining stocks.

fluctuating currency exchange rates on the price. What we think of as the “gold price” is really just the gold price measured in U.S. dollars. [What is needed is a]…single metric to look at for a currency-neutral measure of the gold price that removes the effect of the U.S. dollar [and I have identified a ratio that does just that and it reveals that one should] maintain confidence that the gold bull market will continue, and not to be overly worried by the recent correction in the price of gold and mining stocks.

The comments above and below are excerpts from an article by Geoffrey Caveney (DrStrangeMarket.squarespace.com) which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read. Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner.)

Of course for Americans, and for anyone dealing primarily in U.S. dollars in their financial investments, the value of an asset in dollar terms is important, but in analyzing the trends of gold itself, it is also important to distinguish between the underlying effects of the market value of gold itself, and the effects of the currency exchange rates of the dollar.

One must determine:

- when the gold price rises:

- how much of that is related to the market’s appreciation of the underlying value of gold?

- how much of that is simply related to a weakening of the dollar compared to other currencies?

- When the gold price falls:

- is it about gold itself?, or

- Is it just about a strengthening of the exchange value of the dollar?

…It would be nice to have one single metric to look at for a currency-neutral measure of the gold price that removes the effect of the U.S. dollar, without having to pore over a half-dozen charts of the gold price in different currencies and trying to make sense of what they are all saying in aggregate so, below, is a simple metric and chart to use for this purpose:

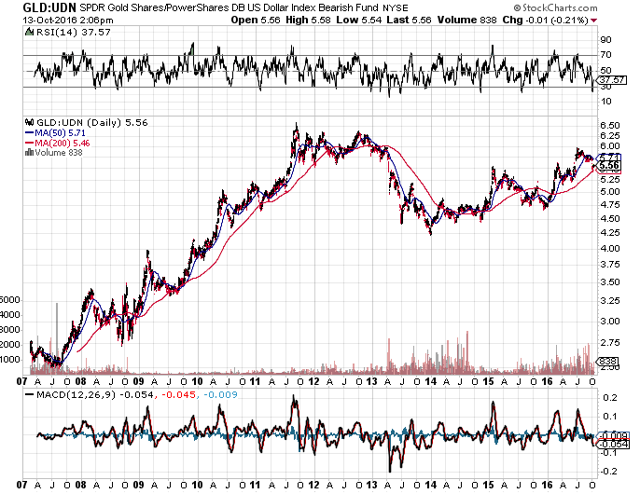

The ratio of SPDR Gold Shares (NYSEARCA:GLD) to PowerShares DB US Dollar Index Bearish Fund (NYSEARCA:UDN):

The point of this metric is that the Dollar Bearish UDN fund will generally be affected by currency movements of the dollar in the same way that gold is: Both UDN and GLD will tend to rise when the dollar falls, and fall when the dollar rises. By taking their ratio, this effect will be cancelled out and…[therefore,]the GLD:UDN ratio will only reflect those movements of the gold price that are actually due to the market’s valuation of the underlying value of gold, not to fluctuations of currency exchange rates of the dollar. Also, since GLD and UDN are both ETFs, taking their ratio will tend to cancel out the effects of fees and other ETF-related costs, since both will have them.

Looking at the chart above, we see again that the currency-neutral gold price indeed bottomed at the end of 2013, and in fact it has been in an uptrend for the three years since then:

This is yet another reason to maintain confidence that the gold bull market will continue, and not to be overly worried by the recent correction in the price of gold and mining stocks.

The 3-year uptrend on the chart above still looks quite solid and intact.

Follow the munKNEE – Your Key to Making Money!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money