Deutsche Bank’s catastrophic derivative exposure has hammered down its stock price from $135 in 2007 to only $17/share today – ergo a heart-stopping price loss of -87%. Furthermore, DB’s stock price appears to be hell bent for leather to follow Lehman Brothers’ lethal path to Wall Street’s graveyard due primarily to its oppressive derivative’s exposure. [As Warren Buffett has said:] “Derivatives are weapons of mass destruction.”

2007 to only $17/share today – ergo a heart-stopping price loss of -87%. Furthermore, DB’s stock price appears to be hell bent for leather to follow Lehman Brothers’ lethal path to Wall Street’s graveyard due primarily to its oppressive derivative’s exposure. [As Warren Buffett has said:] “Derivatives are weapons of mass destruction.”

The WHAT & WHY Of Derivatives

“Megabanks trade risk via derivatives contracts to another firm while keeping the underlying asset on their books. This way they can bypass capital requirements and take on more debt. This, in turn, allows them to make more trades, but it also means that if a sudden downturn surfaces in the markets, the firm which borrowed way beyond their means may quickly go bankrupt. Lehman Brothers experienced this after they’d borrowed 30 times more money than they had in reserve. In that case, a relatively small loss of a mere 3% meant that Lehman no longer had reserves (i.e. capital), and they therefore collapsed, i.e. totally wiped out. The leverage that derivatives allow is incomprehensible. They are betting 30 TIMES MORE MONEY THAN THEY HAVE. This is financially insane.” (Source: http://www.huffingtonpost.ca/nick-fillmore/banks-derivatives_b_4408856.html )

Who was Lehman Brothers…and what happened to them?

Lehman Brothers had humble origins, tracing its roots back to a small general store that was founded by German immigrant Henry Lehman in Montgomery, Alabama in 1844. In 1850, Henry Lehman and his brothers, Emanuel, and Mayer, founded Lehman Brothers.

While the firm prospered over the following decades as the U.S. economy grew into an international powerhouse, Lehman had to contend with plenty of challenges over the years. Lehman survived them all – the railroad bankruptcies of the 1800s, the Great Depression of the 1930s, two world wars, a capital shortage when it was spun off by American Express Co. (AXP) in 1994, and the Long Term Capital Management collapse and Russian debt default of 1998. However, despite its ability to survive past disasters, the collapse of the U.S. housing market ultimately brought Lehman Brothers to its knees, as its headlong rush into the subprime mortgage market proved to be a disastrous step.

On September 15, 2008, Lehman Brothers filed for bankruptcy. With $639 billion in assets and $619 billion in debt, Lehman’s bankruptcy filing was the largest in history, as its assets far surpassed those of previous bankrupt giants such as WorldCom and Enron. Lehman was the fourth-largest US investment bank at the time of its collapse with 25,000 employees worldwide.

The world’s largest financial institutions trade derivatives. Derivatives are instruments that derive their value from fluctuations in the price of an underlying asset such as a stock or a commodity. Financial institutions, asset managers, corporations, and governments use derivatives to manage volatility in assets that their respective enterprises are exposed to. At the time of its bankruptcy, Lehman Brothers had an estimated $35 trillion notional derivatives portfolio.

From 2004-2007 Lehman Brothers and Deutsche Bank (DB) were indeed riding high on the global financial hog. They were literally gorging themselves via derivative exposure – ad nauseam. Then the proverbial poop hit the fan as both Lehman Brothers and Deutsche Bank were hemorrhaging on insane ingestion of many trillions of dollars in derivatives. Subsequently, Lehman Brothers went belly up with its stock price going into freefall from $25/share in 2007 to a mere 10 cents/share by early 2009….Today, Lehman Brothers shares are only 12 cents a share.

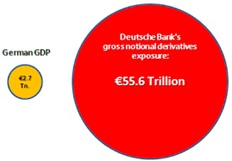

Likewise, Deutsche Bank’s catastrophic derivative exposure has hammered down its stock price from $135 in 2007 to only $17/share today – ergo a heart-stopping price loss of -87%. Furthermore, DB’s stock price appears to be hell bent for leather to follow Lehman Brothers’ lethal path to Wall Street’s graveyard…due primarily to its oppressive derivatives exposure. See Chart below:

Interesting Historical Note: When Lehman Brothers failed, it had $35 Trillion in derivative exposure. Now compare this with today’s Deutsche Bank derivative exposure of a cardiac-arrest $75 trillion…and you will understand why DB share value…[has been] relentlessly and methodically falling in recent years. In fact, today May 3rd, Deutsche Bank stock has already been hammered down more than 6% in today’s early hours of New York trading. Indeed: “Derivatives are weapons of mass destruction” – Warren Buffett

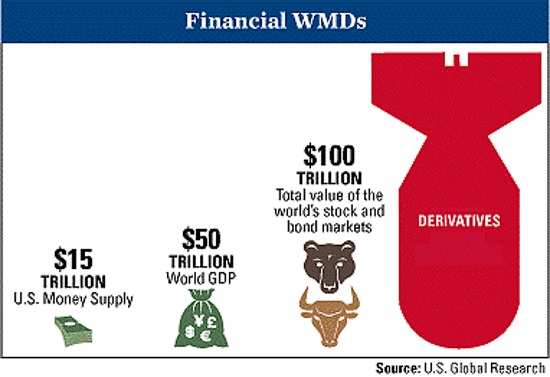

What is the global magnitude of these financial weapons of mass destruction?

Global Derivatives: $1.5 Quadrillion Time Bomb

That’s $1,500,000,000,000,000…equivalent to nearly $200,000 per every man, woman and child on this earth !!

The legendary Lehman Brothers financial dynasty is dead and buried in Wall Street’s cemetery. However, Germany’s giant financial power house – Deutsche Bank is today vying helter-skelter to duplicate the infamous legacy of the tragic Lehman Brothers saga.

Is It Time To Panic About Deutsche Bank?

“At $72.8 Trillion, The Bank With The Biggest Derivative Exposure In The World” was not JPMorgan as some had expected, but Germany’s banking behemoth, Deutsche Bank.” (Source: http://www.infowars.com/financial-armageddon-approaches-u-s-banks-have-247-trillion-dollars-of-exposure-to-derivatives/)

Stop clicking around! #Follow the munKNEE instead

Financial Armageddon Approaches: U.S. Banks Have 247 Trillion Dollars Of Exposure To Derivatives. The following U.S. bank numbers reveal a self-destructing recklessness that is on a level that is near criminal negligence.

Citigroup: Total assets: more than 1.8 trillion dollars

Total derivatives: more than 53 trillion dollars

JPMorgan Chase: Total assets: about 2.4 trillion dollars)

Total derivatives: more than 51 trillion dollars)

Goldman Sachs: Total assets: less than a trillion dollars

Total derivatives: more than 51 trillion dollars

Bank Of America: Total assets: a little bit more than 2.1 trillion dollars

Total derivatives: more than 45 trillion dollars

Morgan Stanley: Total assets: less than a trillion dollars

Total derivatives: more than 31 trillion dollars

Wells Fargo: Total assets: more than 1.7 trillion dollars

Total derivatives: more than 6 trillion dollars

Today six major U.S. banks are betting 24 TIMES MORE MONEY THAN THEY HAVE (i.e. $237 Trillion in total derivatives vs only $10 trillion in total assets). Even more insanely lethal is the derivative exposure of Deutsche Bank, which has $75 trillion vis-à-vis total assets of a mere $1.6 trillion. Sadly DB is betting nearly 47 TIMES MORE MONEY THAN THEY HAVE…it is the biggest derivatives exposure in the world). Clearly, it’s insanely suicidal…

This is financially crazy for the following reason. In a hypothetical case where a relatively small derivatives investment loss of a mere 4% would mean that six major U.S. banks might be totally wiped out. The leverage that derivatives permit is incomprehensible – ludicrously suicidal! It’s even worse for Deutsche Bank, where a derivative investment loss of less than 3% would crash DB into immediate bankruptcy a la Lehman Brothers. To be sure, this is financial Armageddon to the nth degree.

The dire warning words of Warren Buffett are gospel: “Derivatives are weapons of mass destruction.”

Disclosure: The original article, by I. M. Vronsky (silverphoenix500.com) was edited ( [ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

Related Articles:

1.Derivatives: Their Origin, Evolvement and Eventual Corruption (Got Gold!)

The term “derivative” has become a dirty, if not evil word. So much of what ails our global financial system has been laid-at-the-feet of this misunderstood, mischaracterized term – derivatives. The purpose of this paper is to outline the origin, growth and ultimately the corruption of the derivatives market – and explain how something originally designed to provide economic utility has morphed into a tool of abusive, manipulative economic tyranny. Words: 3355

Wall Street has been transformed into a gigantic casino where people are betting on just about anything that you can imagine. This works fine as long as there are not any wild swings in the economy and risk is managed with strict discipline but, as we have seen, there have been times when derivatives have caused massive problems in recent years – the government bailout because of derivatives at AIG; the failure of MF Global because of bad derivatives trades; and the 6 billion dollar loss that JPMorgan Chase recently suffered because of derivatives – [but the next] derivatives panic that comes will destroy global financial markets, and the economic fallout from the financial crash that will happen as a result will be absolutely horrific. [Let me explain my contention.] Words: 1485

3. Will Rising Interest Rates Ignite the Derivatives Time Bomb?

Of the $200+ trillion in derivatives on US banks’ balance sheets, 85% are based on interest rates and for that reason I cannot take any of the Fed’s mumblings about raising interest rates seriously at all. Remember, most if not all, of the bailout money has gone to US banks in order to help them raise capital. So why would the Fed make a move that could potentially destroy these firms’ equity and essentially undoing all of its previous efforts? That being said I still see derivatives as a trillion dollar ticking time bomb with a short fuse. Words: 506

4. $22,000 – $50,000 Gold Required To Salvage World’s Debts & Deriv

The current meltdown of the world’s debt bubble is likely to continue in the course of the next months and Hugo Salinas Price, Mexican business magnate, investor, and philanthropist and the president of the Mexican Civic Association for Silver, believes that the salvaging all debt and derivatives might require a gold price as high as between $22,000 and $50,000 per ounce. Here’s his rationale.

5. Derivatives Crisis & Economic Meltdown Could Result From Falling Oil Prices – Here’s Why

We are heading for a derivatives crisis unlike anything that we have ever seen. It is going to make the financial meltdown of 2008 look like a walk in the park.

6. Derivatives Are Nothing More Than A “Game” of Russian Roulette! Here’s Why

Russian Roulette: Put one bullet in the cylinder of a revolver, spin the cylinder, point the gun at YOUR head, and pull the trigger. Most revolvers have 6 chambers, so your odds of surviving are 5 in 6, IF you quit after pulling the trigger once. Press your luck, spin the cylinder, point the gun, and pull the trigger again. It might be okay. Try for a third time? Now let’s play Russian roulette – derivatives style.

7. Bursting of Global Derivatives Bubble Will Be An Utter Nightmare

Never before in the history of the United States have we been faced with the threat of such a great financial catastrophe but, sadly, most Americans are totally oblivious to all of this. They continue to have faith that their leaders know what they are doing, and they have been lulled into complacency by the bubble of false stability that we have been enjoying for the last couple of years. Unfortunately for them, however, this bubble of false stability is not going to last much longer and when the financial crisis comes it is going to make 2008 look like a Sunday picnic. Let me explain why I believe the aforementioned to be the case.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money