I believe this sell-off is a good thing for the S&P 500 – as the outcome will show us where fair value might be. I believe that we will see the market return to a more reasonable forward P/E of 13, sending SPY to $150.00 – or another 5 percent decline. [Let me explain further.]

where fair value might be. I believe that we will see the market return to a more reasonable forward P/E of 13, sending SPY to $150.00 – or another 5 percent decline. [Let me explain further.]

So writes Mark Meadows in edited excerpts from his original article* as posted on SeekingAlpha.com entitled SPY Has Another 5% To Fall.

[The following article is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Meadows goes on to say in further edited excerpts:

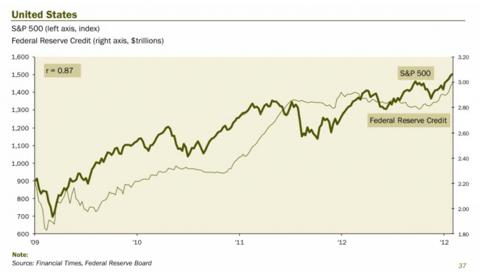

There is a 0.87 correlation between the Federal Reserve’s balance sheet and the S&P 500. Given that correlation (over the past five years) it is only logical that Bernanke’s announcement that he will begin to taper would send stocks headed lower.

Earnings Growth Spurred by Cost Cutting

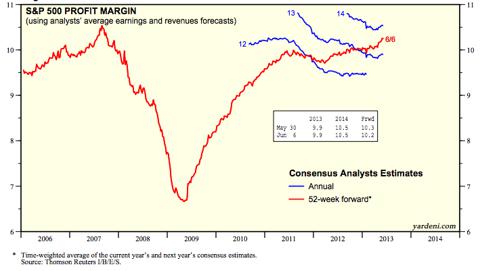

While Q1 saw record profits, the basis of corporate earnings was cost cutting, sending up a caution flag for future margin growth. Revenue growth has lagged growth on the bottom line. First quarter revenue growth was expected to come in at 1% – compared to profit growth of 5%. In addition, less than half – 200 – of the S&P 500 were expected to report revenue growth of 5% or more.

Without revenue growth driving profits higher, companies will have to continue to look to increase margins – something that naturally becomes increasingly challenging. As the below chart demonstrates, profit margin is near 2007 highs.

Valuation

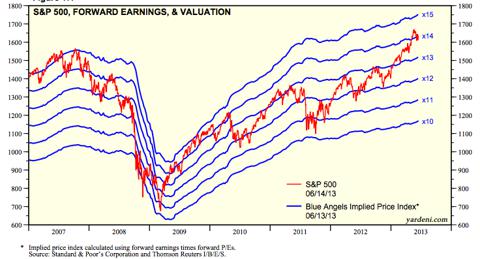

The S&P’s trailing P/E ratio rose to a multiple of 18.3 times as of last Friday, while the forward P/E gained to 14.9. Historically, this is not particularly high; the S&P 500 traded around 16 times forward earnings in 2007 and a staggering 28 times forward earnings in 2000.

However, in an economic climate where real GDP growth is anemic and real disposable personal income shrunk in Q1 at the fastest rate since 2009, I believe that this forward valuation is rich.

As the chart above shows, the S&P 500 traded at a forward valuation capped at 13 times earnings for much of 2010 through early 2013, when economic growth was higher. In recent history, only during the boom of 2006-2007 was the valuation richer. Expecting that the S&P 500 returns to the 2010-2012 valuation, I predict that SPY falls to $150.

_____

Save time! Here are 4 ways to access the best articles on the internet!

Sign up for our FREE Market Intelligence Report newsletter (sample)

“Follow the munKNEE” daily posts via Twitter or Facebook

Set up an RSS feed: It’s really easy – here’s how

_____

Earnings Season Paramount

Fundamentally, the S&P 500 rallied through Q1 earnings season, though at this time, the market was still on a QE3 high. As noted above, earnings last quarter were not particularly strong, with weak revenue growth despite record profits.

This earnings season, I will be watching to see if companies start to report more top-line growth that trickles down to the bottom line. If we see a trend, it would not be surprising to see the SPY shake off these recent losses and move back towards recent highs but I believe that is a big mountain to climb.

Conclusion

Given that the bottom-line corporate growth has been driven more by cost cutting than economic expansion, and the impending Fed tapering shrinking the Fed’s balance sheet, returning to a recent, more conservative valuation of 13 times forward earnings seems in the cards – putting the S&P 500 index at 1,500 given current expectations.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://seekingalpha.com/article/1514262-spy-has-another-5-to-fall

Related Article:

1. 30 Analyses of Why Stock Markets Are Tanking – Finally

There are many, many different takes on why the stock market has been ripe for a fall and why it has finally happened. Below are 30 of the best-of-the-best such analyses to help you come to some sort of resolution. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money