An earlier article on gold & silver went viral with almost 30,000 reads on munKNEE.com alone and continues to be read by hundreds of goldbugs daily. Below is an updated chart and analysis suggesting that gold & silver have further to drop before they go parabolic. Take a look and share it with friends.

munKNEE.com alone and continues to be read by hundreds of goldbugs daily. Below is an updated chart and analysis suggesting that gold & silver have further to drop before they go parabolic. Take a look and share it with friends.

So says Juan Eduardo Morales Veas (www.moneygreedandfear.com) in edited excerpts from his original submission.

(NOTE: This post is presented by Lorimer Wilson, editor of www.munKNEE.com and the free Intelligence Report newsletter (see sample here). The article may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read.

Veas goes on to say, in part:

My Analysis of the Future Price of Gold

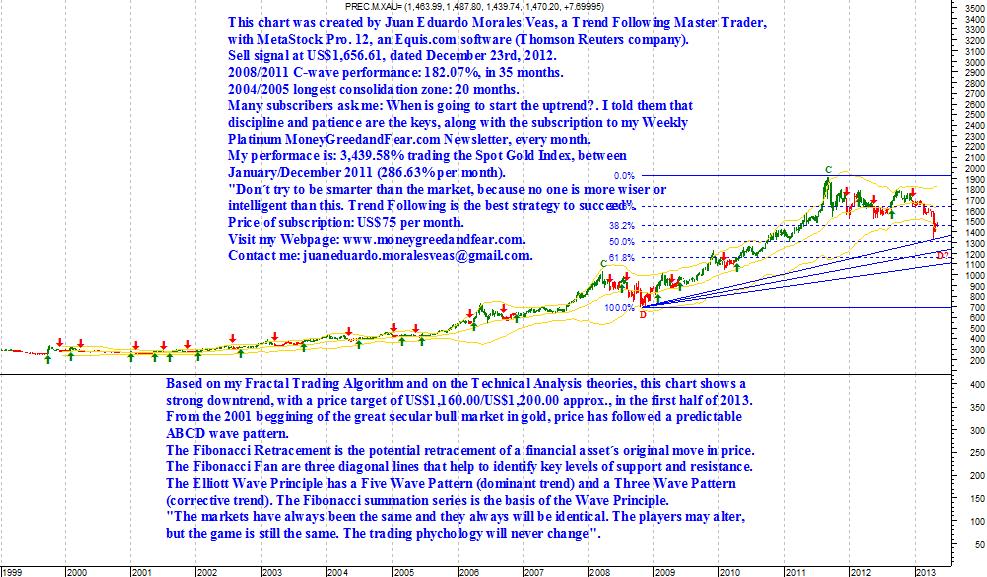

Back in October 2012, when gold was in the process of declining from $1,800/ozt at the beginning of the month to $1,700/ozt at month-end I predicted (see here) that gold would continue dropping to $1,675/ozt by year end. In fact, gold dropped to $1,636/ozt in mid-December. (Incidentally, I issued a sell signal to my clients on December 23rd at $1,656.61/ozt)

My analysis below suggests that gold’s strong downtrend will continue and reach somewhere between $1,160/ozt and $1,200/ozt by mid-year before making a parabolic rally to US$3,950.00 in the last quarter of 2013.

Why has/is this happening? Because the price of gold during this secular bull market has followed a predictable ABCD wave pattern. In the chart below I have drawn the Fibonacci Fan of 3 diagonal lines that help identify key levels of support and resistance.

My Analysis of the Future Price of Silver

Also back in October, 2012, with silver trading down from $35.66 at the beginning of the month to approx. $32 at month’s end, I predicted (see here) that silver would continue falling and reach $30.50 by the end of 2012. In, fact it dropped to $29.64. (Incidentally, I issued a sell signal to my clients on December 23rd at $29.98)

My analysis below suggests that silver’s strong downtrend will continue and reach somewhere between $15/ozt and $18/ozt by mid-year before making a parabolic rally to US$117.00 in the last quarter of 2013.

Veas offers a Weekly Platinum MoneyGreedAndFear.com Newsletter at a cost of US$75/mo. Contact him at JuanEduardo.MoralesVeas@gmail.com

Below are articles outlining Veas’ previous price predictions:

October 31, 2012

My previous article on gold & silver went viral with almost 30,000 reads on munKNEE.com alone and continues to be read by hundreds of goldbugs daily. Below is an updated chart and analysis suggesting that gold & silver have further to drop before they go parabolic. Take a look and share it with friends. Read More »

2. Gold & Silver Will Soon Collapse to $1,380 and $18 Resp. & Then Surge to $3,950/$117 in 2013

July 31, 2012

Due to the severe financial crisis in Europe, capital will continue to take refuge in the U.S. Dollar and gold and silver will collapse to US$1,380/oz. (Fibonacci Retracement 61.8% level) and US$18/oz. (Fibonacci Retracement 76.8% level) respectively, in the third quarter of 2012. Read More »

2. Gold Will Drop to $1,450 This Month Before a Parabolic Move to $3,950!

Based on my technical analysis gold will drop to $1,450/oz. before the end of May and then go parabolic in the next C-wave to $3,950/oz. Below is a chart of how I see the price of gold unfolding over the next while. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

From an earlier story on Silver:

RE: The Silver chart: I’d like to suggest that because of the massive naked shorting* of silver (and other PM’s), the PM charts have been “gamed” by the Big Central Banks to make PM’s “future” look like a bad investment! Given the above, if you were to draw a line form the late 2008 low upward through the latest plunge it seems to indicate a descending triangle that intersects with todays prices of about $24.

I believe this will be a major turning point for Silver and expect to see Silver move upward in small leaps and bounds as all those that shorted Silver scramble to cover their trades, not continue downward as Bulkowski’s Measure Rule chart would seem to indicate; due to the abnormal bias to Silver’s (and other PM’s) current value caused by the above mentioned naked shorting which resulted in huge paper PM selloffs but little to no increase in the actual availability of physical PM’s.

Investors trust in the paper PM market is now starting to separate itself from their trust in the physical PM market, which I think is really good for personal investors because the paper market has now been proven to be easily “gamed” by the biggest players who have control over not only the posted PM values but also the ability to close trades quickly!

The physical PM market, on the other hand remains a much more level playing field for all. Sure there are those with very large holdings that can cause market movements, like in the 80’s, when the Hunt Brothers caused the Silver market to skyrocket but because the total about of physical Silver (and Gold) is “limited,” selling naked shorts will never have the same effect on the physical market. This separation in trading accountability could in itself create a new level of TRUST in physical PM’s (at exactly the time when more investors globally than ever before are worried about long term fiscal solvency), that if widely accepted would add to PM’s value both now and in the future!

In addition to the above differences between paper and physical PM’s, I believe that it is important to add that since many acquire PM’s as a hedge against long term reductions in the value of paper currencies. Plus, the ability to actual have control over their PM’s is important since that removes several layers of Trust in the System, which is required by paper holdings (both PM’s and or currency). Owning physical PM’s also allows these same investors to trade/barter among themselves should the opportunity arise, which could lead to additional savings while at the same time keeping these transactions completely private.

The phrase, To Have And To Hold may very soon apply to all PM owners and not just newlyweds…

*More here on the naked shorting:

https://munknee.com/2013/04/gold-what-caused-the-latest-bloodbath-why/

and

https://munknee.com/2013/04/gold-crash-what-crash/