“Follow the munKNEE” via twitter & Facebook or Register to receive our daily Intelligence Report

I expect gold to move sideways or trend down in the first half of 2013  [and, as such,] I would consider this as a good opportunity to buy gold as there is still no long-term fix in place for the economic and financial problems [that the U.S., and indeed the world, face. Here’s why]. Words: 665; Charts: 5

[and, as such,] I would consider this as a good opportunity to buy gold as there is still no long-term fix in place for the economic and financial problems [that the U.S., and indeed the world, face. Here’s why]. Words: 665; Charts: 5

So writes the Economics Fanatic (http://www.economicsfanatic.com/) in edited excerpts from his original post* on Seeking Alpha entitled Gold Down 30% In Dow Terms: More Correction Likely.

This article is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The Economics Fanatic goes on to say in further edited excerpts:

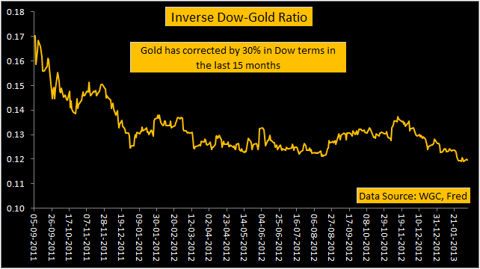

…Equities have outperformed gold in the last 15 months. On converting this observation into numerical terms, [the inverse Dow-Gold]…ratio from September 2011 to February 2013 [is as follows]:

As mentioned earlier, the primary objective of this discussion is to underscore the importance of portfolio diversification. [While] I am bullish on gold long-term…if [I had]… 100% [of my portfolio in] gold,…[it] would be down by 30% at a time when a diversified portfolio might [likely] be performing well or [even]outperforming. Investors, therefore, need to create a portfolio having a mixed asset class exposure such as gold, equities, industrial commodities, agricultural commodities, real estate and corporate bonds among others.

Given the current expansionary policy environment, I would suggest 20% exposure to gold and precious metals, a 20% exposure to domestic equities, 20% exposure to emerging market equities, 20% exposure to industrial and agricultural commodities and 20% exposure to cash and investment grade corporate bonds. The portfolio diversification might differ depending on age and other factors.

Coming [back] to the expected trend in gold and equities, I expect [a] further decline in gold in Dow terms and, as such, investors [would be well advised to] be overweight in equities and underweight in gold and precious metals for the first half of 2013.

One of the primary reasons for being bullish on equities is related to the global economic performance. An improving or stable global economy will result in more liquidity flowing into equities. As the chart below shows, there has been a meaningful improvement in the global purchasing manager index in the recent past. With this improving trend likely to continue, equity market sentiment will remain bullish.

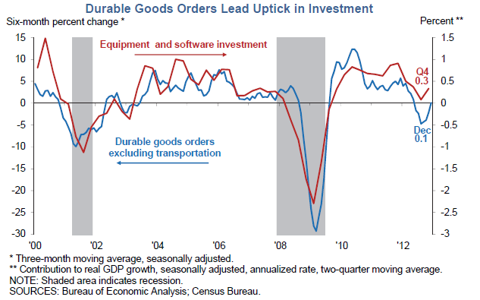

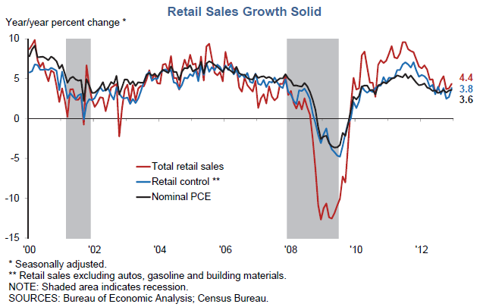

In the U.S., an increase in durable goods orders has resulted in an uptick in investments, which is positive for the economy. At the same time, retail sales growth has been robust and ensures that the first quarter will be decent in terms of economic growth. I am not suggesting that economic activity is the only factor that can lead to upside in equities. However, given the current bullish sentiment and liquidity scenario, equities can witness further upside.

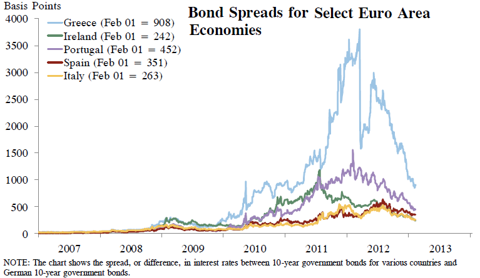

In terms of economic activity and financial market risk, an improvement in the Euro zone PMI gives yet another reason to believe that equities can sustain at current levels or trend higher. Higher bond spreads for the PIIGS did result in declining equity markets in the past. Currently, the bond spreads for PIIGS is on a decline and should decline further if economic activity improves in the Euro zone.

Besides the economic fundamental factors, I personally don’t see any irrational exuberance in equity markets at this point of time. Investors can expect…a robust rally before any healthy and meaningful correction.

Conclusion

Given the above factors, I expect gold to move sideways or trend down in the first half of 2013 [and, as such,] I would consider this as a good opportunity to buy gold as there is still no long-term fix in place for the economic and financial problems [that the U.S., and indeed the world, face].

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/1163591-gold-down-30-in-dow-terms-more-correction-likely

Register HERE for Your Daily Intelligence Report Newsletter

It’s FREE

The “best of the best” financial, economic and investment articles

An “edited excerpts” format to provide brevity & clarity for a fast & easy read

Don’t waste time searching for informative articles. We do it for you!

Register HERE and automatically receive every article posted

“Follow Us” on twitter & “Like Us” on Facebook

Related Articles:

1. Bull Market in Stocks Isn’t About to End Anytime Soon! Here’s Why

As we all know, money printing always leads to inflation. It’s just a matter of figuring out which assets get inflated. This time around gold is not the only beneficiary, stocks are, too, and I’m convinced that the chart below holds the key to the end of the bull market. Words: 475; Charts: 1

2. 5 Compelling Reasons Why It’s Now Time to Sell Gold

I recently explained my thesis for why gold’s 12-year winning streak will come to an end in 2013…[and] nearly a month into 2013, the case for selling gold is gaining strength. [This article puts forth 5 compelling reasons why it is now time to sell gold.] Words: 690 ; Charts: 2

3. Gold On Verge of Another MAJOR Down Leg – Here’s What to Do Now

I would love nothing more than to tell you that gold has finally embarked on its next leg up to $5,000+ but the fact of the matter is that there is no evidence that it has. Period. In fact, gold is telling you exactly the opposite. Gold is now nearly $257 below its all-time record high. It can barely rally and very time it does, the rally fades away and now the price of gold is dangerously near an important weekly sell signal on my systems, which stands at $1,657. Words: 780; Charts: 1

4. 5 Reasons to Short Gold In 2013

There are significant challenges to gold prices increasing in 2013. In fact, I believe that gold prices should move down in 2013 because of five strong headwinds, elaborated in this article. Words: 464

5. Gold Is Looking Increasingly Vulnerable – Here’s Why

The threats of global recession, insurmountable debt, terrible government policy, central bank support, and many other very persuasive arguments present gold as a very appealing investment or safe haven but all of this is an illusion. Gold was a sensible investment in the early part of the bull market (1999-07), but has now become a false sense of security for many investors who will soon learn the hard way. Not only are the fundamentals already priced in, the technicals severely weakened, and the extremes in gold optimism easily apparent, but the bad news for gold could soon get much worse. The next weeks or few months will hopefully give us a lot more clarity. Words: 1170

6. Is Gold’s 13 Year Run Almost Over?

[While] the price of gold has gone up for 12 straight years, and is on pace to make it 13 when this year comes to a close, it seems that despite all of the gold bugs calling for the metal to surge to unbelievable highs, major financial institutions are calling for the gold bubble to finally burst in the coming months. [Let’s examine what they and others have to say.] Words: 450

7. It’s Time to Seriously Consider SHORTING Gold – Here’s Why

I view the current market weakness in gold, coupled with the pullback in trader positions, as a shorting opportunity which is strong in terms of reward vs. risk. I have come to that conclusion by questioning the assumptions that many make about it, isolating its fundamental drivers and providing a trading recommendation as to where I believe the price is headed in the future. Let me share my analyses with you. (Words: 1440; Charts: 4; Tables: 1)

8. 7 Indications That Gold & Silver Bearishness Most Likely Will Continue

This article looks at 7 reasons why gold and silver should experience further weakness over the days/weeks ahead. (Words: 206; Charts: 5)

9. Rising Deflation Concerns Could Cause Gold to Plummet Dramatically – Here’s Why

The arguments for gold to rise dramatically are well known and highly publicized. The arguments for gold to remain flat or to decline are minimally discussed and generally attacked vigorously when raised. [I do just that in this article and the conclusions will not be liked by the goldbugs.] Words: 285

10. My Case Against the Case Against The Case Against Gold

All thing considered, it seems clear that the long-term real returns of gold have been poor (compared to stocks and bonds), and I see no reason to expect long-term price appreciation for gold to be above inflation. In fact, as with any non-income producing asset, it would be unreasonable to expect gold to provide significant positive real returns over an indefinite period of time…I would argue that buying gold is a short-term gamble that is completely dependent on the unpredictable vagaries of perception, market psychology and the “greater fool” theory…While it is true that gold can be a good short-term trade and offer superior returns over shorter periods (as has been the case in recent years) I believe that stocks will continue to substantially outperform gold over time. [Let me explain these less than popular conclusions further.] Words: 1258

11. QE Could Drive S&P 500 UP 25% in 2013 & UP Another 28% in 2014 – Here’s Why

Ever since the Dow broke the 14,000 mark and the S&P broke the 1,500 mark, even in the face of a shrinking GDP print, a lot of investors and commentators have been anxious. Some are proclaiming a rocket ride to the moon as bond money now rotates into stocks….[while] others are ringing the warning bell that this may be the beginning of the end, and a correction is likely coming. I find it a bit surprising, however, that no one is talking of the single largest driver for stocks in the past 4 years – massive monetary base expansion by the Fed. (This article does just that and concludes that the S&P 500 could well see a year end number of 1872 (+25%) and, realistically, another 28% increase in 2014 to 2387 which would represent a 60% increase from today’s level.) Words: 600; Charts: 3

12. 5 Reasons To Be Positive On Equities

For the month of January, U.S. stocks experienced the best month in more than two decades [and the Dow hit 14,009 on Feb. 1st for the first time since 2007]. Per the Stock Traders’ Almanac market indicator, the “January Barometer,” the performance of the S&P 500 Index in the first month of the year dictates where stock prices will head for the year. Let’s hope so…. [This article identifies f more solid reasons why equities should do well in 2013.] Words: 453

13. World Economy & Market Forecast: More Sunshine & Less Stormy Weather Ahead

It seems clear that there are a number of investors who have gained confidence in the global economy and are seeking to capture the growth opportunities taking place around the world. With the European crisis comfortably in the rear view mirror and global central banks taking the position that they will continue their easing policies, investors have taken their foot off the brake and have begun to accelerate….We see more sunshine and less stormy weather ahead [and explain why that is the case in this article]. Words: 695; Charts: 3

14. Start Investing In Equities – Your Future Self May Thank You. Here’s Why

As Winston Churchill once said: “A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty” and in that vain I challenge all readers to fight off the negativity, see long-term opportunity in global equity markets and, most importantly, remain invested. Your future self may thank you. Words: 732; Charts: 6

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money