“Follow the munKNEE” via twitter & Facebook or Register to receive our daily Intelligence Report

I explained in an earlier article* my thesis for why gold’s 12-year winning streak will come to an end in 2013…[and] nearly a month into 2013, the case for selling gold is gaining strength. [This article puts forth 5 compelling reasons why it is now time to sell gold.] Words: 690 ; Charts: 2

will come to an end in 2013…[and] nearly a month into 2013, the case for selling gold is gaining strength. [This article puts forth 5 compelling reasons why it is now time to sell gold.] Words: 690 ; Charts: 2

So writes Mike Williams in edited excerpts from his article** as originally posted on Seeking Alpha under the title 5 Compelling Reasons To Sell Gold.

This article is presented compliments of www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Williams goes on to say in further edited excerpts:

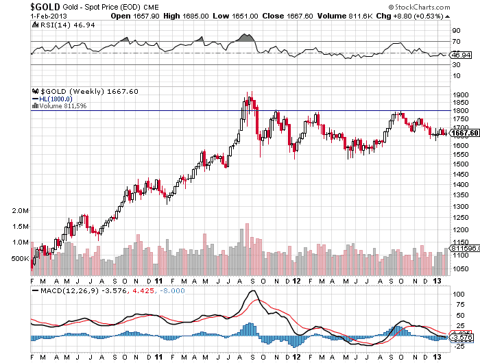

Since putting in its 2012 high at $1,800 in the first quarter, gold has, thus far, been unable to break out above that resistance after three attempts — even with the aid of QE3 and additional treasury purchases. Long gone are the days when even a hint at further easing on behalf of a major central bank sent the metal soaring a few percentage points.

Below are 5 compelling reasons why it is now time to sell gold:

1. Outstanding Strength in Equities

With the S&P 500 breaking above the psychologically significant 1,500 level mark and stocks’ ability to shrug off any bad news (“climbing the wall of worry”), the opportunity costs of allocating capital to gold are rising quickly. Let’s think about this from the perspective of a fund manager.

While many funds, such as Ray Dalio’s Bridgewater Associates, are bullish on growth and are buying gold as a hedge against inflation, it’s plausible that a very large number are still sticking to either the “doomsday trade” or the low-growth, low-rate environment trade. Those who positioned themselves for a bearish 2012 were probably met with major redemptions as the year came to a close, which is what some are attributing gold’s year-end slide to….[It has been suggested] that funds had to sell some gold holdings to meet investor calls for their cash back. This seems plausible, and I’d argue that a similar change in psychology is under way now.

…In 2012 was the hedge fund industry experienced significant underperformance and, as equities continue their historically strong start to 2013, it’s likely that many are finding themselves already trailing their benchmarks by a wide margin. Anyone who was betting on a low-growth environment where stocks move marginally was probably holding gold-related assets, and is now worrying. Gold, which as we know doesn’t produce any income unless you sell it, is awfully hard to hold when stocks are soaring. It’s going to get harder as the bears start to capitulate and retail investors finally get into equities….

2. Correlations

…The EUR/USD has been rising rapidly of late…[yet] despite this dollar weakness, gold has been unable to catch a strong bid. A major downward move in the dollar should have supported gold prices; instead we’re still under $1,700. The same can be seen in the breakdown of the gold/S&P correlation, which should cause many to rethink their theses for holding gold.

3. Macro Indicators Showing Structural Shifts

The yield on the U.S. 10-year Treasury yield is now above 2%, and the 2Y-10Y spread appears to be on its way to 200 bps. As mentioned above, the euro has gained significant ground on the dollar rather quickly, and many other currency pairs (such as EUR/CHF) are also indicating that the “fear trade” may be unwinding.

4. Fed Action Not That Bullish

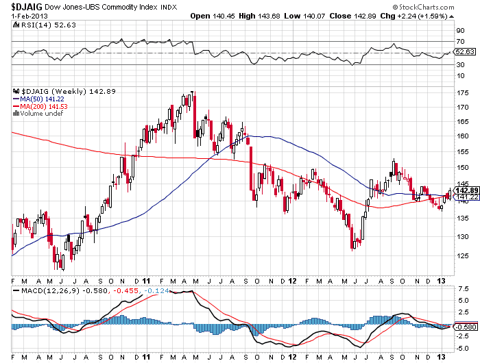

QE has lost its shock value, and the top that the commodities complex put in during 2011 (which I think coincided with the peak of Fed-induced enthusiasm in commodities trading) looks as if it’s going to hold.

Click to enlarge images.

Today, the view that the Fed’s current policies will result in a major devaluation of the USD — and thus sent commodities to record highs — is a bit less prevalent. This is a major change in the way traders approach commodities as a whole and has major effects on how they formulate opinions on gold.

5. Technicals

Finally, the chart for gold is also bearish:

Following the announcement of QE3, I wrote that I felt gold would finally take out the $1,800 level, which it had tested once in both 2011 and 2012. When the resistance held, I believed it was a major signal that investor enthusiasm due to Fed policies had waned.

Right now, gold is range-bound and consolidating between $1,650 and $1,690. I think we’ll stay in this range for a while until we get a temporary change in the direction of equities, causing people to rethink their allocations. My guess is, obviously, that it loses $1,650 and tests $1,600.

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/1097131-2013-the-end-of-gold-s-12-year-winning-streak

**http://seekingalpha.com/article/1153051-5-compelling-reasons-to-sell-gold

Register HERE for Your Daily Intelligence Report Newsletter

It’s FREE

The “best of the best” financial, economic and investment articles

An “edited excerpts” format to provide brevity & clarity for a fast & easy read

Don’t waste time searching for informative articles. We do it for you!

Register HERE and automatically receive every article posted

“Follow Us” on twitter & “Like Us” on Facebook

Related Articles:

1. Gold On Verge of Another MAJOR Down Leg – Here’s What to Do Now

I would love nothing more than to tell you that gold has finally embarked on its next leg up to $5,000+ but the fact of the matter is that there is no evidence that it has. Period. In fact, gold is telling you exactly the opposite. Gold is now nearly $257 below its all-time record high. It can barely rally and very time it does, the rally fades away and now the price of gold is dangerously near an important weekly sell signal on my systems, which stands at $1,657. Words: 780; Charts: 1

2. 5 Reasons to Short Gold In 2013

There are significant challenges to gold prices increasing in 2013. In fact, I believe that gold prices should move down in 2013 because of five strong headwinds, elaborated in this article. Words: 464

3. Gold Is Looking Increasingly Vulnerable – Here’s Why

The threats of global recession, insurmountable debt, terrible government policy, central bank support, and many other very persuasive arguments present gold as a very appealing investment or safe haven but all of this is an illusion. Gold was a sensible investment in the early part of the bull market (1999-07), but has now become a false sense of security for many investors who will soon learn the hard way. Not only are the fundamentals already priced in, the technicals severely weakened, and the extremes in gold optimism easily apparent, but the bad news for gold could soon get much worse. The next weeks or few months will hopefully give us a lot more clarity. Words: 1170

4. Is Gold’s 13 Year Run Almost Over?

[While] the price of gold has gone up for 12 straight years, and is on pace to make it 13 when this year comes to a close, it seems that despite all of the gold bugs calling for the metal to surge to unbelievable highs, major financial institutions are calling for the gold bubble to finally burst in the coming months. [Let’s examine what they and others have to say.] Words: 450

5. It’s Time to Seriously Consider SHORTING Gold – Here’s Why

I view the current market weakness in gold, coupled with the pullback in trader positions, as a shorting opportunity which is strong in terms of reward vs. risk. I have come to that conclusion by questioning the assumptions that many make about it, isolating its fundamental drivers and providing a trading recommendation as to where I believe the price is headed in the future. Let me share my analyses with you. (Words: 1440; Charts: 4; Tables: 1)

6. 7 Indications That Gold & Silver Bearishness Most Likely Will Continue

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money