If I had to guess, I would say that a majority of people in the country still view the housing market in a negative light. They note:

the housing market in a negative light. They note:

- the still-large overhang of foreclosed properties,

- the still-low rate of new housing starts, and

- the still-depressed level of housing prices in many parts of the country

but that is looking at the market from a static viewpoint. There have been some very important improvements in the housing market over the past 18 months…that have all the makings of a clear turnaround that is underway and likely to continue. [Let me explain.] Words: 388

So says Scott Grannis (http://scottgrannis.blogspot.ca) in edited excerpts from his article* entitled Housing market continues to improve.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), may have edited the article below to some degree for length and clarity – see Editor’s Note at the bottom of the page for details. This paragraph must be included in any article re-posting to avoid copyright infringement.

Grannis goes on to say, in part:

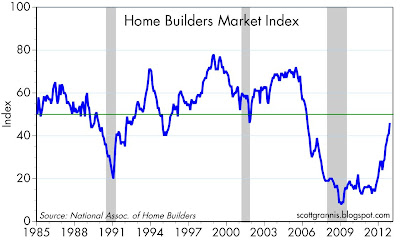

1. Home Builders’ Perceptions of Current Single-family Home Sales & Sales Expectations Up

The chart below shows the results of a monthly survey of home builders’ perceptions of current single-family home sales and sales expectations for the next six months. Even though home builders’ sentiment is still below 50—which signifies that somewhat more builders still view conditions as poor rather than good—the improvement in the index so far this year has been dramatic.

2. The Number of Homes for Sale is Relatively Small

There may be lots of housing inventory “waiting in the wings,” but currently the number of homes for sale is relatively small compared to the current rate of sales [as the chart below illustrates]. Again, dramatic improvement on the margin.

3. A Significant Decline in the Number of Vacant Homes for Sale

The chart below shows the fraction of homes for sale that are vacant. While still somewhat high from an historical perspective, there has been a significant decline in the number of vacant homes for sale this year.

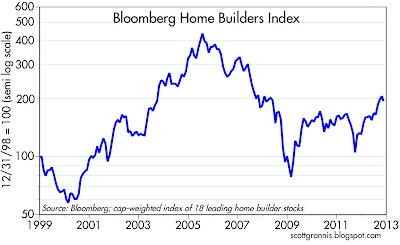

4. The Stocks of Major Home Builders Have Increased

As the chart below shows, the stocks of major home builders have increased significantly from their lows of October 2011—up 94%. Stocks are still depressed from their bubble highs of 2005, but the recovery from the lows has been dramatic.

Conclusion

[The above exemplfy that] on the margin, there have been some very important improvements in the housing market over the past 18 months. It’s hard for me to believe that these changes are ephemeral—they have all the makings of a clear turnaround that is underway and likely to continue.

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. This Detailed Analysis Suggests the U.S. Housing Crash Is Finally OVER!

For the past few months, existing home sales levels have been weaker than expected. The focus, however, should not be on the weakness of the headline numbers. In actuality, the softening in existing home sales is showcasing the potential for acceleration in new home sales. [Let me expain.] Words: 1205

2. Many Not So Sure That Our Housing Problems Are Behind Us – Here’s Why

With recent numbers positive for housing realtors, politicians, and others with vested interests, are quick to claim we are on our way back – but are such numbers really meaningful and sustainable? Many more objective analysts, however, are less sure or disagree with this conclusion that the bottom has been reached yet. Here’s what some of them have to say. Words: 1377

3. Recent Data Suggest a Tidal Wave of Foreclosures is Coming! Here’s Why

The real estate market had started to stabilize on signs that foreclosure inventory was decreasing but a rise in foreclosure starts suggests that a tidal wave of foreclosures is building, especially in states with a judicial foreclosure process.

4. Housing NOT Coming Back Any Time Soon! Here’s Why

“Ben Bernanke is trying like mad to stimulate credit and lending but to no avail. It’s an uphill battle because of demographics, student debt, and lack of jobs. [Frankly however, given such an environment,] prospects for family formation are fundamentally very weak and overall economic fundamentals are very weak as well” [and that certainly does not bode well for housing coming back anytime soon. Let me explain.] Words: 650

5. Housing Prices Expected to Rebound in 2013 – 2014 – Here’s Why

We are currently seeing bullish indicators regarding housing demand coupled with bearish indicators regarding housing prices. Let’s take a look at the past relationship between house demand and house prices and see what it suggests for the future in real estate prices. Words: 450

6. This Hard Data Clearly Says: Real Estate is in Recovery Mode!

Auto sales, consumer confidence, manufacturing, retail sales, exports – you name it – over the last six months, nearly every facet of the U.S. economy has shown improvement and the real estate market is no exception. [Here are 11 irrefutable signs that such is the case.] Words: 800

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money