The best way to look at miners, in relation to gold, is to look at the relative strength of each which is most clearly illustrated through ratio analysis. Whether you are a fundamental or technical analyst, both schools of thought support the notion of investing in sectors that exhibit positive relative strength. For those unfamiliar, the idea is that relative strength tends to persist over time and that it is often best to invest in securities that exhibit positive relative strength. [So what does relative strength analysis suggest is the appropriate course of action these days? Let’s take a look.] Words: 805

strength of each which is most clearly illustrated through ratio analysis. Whether you are a fundamental or technical analyst, both schools of thought support the notion of investing in sectors that exhibit positive relative strength. For those unfamiliar, the idea is that relative strength tends to persist over time and that it is often best to invest in securities that exhibit positive relative strength. [So what does relative strength analysis suggest is the appropriate course of action these days? Let’s take a look.] Words: 805

So says Brennan Basnicki (http://tradersvideoplaybook.com/) in edited excerpts from his original article* posted on Seeking Alpha entitled Relative Strength In Gold Miners Favors Miners Over Gold

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), may have edited the article below to some degree for length and clarity – see Editor’s Note at the bottom of the page for details. This paragraph must be included in any article re-posting to avoid copyright infringement.

Basnicki goes on to say, in part:

Last week I wrote an article [There’s No Rationale For Owning Gold Mining Equities – It’s As Close As You Can Get To Insanity! Here’s Why] suggesting that portfolio allocation to gold miner stocks (GDX and GDXJ) was not an effective way to gain exposure to gold. The article illustrated how the correlation between miners and gold had recently approached zero. Unfortunately, many people took this to be an outright bearish article on miners, and that was not the intention. I just wanted to highlight that the relationship had changed, and offered a couple of reasons perhaps why the relationship had changed. Further, miners have significantly underperformed gold over the last two years, and until that trend showed signs of a change, I suggested one would do best to respect the trend and invest alongside of it.

Given all the comments made, I have decided to explore the relationship further. Historical relationships don’t last forever, and what is in focus today is often forgotten tomorrow and, interestingly enough, it appears that ratio analysis favors the miners since the summer, and this could be the start of a new trend. There has been a series of two higher lows and a significant break of the downwards trend that existed for 2011 and the first half of 2012. More plainly stated, relative strength appears to favor the gold miners over gold recently.

A similar pattern is seen in the junior miners; there has been a break of the downwards trend and the Novembers low was higher than the summer lows.

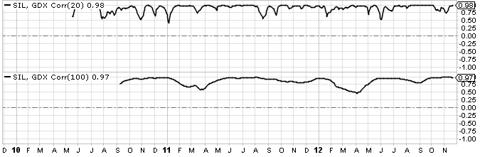

It should come as no surprise that the correlation between silver miners and gold miners is quite high. The 20 and 100 day correlations between silver miners and gold miners are .98 and .97, respectively.

That being said, despite the high correlation, gold miners have underperformed silver miners over the last year.

From this analysis, there does seem to be evidence that:

- miners may outperform gold in the future.

It appears that there is a bearish mainstream consensus on miners due to the poor performance over the last couple of years. The change in trend recently, however, suggests that the future could be different. Typically, mainstream consensus develops well after a trend has reversed. If such a change were to take place, gold miners could see a significant bounce as they catch up to both silver miners and gold. When a security all of a sudden hits the spotlight after being hated on for an extended period of time, there is opportunity for significant price appreciation in a short period of time….

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- It’s FREE

- It contains the “best of the best” financial, economic and investment articles to be found on the internet

- It’s presented in an “edited excerpts” format to provide brevity & clarity of content to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you and bring them to you each day!

- Sign up HERE and begin receiving your newsletter starting tomorrow

However, before getting too excited about miners, one must keep in mind that:

- relative strength in miners can still be accomplished with negative returns. Further,

- the recent change in relative strength is still a relatively new trend, and any deterioration in this trend could point to further weakness in miners.

Given the relative strength being displayed in miners, I would say that I am more bullish than bearish on miners, however that opinion could change with the slightest evidence of resumption of prior trends. Despite this article suggesting that gold miners may outperform gold in the future, one should still consider owning outright gold in a portfolio over gold miners when trying to develop an optimal portfolio. Miners could be a great component of your equity allocation, but shouldn’t be considered for your commodity allocation in your portfolio.

*http://seekingalpha.com/article/1030231-relative-strength-in-gold-miners-favors-miners-over-gold

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

Hedge fund manager Hugh Hendry has stated, “There is no rationale for owning gold mining equities. It is as close as you get to insanity. The risk premium goes up when the gold price goes up.” Indeed, the notion that adding gold and other commodities to one’s portfolio produces a higher expected return with lower risk failure has failed of late and can be illustrated through the following charts. Words: 808

2. Which Is the Best Buy Now – Gold or Gold Stocks?

You have probably read in multiple articles that mining stocks offer leverage to the movement of the underlying metal. This hasn’t been the case over the past several years, however, which has created some confusion in the precious metals investment community. While the gold price has more than doubled (+110%) in the past five years, the AMEX Gold Bugs Index (HUI) is up only 15% so why do people keep saying that mining stocks offer leverage? Well, because they do during certain periods of the bull market. [Let me explain the situation more fully and exactly where we are in the current bull market.] Words: 677

3. We Are Certain Gold Producers Will Soar – Here’s Why

For the past eighteen months, gold stocks have been pummeled…What’s going to move these darn stocks? Will their day ever come? Could our research – gulp – be wrong? Jokes have even started circulating…[such as] a) What’s the difference between a seagull and a gold stock investor? The seagull can still make a deposit on a Mercedes. b) Gold equities may be bad, but I slept like a baby last night. I woke up every hour and cried. Laugh or cry, however, underneath this heap of stock-certificate debris is the contrarian opportunity of a lifetime. That’s a strong statement, I know, but below I present numerous well-researched reasons why I’m convinced gold stocks are one spark away from igniting the portfolios of those with the cash to buy, courage to act, and patience to hold. Words: 2800

4. Dr. Nu Yu’s Latest Analysis Shows Why Current Gold, Silver and HUI Levels Are No Surprise

4. Gold & Silver Streaming Companies Generate Greater Returns Than Any Other PM Sector! Here’s Why

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money