payments can only be made by adding more debt. This process has a sure ending. Like the flush of a toilet, the spiral goes faster and faster until it finally ends. [Let me put forth just how serious the problem is.] Words: 431

payments can only be made by adding more debt. This process has a sure ending. Like the flush of a toilet, the spiral goes faster and faster until it finally ends. [Let me put forth just how serious the problem is.] Words: 431

So says Monty Pelerin (www.economicnoise.com) in edited excerpts from his original article*.

[Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.]

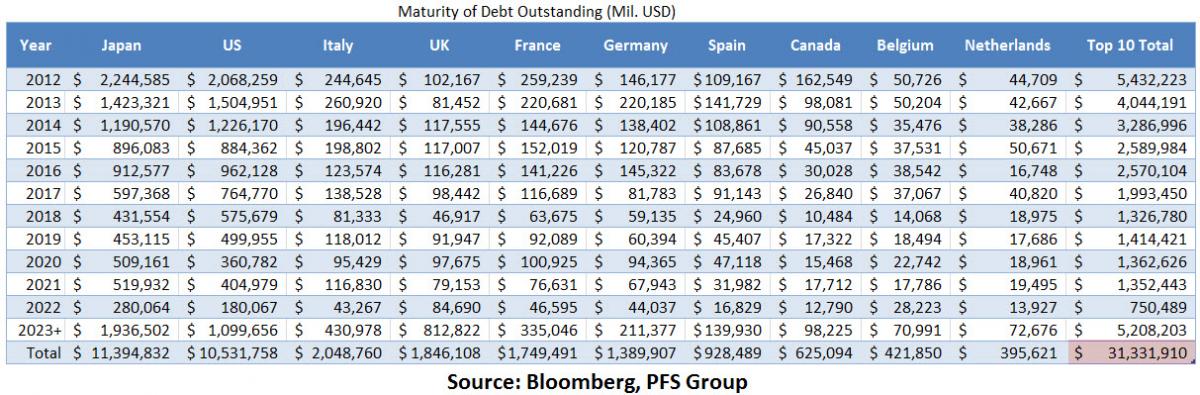

Global central banks of the top 10 debtor nations will be rolling over approx. 50% of their outstanding debt between now and 2015 because large portions of debt will be maturing in just the next two and a half years. This is a staggering amount equal to 20% of the entire world’s GDP!

As the table below shows, both the U.S. and Japan will see 20% of their total outstanding debt mature just between now and the end of the year and Canada [a whopping] 26%! The other members of the top 10 are only in a slightly better position with all but the UK to see double-digit debt rollovers of their total outstanding debt between now and 2015.

The above only reflects debt maturing. This amount would be difficult enough to finance, but these nations all run deficits which must be funded as well….The U.S., for example, will need to fund new debt resulting from projected deficits almost equal to its rollovers in the next three years. The total amount of debt issuance to meet both requirements totals over $8 Trillion dollars. Other countries in the above table run annual deficits which must also be added on to their rollover requirements. Proportionately, some are bigger than what is required in the US.

Where this funding will come from is the $64 Trillion question. There is just too much debt maturing over the next couple of years for capital markets to absorb. As such, it is highly likely we will see global quantitative easing occur as central banks step in to be buyers of last resort to help suppress interest rates and keep debt servicing costs low….It is likely [the money] will be created out of thin air…exactly as it has been for much of the last four years….If so, the question is when and how does this Ponzi scheme collapse? These debts cannot be funded without massive debasement of the currency — all currencies.

Conclusion

Nothing has been done to stop this march to ruin by the political classes – and nothing will be done! When this ends will be determined not by politicians but by markets who will eventually discipline politicians and all who trusted them. “Got Gold?”

[Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.]

*http://www.economicnoise.com/2012/07/24/the-debt-death-spiral-2/

Related Articles:

1. Foreigners Beware: U.S. Treasury Maturity Dates are Alarming

While many investors want to believe that U.S. treasuries are a safe haven, I will use this article to debunk that myth with plain hard evidence…[to support my contention that] holding U.S. bonds is the worst investment going forward. Words: 500

This short video – on the unsustainability of government spending – should be watched by everyone, including those not yet old enough to vote. It should be shown in every high school and college classroom. Anyone that cannot understand this presentation should not be allowed out without a guardian.

3. Richard Duncan: IF Credit Bubble Pops Civilization Won’t Survive the Depression that Follows

Our civilization would not be able to handle such a transition from an expansionary credit based economy where goods and services were readily available into a paradigm of credit contraction, supply shortages and destitution and this is what is coming. There is no way to prevent it – only to defer it until a later date – and that day will soon be upon us. Words: 590

The outcome of the election of 2012 will [only] determine the rate of speed at which we approach the [financial] cliff [because] neither political alternative is willing to change course, to steer away from the cliff. The cliff is so high that whether we go over it at 200 mph (Obama) or whether we merely slip over the edge (Romney), the end result is the same — fatal for the economy and perhaps our entire political system. It is the fall that will kill us. [This article explains why that is going to be the case.] Words: 1135

5. U.S Likely to Hit the Financial Wall by 2017! Here’s Why

The deficits aren’t going to stop anytime soon. The debt mountain will keep growing…Obviously, the debt can’t keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things….The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for….[and] the Federal Reserve will hear their prayer. When will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. [Let me explain what I expect to unfold.] Words: 1833

6. This Will NOT End Well – Enjoy It While It Lasts – Here’s Why

…The US Government and its catastrophic fiscal morass are now viewed by the world as a ‘safe haven’. This would easily qualify for a comedy shtick if it weren’t so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media. [Let me explain what they are.] Words: 1150

7. Events Accelerating Towards an Ultimate Dollar Catastrophe! Here’s Why

With the U.S. election just months off, political pressures will mount to favor fiscal stimulus measures instead of restraint. Such action can only accelerate higher domestic inflation and intensified dollar debasement culminating in a Great Collapse – a hyperinflationary great depression – by 2014. [Let me explain why that is the inevitable outcome.] Words: 2766

8. Major Inflation is Inescapable and the Forerunner of an Unavoidable Depression – Here’s Why

Whether our current economic crisis will end with massive inflation or in a deflationary spiral (ultimately, either one results in a Depression) is more than an academic one. It is the single most important variable for near and intermediate term investing success. It is also important in regard to taking actions which can prepare and protect you and your family. [Here is my assessment of what the future outcome will likely be and why.] Words: 1441

9. An Inflation Inferno is Expected – but When?

Daniel Thornton, an economist at the Federal Reserve Bank of St. Louis, argues that the Fed’s policy of providing liquidity has “enormous potential to increase the money supply,” resulting in what The Wall Street Journal’s Real Time Economics blog calls “an inflation inferno.” [Personally,] I think it’s too soon to make significant changes to a portfolio based on inflation fears. Here’s why. Words: 550

10. Major Price Inflation Is Coming – It’s Just a Matter of Time! Here’s Why

The developed economies of the world have opened the money spigots…[and this] massive money and credit creation is sitting in the banking system like dry tinder just waiting for a spark to set it ablaze. How quickly it happens is anyone’s guess, but once it does we are likely to be enveloped in a worldwide inflation unlike anything before ever witnessed. [Let me explain further.] Words: 625

Evidence shows that the U.S. money supply trend is in the early stages of hyperbolic growth coupled with a similar move in the price of gold. All sign point to a further escalation of money-printing in 2012…followed by unexpected and accelerating price inflation, followed by a rise in nominal interest rates that will bring a sovereign debt crisis for the U. S. dollar with it as the cost of borrowing for the government escalates…[Let me show you the evidence.] Words: 660

12. Current Distortion of Interest Rates is Unsustainable & Will Have Dire Consequences

Interest rates have been manipulated to keep them extremely low in an attempt to stimulate the economy but…unless deficits are dramatically reduced…. interest rates will eventually rise and government interest expense will double or triple from the amounts being paid today. That potentially triggers a debt death spiral, where government has to borrow more than otherwise expected. It also raises the credit risk and could ratchet interest rates up again. It has happened to Greece, Portugal, Spain and other European countries already this year and could well happen in the U.S. too. Words: 595

13. Eventual Rise in Interest Rates Will Be Downfall of U.S. – Here’s Why

Everyone who purchases a Treasury bond is purchasing a depreciating asset. Moreover, the capital risk of investing in Treasuries is very high. The low interest rate means that the price paid for the bond is very high. A rise in interest rates, which must come sooner or later, will collapse the price of the bonds and inflict capital losses on bond holders, both domestic and foreign. The question is: when is sooner or later? The purpose of this article is to examine that question. Words: 2600

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money