to support this claim. Typically, the primary support is the fact that the Gold price has meaningfully risen over the last decade but citing a rising price is simply insufficient to draw such conclusions. [Let me explain.] Words: 534

to support this claim. Typically, the primary support is the fact that the Gold price has meaningfully risen over the last decade but citing a rising price is simply insufficient to draw such conclusions. [Let me explain.] Words: 534So says Eric Parnell in edited excerpts from his original article* as posted on www.SeekingAlpha.com.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Parnell goes on to say, in part:

Gold is not in a bubble. This is true for several reasons.

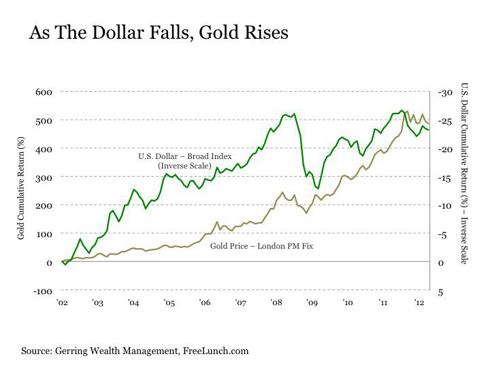

1. As the dollar has fallen over the last decade, gold has risen and, given the fact that global central banks including the U.S. Federal Reserve remain engaged in competitive currency devaluations in an environment where markets remain on the brink of crisis, little reasons exists to suspect that this trend is going to stop any time soon.

Automatic Delivery Available! If you enjoy this site and would like every article sent to you automatically then go HERE and sign up to receive FREE Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

Spread the word. munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

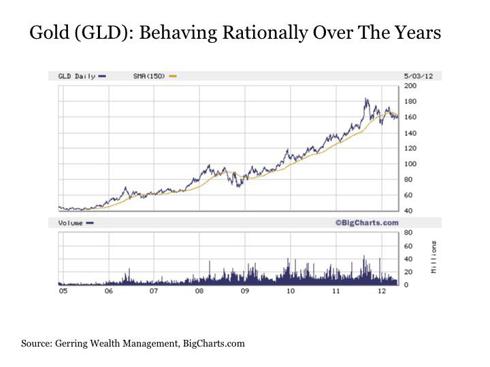

2. The price of Gold has responded repeatedly to its 150-day and 200-day moving averages and it has rarely deviated from these long-term trend lines [as seen in the chart below]. Gold’s price movement over time also lacks any of the parabolic short-term price escalation that is characteristic of a bubble. To the contrary, it’s price movement has been very predictable and rational all along the way.

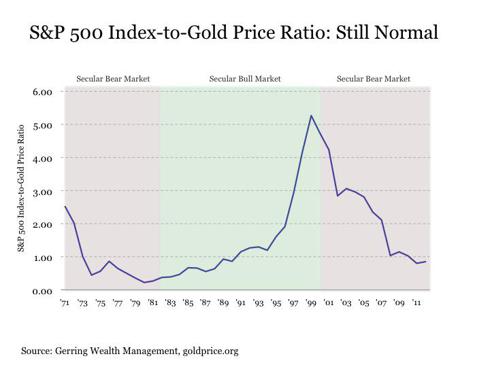

3. Gold is trading at a reasonable price ratio relative to the S&P 500 Index given the current market environment. Since 1971 when the Bretton Woods system was officially terminated and the gold price was free to fluctuate, we have experienced three market cycles:

- a secular bear market for stocks that ended in 1982,

- a secular bull market from 1982 to 2000, and

- the secular bear market that has existed since 2000 through today.

During the secular bull market:

- the stocks-to-gold ratio steadily increased amid price stability and investor confidence about the stability of the global economy.

During the two secular bear market phases:

- the stocks-to-gold ratio steadily declined due to inflationary/deflationary pressures and uncertainty surrounding the global economic instability and the viability of the fiat currency system.

At a current stocks-to-gold ratio of 0.85, we are still well above the lows of 0.22 reached at the bottom of the last secular bear market [as illustrated in the graph below].

The above are just three of many reasons why Gold is not in a bubble.

Conclusion

Gold continues to represent an ideal portfolio allocation to protect against the threat of pricing instability and economic crisis across many regions around the world. This is particularly true with many global central banks still firmly engaged in increasingly easy monetary policy in an ongoing effort to restore growth and, as long as uncertainty reigns, Gold will continue to represent an attractive portfolio holding.

*http://seekingalpha.com/article/559261-why-gold-is-not-in-a-bubble?source=email_macro_view&ifp=0 (To access the articles please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Richard Russell: NOW is the Time to Begin Amassing Your Future Fortune – Here’s Why and How

Great fortunes are made at super-bear market lows but you must have the money at the lows. [That is precisely] why gold is so singular and valuable. If you have gold at the bottom of the next bear market, you can exchange it for a collection of great common stocks or funds, and then sit back and relax.

2. Gold’s Current Bull Market Will Be Even Bigger Than The One In The 1970s – Here’s Why

The fundamentals supporting a mania in gold and gold stocks are such that I think a strong case can be made [to support my contention] that the current bull market in gold is far stronger than the one from the 1970s. [I present below] the major observations I feel…support such a thesis. Words: 700

3. New Analysis Suggests Gold Going to $3,495 in 2013, $6,233 in 2014 and Peaking at $31,672 in 2015!

Nick Laird has put together an Elliott Wave theory prediction using ‘The Golden Mean’ & ‘Fibonacci Sequences’ to arrive at future prices for gold…which he is hopeful will serve as ‘a roadmap which gold may take as it climbs to new highs’. See the chart below. Words: 625

4. Gold: $3,000? $5,000? $10,000? These 151 Analysts Think So!

151 analysts maintain that gold will eventually reach a parabolic peak price of at least $3,000/ozt. before the bubble bursts of which 101 see gold reaching at least $5,000/ozt., 17 predict a parabolic peak price of as much as $10,000 per troy ounce and a further 13 are on record as saying gold could go even higher than that. Take a look here at who is projecting what, by when and why. Words: 844

5. Will Gold Peak at $2,500, $8,890 or $15,000?

When considering that the conditions which propelled gold and silver to their 1980 highs are much worse today, I predict both metals will easily eclipse those previous highs. That means $2,500 gold and $150 silver at the very minimum, but more likely a parabolic ascent to $8,890 gold and $517 silver before all is said and done. Words: 1063

6. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

7. Deja Vu? Is Gold Just in a Correcting Phase on Its Way to Parabolic Peak of $4,294?

The current volatility in the precious metals market doesn’t necessarily indicate a change in secular direction. [In fact,] if today’s gold price was to rise by the same degree over the next 14 months [as it did from the beginning of 1979 into 1980, it would hit $4294/ozt. by Jan 2013! Let me explain.] Words: 420

8. Contracting Fibonacci Spiral Puts Gold Near $4,000 by 2013 and $7-10,000 by 2020

Gold is operating on a smaller Contracting Fibonacci Spiral Cycle that is in synch with the larger Contracting Fibonacci Spiral the markets are in. Adding together the sum of parts… the price of gold will move up in price in 2013, 2016, 2018, 2019 and 2020, with each subsequent leg moving less in percentage terms than the prior move. Gold advanced 4 foldish from 1999 until 2008 ($252/ounce to $1046/ounce) suggesting that gold should top out below $4000/troy ounce by the end of January, 2013…[on its way] to $7,000 and $10,000 per troy ounce by 2020. [Let me explain.] Words: 834

9. Nick Barisheff: $10,000 Gold is Coming! Here’s Why

This is not a typical bull market. Gold is not rising in value, but instead, currencies are losing purchasing power against gold and, therefore, gold can rise as high as currencies can fall. Since currencies are falling because of increasing debt, gold can rise as high as government debt can grow. Based on official estimates, America’s debt is projected to reach $23 trillion in 2015 and, if its correlation with the price of gold remains the same, the indicated gold price would be $2,600 per ounce. However, if history is any example, it’s a safe bet that government expenditure estimates will be greatly exceeded, and [this] rising debt will cause the price of gold to rise to $10,000…over the next five years. (Let me explain further.] Words: 1767

From questions whether gold is in a bubble to predictions that soaring prices are just around the corner, one thing is clear: a new phase of awareness for gold is upon us. How far might it move before these troubling times are over? [Let’s take a close look at a variety of factors and scenarios before coming to a conclusion.] Words: 5717

11. Gold Will Reach $3,000/$4,000/$5,000 Before This Bull Market Is Over! Here are 12 Factors Why

I believe that the price of gold will… reach… $3,000, $4,000, and even $5,000 [per troy] ounce…during the course of this long-lasting bull market, a bull market that still has years of life left to it…[although] prices will remain extremely volatile – with big swings both up and down along a rising trend…The future price of gold is a function of past and prospective world economic, demographic, and political developments [and in this article] I review some of these developments and trends – so that you can come to your own “golden” conclusions. Words: 3800

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money