Dow 13,000 is a meaningless number! [True] the DJIA index has touched that number for the first time since 2008 but, when priced in gold, it has actually declined. Let me explain. Words: 245

number for the first time since 2008 but, when priced in gold, it has actually declined. Let me explain. Words: 245

So says Mark Motive (www.planbeconomics.com) in edited excerpts from his original article* as posted on Seeking Alpha which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!),has further edited below for length and clarity – see Editor’s Note at the bottom of the page. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

Motive goes on to say, in part:

Quite simply, some of the biggest stock market booms in history were coupled with the some of the biggest currency devaluations in history. The Weimar Republic and Zimbabwe are two examples that come to mind. I’m not saying that the U.S. is anywhere close to the Weimar Republic or other hyperinflationary environments (at least, not yet), but the same principles apply. With trillions of dollars injected by central banks into the global financial markets over the past few years, I can’t help but think these stock market gains are somewhat diluted. Housing deflation aside, is $1 today what it was at the bottom of the market in March 2009?…

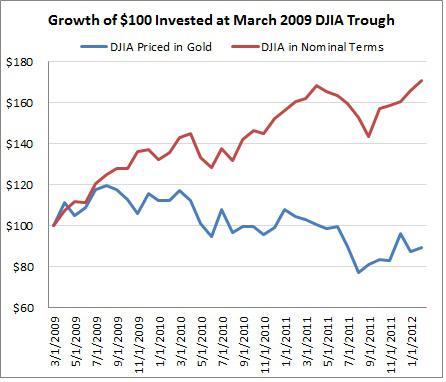

One of my preferred proxies for monetary expansion is gold. When measured in terms of gold, the DJIA has actually fallen by almost 11% since the March 2009 bottom [while] the DJIA has risen over 70% in nominal terms during the same time period [see chart below].

In my opinion, we should be concerned about this massive discrepancy, and celebrating Dow 13,000 may be premature.

*http://seekingalpha.com/article/380571-dow-13-000-try-that-priced-in-gold?source=email_macro_view&ifp=0

Editor’s Note: The above article has been has edited ([ ]), abridged (…) and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Why spend time surfing the internet looking for informative and well-written articles when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read. Sign-up for Automatic Receipt of Articles in your Inbox and follow us on

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet.

Related Articles:

1. Your Stock Market Gains Are Just an Illusion! Here’s Absolute Proof

In my opinion, the greatest threat to long-term and retirement investors is the wealth-destroying triple combination of monetary inflation, asset deflation, and inflation taxes. Fully understanding [these factors] is absolutely essential for financial survival because history shows us quite clearly that when all three of these major wealth destroyers are working together in the real world then conventional investing methods cannot withstand the destruction of investor wealth that occurs. [Let me explain why, then, your past and future stock market gains actually have been, and will continue to be, absolutely nothing more than a mirage – a cruel illusion that has and will continue to only benefit our governments – unless you develop a drastic out-of-the-box investment strategy that is radically different from anything that currently exists (or is in the public domain).] Words: 3456

2. Your Portfolio Isn’t Adequately Diversified Without 7-15% in Precious Metals – Here’s Why

The traditional view of portfolio management is that three asset classes, stocks, bonds and cash, are sufficient to achieve diversification. This view is, quite simply, wrong because over the past 10 years gold, silver and platinum have singularly outperformed virtually all major widely accepted investment indexes. Precious metals should be considered an independent asset class and an allocation to precious metals, as the most uncorrelated asset group, is essential for proper portfolio diversification. [Let me explain.] Words: 2137

3. Which Gold and Silver Assets (and How Much) Should You Own?

It is no longer a matter of whether or not you should buy gold and/or silver but, rather, which type of investment(s) and how much. You don’t need a lot but you do need some – and here’s a primer on just what type of investment vehicles are available and recommendations on just how much you should buy. Words: 1086

4. It is Imperative to Invest in Physical Gold and/or Silver NOW – Here’s Why

Asset allocation is one of the most crucial aspects of building a diversified and sustainable portfolio that not only preserves and grows wealth, but also weathers the twists and turns that ever-changing market conditions can throw at it. However, while the average [financial] advisor or investor spends a great deal of time carefully analyzing and picking the right stocks or sectors, the basic and primary task of asset allocation is often overlooked. [According to research by both Wainwright Economics and Ibbotson Associates and the current Dow:gold ratio, allocating a portion of one’s portfolio to gold and/or silver and/or platinum is imperative to protect and grow one’s financial assets. Let me explain.] Words: 1060

5. Protect Your Portfolio By Including 15% Gold Bullion – Here’s Why

We are reading a lot of hype these days about gold and the necessity to own it but only about 2% of ‘investors’ actually have gold in their portfolios and those that have done so have insufficient quantities to offset the future impact of inflation and to maximize their portfolio returns. New research, however, has determined a specific percentage to accomplish such objectives. Words: 1063

6. Your Savings and Investments Will Be in Dire Jeopardy Going Into 2012 Unless…..

The United States is now so far in debt, it will never be able to pay it off, that is, without hyper-inflation. That subject alone will require many more articles than this. The sky is not falling (yet) but your savings and investments are in dire jeopardy going into 2012. You might wish to now do something to protect yourself. [May I offer the following investment ideas.] Words: 1648

7. Gold Bugs: Here’s How to Make the Most of the Continuing Bull Market in Gold!

All you gold bugs out there (and budding gold bugs too!) should find this article of extreme interest. With gold about to make a major move upwards in price NOW is the time to position your gold-investment allocation to maximize your dollars deployed and returns generated. Those in the know will not be investing in physical or paper gold, or even the stocks of the miners, but in the long-term warrants of the very few mining companies that offer such an opportunity. This article provides a primer on the MAJOR advantage that long-term warrants have in a market upleg and identify the specific warrants that are available. Words: 1037

8. 2 Misguided Assertions About Gold – Read On Mr. Buffett!

In which form would you prefer to hold your monetary savings — in the form of money that banks can create in unlimited amounts out of nothing, or in the form of a metal that has been used as money for thousands of years and whose supply never increases by more than 2% from one year to the next? The answer…isn’t necessarily straightforward [as] a lot depends on the policies being implemented at the time by central banks and governments [- but let me try.] Words: 1300

9. There is a MUCH Better Way to Own Gold Than Via ETFs and ETRs – Here’s How

Late last year the Royal Canadian Mint intoduced an Exchange Traded Receipt (ETR) in another long line of paper-gold investments that are now trading on securities exchanges worldwide. It, like all of the other programs, comes with a slew of fees and risks. [Why not take personal physical possession of your gold or silver, store it in an allocated and secure non-government vault, be able to have any or all of it shipped to you immediately upon request – and for dramatically less than any ETF or ETR? Let me explain how easily it is to do just that.] Words: 1601

10. Believe It or Not: Only 1 Fund Has Outperformed Physical Gold Since 2007!

Out of the 7,500 separate mutual funds available, and with 22,000 shares classes to choose from, only 1 fund – just ONE fund – actually managed to achieve a greater percentage return than gold bullion since the alarm bells rang out at the turn of 2007! [That being said, are you still one of the 99% of investors who, for whatever reason (are you foolishly listening to the “advice” provided by your stock broker/securities salesman going under the guise of a financial “advisor”), is still without any physical gold or silver?] Words: 395

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money