past decade actually fared when their performance was measured in gold instead of dollars. You will be shocked at how poorly they (and you?) have really done and you, too, will come to the conclusion that – investing in the stock market is for losers. Words: 790

past decade actually fared when their performance was measured in gold instead of dollars. You will be shocked at how poorly they (and you?) have really done and you, too, will come to the conclusion that – investing in the stock market is for losers. Words: 790So says Jeff Clark (www.caseyresearch.com) in edited excerpts from his original article* entitled Start Thinking in Terms of Gold Price.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The report’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Clark goes on to say, in part:

Someday, we (or our heirs) are going to spend some of the wealth we are accumulating [but] how much we can actually buy with our gains will directly depend on how hard inflation has hit whatever our investments are denominated in. The only reliable way to measure the value of investments [in real terms, that is, adjusted for inflation,] is to [look at how well our investments would have done had they been denominated in gold instead of dollars. It is the only] way investors can tell how they’re [really] doing…and, since most people don’t adjust for inflation, their investments are not doing as well as they think.

Who in the world is currently reading this article along with you? Click here

Re-Indexing in Gold Changes Everything

To demonstrate the effect of currency dilution, we’ve developed a tool for re-indexing popular indices from dollars to gold. Doing so provides a more accurate picture of the dilution of investments made in dollars (and would work just as well in euros or other currencies). We use gold in grams so the indices won’t be priced in decimals.

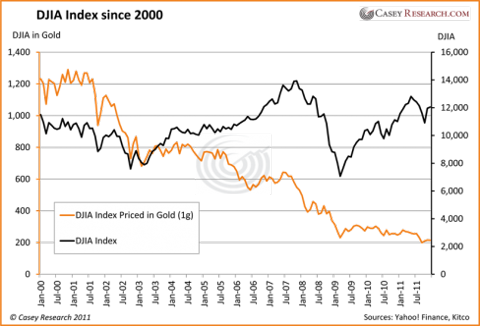

1. Dow Down 82.5%!

(Click to enlarge)

While the Dow Jones Industrial Average is up 4.7% in dollar terms, it’s lost 82.5% when measured in gold grams. An investment of $10,000 on January 1, 2000 would total just $10,470 today (excluding dividends) – but in gold it’s worth only $1,750. In other words, investments made in the DJIA Index have not only lost money in real terms, they’re worth a pittance when measured in gold. This is a breathtaking loss.

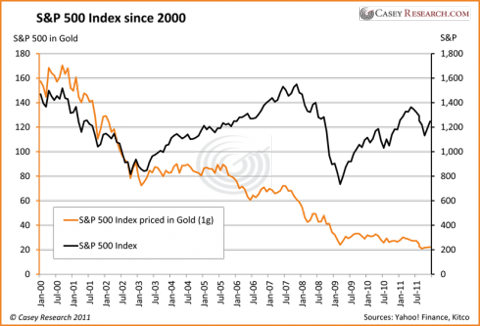

2. S&P 500 Down 85.8%!

(Click to enlarge)

The S&P 500 is down 15.1% in dollars since 2000, but it’s lost 85.8% against gold. If you’ve owned an S&P index fund, you not only have fewer dollars that what you started with (excluding dividends) but have fallen dramatically behind when compared to the monetary asset of gold.

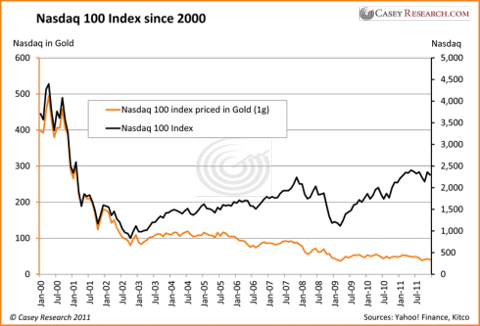

3. Nasdaq 100 Down 89.7%!

(Click to enlarge)

Tech stocks show a whopping decline of 38% in dollars over the same time period, but money invested in that sector has lost 89.7% when measured in gold grams.

4. Hang Seng Down 82.3%!

(Click to enlarge)

The stock market for Hong Kong, one of the largest exchanges in Asia, shows an increase of 6% in dollars. However, it’s lost 82.3% when priced in gold.

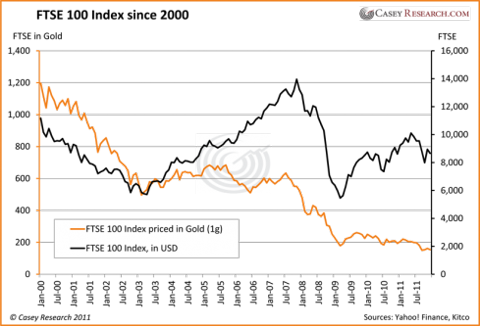

5. FTSE Down 87.1%!

(Click to enlarge)

The primary stock market for U.K. companies is down 22.4% since 2000 calculated in dollars, but has fallen 87.1% in gold grams.

Conclusions

Measuring portfolios in dollars exaggerates performance in real terms. This isn’t to say that one shouldn’t invest in stocks. It means that one must:

- be cognizant of how results compare to gold or other real assets that one might buy with whatever currency one is dealing with;

- adjust brokerage statements to allow for currency dilution; and

- not rely on stocks in general to outpace inflation.

Someday we’ll want to spend the gains we’re making [so] how…[can] we avoid the long-term erosion of the currencies we invest in? The answer is simple: save in gold. The dollars you keep in a money-market account will steadily lose value year after year. In fact, monies deposited into a simple savings account in 2000 have lost an incredible 25% of their purchasing power since then. Conversely, if those savings were denominated in gold, the wealth would have not only been preserved but increased. We believe this trend will continue – and accelerate.

It will become increasingly important to your financial future that you cash in earnings from time to time and save them in precious metals – not in dollars, euros, yen, yuan, or even Swiss francs. Save in gold. That new car or retirement home or world travel you want to spend money on someday will be a lot easier to afford if your savings are denominated in the one asset that can’t be debased, devalued or destroyed.

*http://www.caseyresearch.com/articles/start-thinking-terms-gold-price

Related Articles:

1. Alf Field’s 7 “D’s” of the Developing Disaster Revisited

When the supply of something is increased sharply relative to demand, the value of that commodity will decline. If the supply continues to increase rapidly and indefinitely, then that item will become worth less and less, with the potential to finally become nearly worthless. This is the Developing Disaster facing the US Dollar and the world. This is the factor that could become the single most important criterion in investment allocation decisions and possibly even for individual financial survival…[Let me explain this further by reviewing the 7 major problems facing the U.S. (and thus the world) and how they all will lead to problem #7 – devolution.] Words: 1520

2. Inside The Consumer Price Index: What Inflation Really Means To You

5. Environment is Inflationary, NOT Deflationary – Here’s Why

9. Global Money Printing Is A Recipe For A Global Economic Nightmare

If the U.S. dollar is being devalued so rapidly, then why does it sometimes increase in value against other global currencies? It is because there are times when one particular global currency will fall faster than the others but the reality is that they are all being rapidly devalued. As the 6 charts below illustrate, the UK, the EU, Japan, China and India, as well as the U.S., have all been printing money like there is no tomorrow. Unfortunately, this is a recipe for a global economic nightmare. Words: 1102

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money