Gold falls when a financial crisis worsens for 2 basic reasons which make total sense when looked at objectively. Resultant government intervention then creates the environment for a future rise in the price of gold. This article explains the causes of the downs and ups in the price of gold and offers suggestions on how and when to act. Words: 868

So conveyed Plan B Economics (www.planbeconomics.com) in their original article*.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has further edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Who in the world is currently reading this article along with you? Click here

The article goes on to say, in part:

Why Does Gold Fall When a Financial Crisis Worsens?

Investors need to understand two things:

- gold is priced in US dollars meaning that as the dollar rises the price of gold falls, all things being equal. The dollar is quickly rising because it is a safe haven (US Treasuries are a safe haven that must be purchased in US dollars) and because asset liquidations around the world are gaining speed causing a growing shortage of dollars.

- gold…is a source of funding for margin calls made on declining assets. This means that gold is undergoing a degree of “forced selling.”

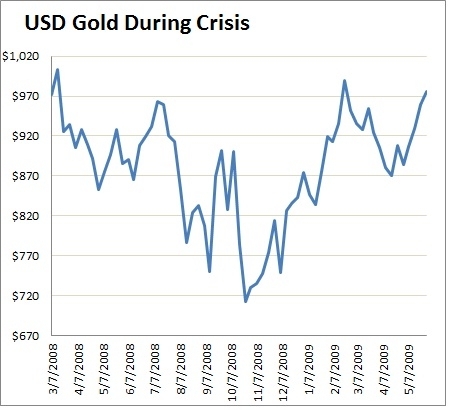

One only has to go back a couple years to see how gold reacts during a financial crisis. The chart below shows the price of gold during the financial crisis…in March 2008…During this time, gold prices fell by about 25% and subsequently recovered all losses. This was a scary ride for anyone holding gold at the time, but it’s an incomplete view of gold’s performance during the crisis.

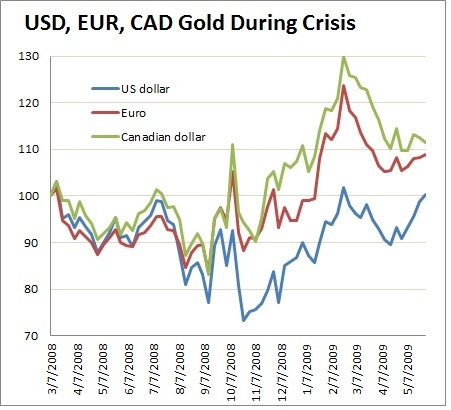

The second chart below shows gold during the same period priced in US dollars, euros and Canadian dollars (indexed to 100 for comparison purposes). During the 2008/2009 crisis…the US dollar was rising while the euro and Canadian dollar were falling and this is reflected in the different gold prices. Gold priced in Euros and Canadian dollars fell less and recovered faster than gold priced in US dollars. This is precisely because the US dollar was so strong during that period. However, as the monetary response began to unfold (QE1 announced December 2008) and trillions of US dollars were unleashed to backstop the financial system, gold in all currencies began to rally dramatically.

- Economic/financial crisis leads to asset liquidation and dollar shortage

- Dollar shortage leads to dollar appreciation and gold depreciation (in dollar terms)

- One form of asset liquidation – forced gold selling – leads to gold depreciation (in all currencies)

- Eventual monetary response creates surplus of dollars

- Surplus of dollars causes dollar depreciation and gold appreciation

Should I Buy, Hold or Sell?

For US investors, in my opinion, a crisis in which a skyrocketing dollar sends gold plummeting in US dollar terms could create a big gold buying opportunity, like it did in 2008.

Editor’s Note: Why spend time surfing the internet looking for informative and well-written articles on the health of the economies of the U.S., Canada and Europe; the development and implications of the world’s financial crisis and the various investment opportunities that present themselves related to commodities (gold and silver in particular) and the stock market when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read.

Sign up here to begin receiving munKNEE.com’s FREE Financial Intelligence Report

[The above] said, the basic steps outlined above could take months to fully materialize. The market is disappointed (read: impatient) with the Fed’s lackluster curve-flattening program (i.e. Operation Twist) because it delays the possibility of additional quantitative easing. However, as the economy continues to deteriorate, the probability of QE3 rises [and] this process could take a long time, and the Fed won’t act until it must act. The Fed simply no longer has the credibility and political support to act boldly and pre-emptively, so it must wait until there’s blood in the streets and politicians are begging for relief.

For non-US investors that own gold, pay attention to the price of gold in your domestic currency because, unless you have hedged, your exposure is relative to your home currency, not US dollars.

*http://www.planbeconomics.com/2011/09/23/how-gold-performs-during-a-financial-crisis/

Editor’s Note:

Sign-up for Automatic Receipt of Articles in your Inbox or via

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet edited for clarity and brevity to ensure you a fast an easy read.

Related Articles:

1. Gold Going to $1,300? “Three-Peaks and a Domed House” Pattern Suggests That’s Possible

The price of gold is still in the “Plunge” phase of the “Three-Peaks and a Domed House” pattern [and is projected to drop to the lowest price of the enitire pattern which is $1,300 per troy ounce. Yes, $1,300! Words: 868

2. Will Gold Drop as Low as $1,200 Before Spurting to $2,000?

In the long run developments in the financial markets and around the world seem to conspire to whip up a perfect storm for the gold price, taking it up towards $2,000 and further. That new upleg, however, could very well start from a much lower level than now. There are quite a few developments that could easily send the gold price lower in the coming months. Is $1,200 gold in the cards? Words: 739

3. Back Up the Truck: It’s Time to Buy Gold With Both Hands! Here’s Why

The past few years have seen the development of the notion that GLD and SLV represent uncorrelated plays on the market, making them safe haven bets for your portfolio. Looking at historical trends (aside from 2011), [however,] one would have to go back to 2007 to find a year where these two metals weren’t highly correlated to the S&P 500. For all of 2011, both ETFs have featured low correlation, but as recent trading weeks have shown, old habits die hard, as the two ETFs have fallen back into a highly correlated trend. Let’s take a look at the particulars.] Words: 672

6. Where Do Gold & Silver Rank in Vulnerability to a Recession Among Other Commodities?

A Barclays Capital research [report] notes that gold prices are vulnerable to a recession – more so than some of the other commodities. In the last recession of 2008, gold prices appreciated the least among precious metals. Below is a table that ranks 30 different commodities. Words: 571

7. Gold as a Safe Haven is Worthless!

If there is one thing we’ve learned about gold in recent years – and recent days – it is this: gold is not a haven investment… There are many theories about gold’s correction. [Let’s take a look.] Words: 781

8. Ian Campbell’s Commentary: Gold – The Safest Haven?

Is physical gold the best available ‘safe-haven’ or is it the U.S. dollar – or perhaps even U.S. Treasuries? Words: 793

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money