Economic inflection points are seldom obvious but if we take the time to analyze all the  data, there are at least five indicators that suggest another U.S. recession is not imminent. [Take a look.] Words: 920

data, there are at least five indicators that suggest another U.S. recession is not imminent. [Take a look.] Words: 920

So says Lou Basenese (www.wallstreetdaily.com) in an article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Basenese goes on to say, in part:

I embrace the adage that a picture is worth a thousand words. Instead of bloviating about a particular investment or economic topic, I handpick a few graphics to do some of the talking for me. Earlier, I served up two charts to squelch the nasty rumor that the U.S. economy is headed for another recession. [Basenese’s article** (edited ([ ]), abridged (…) and reformatted) is presented below, in part:]

Say goodbye to long-winded commentary and hello to easy-to-understand pictures, accompanied by some very brief observations.

This week, we’re tackling the nasty rumor that the U.S. economy is headed for (gasp) another recession. Why? Because earlier in the week, the world’s largest bond fund manager, Bill Gross, said the U.S. economy risks lapsing into a recession.

Oh really? Then how do you explain the fact that railroad shipments are at the highest levels in almost three years or that the Federal Reserve’s industrial production index is clearly rebounding?

1. Federal Reserve Industrial Production Index

2. Association of American Railroads Loading Index

If the economy were indeed destined for a recession, production materials wouldn’t be moving across America on the rails and industrial production would be decreasing, not increasing. Just saying, Mr. Gross.

3. Baltic Dry Index

While we’re at it, we might as well prove that the early signs of an economic uptick in the United States aren’t an isolated event, either. Just look at the latest price action in the Baltic Dry Index.

For those that don’t know, the index tracks the cost of shipping major raw materials. Like iron ore, coal, grain, cement, copper, sand and gravel, fertilizer, even plastic granules. Or, more simply, the precursors of economic output. As such, the index provides a measurement of the volume of global trade at the earliest possible stage and since August, it’s up about 50%, indicating that the building blocks of global growth are on the move again, too.

However, the contrarian position [presented in that article] jostled some readers…[but] it’s a good sign when so many people disagree with a contrarian viewpoint. Why? Because the average investor is chronically late. They seldom sniff out key turning points and the truth is, we can’t wait for the majority of economic indicators to turn positive before sounding the all-clear. Instead, we need to be on the lookout for green shoots – those subtle indications that a change in direction is afoot. With that in mind, I’m serving up two more indicators to hopefully convince you that the U.S. economy is not doomed to collapse in the months ahead.

4. Cass Freight Index

The latest reading of the Cass Freight Index, which measures [the actual freight shipped by 400 North American companies]…across a broad sampling of industries – including consumer packaged goods, food, automotive, chemical, OEM, retail and heavy equipment – is clearly positive.

In fact, shipping volume in September jumped to almost a four-year high, with more shipments than in any single month since the recession started. What’s more, the index is up 7.5% year-over-year and that proves that the September uptick is indicative of a longer-term trend, not a short-term anomaly.

Here are the two key takeaways…

Key Point #1: The Cass index captures truck shipments, too, so it proves it’s not just railcar loadings that are on the rise. All shipping activity in North America is picking up. That wouldn’t be happening if we were on a crash course with another recession.

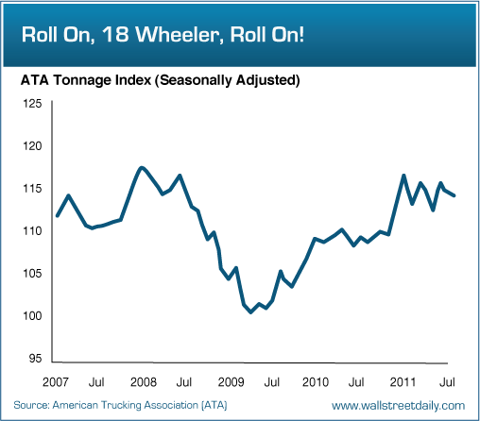

5. American Trucking Association Tonnage Index

Key Point #2: The Cass index often leads the American Trucking Associations [ATA] tonnage index at turning points. The latest readings of the ATA tonnage index, which measures the change in tonnage hauled by fleets, have been improving.

In July, the ATA index dropped 0.8%. In August, it was only off 0.2% so when the September numbers are released shortly, don’t be surprised if they’re positive. Again, if we were headed for a recession, the ATA index should be falling dramatically – but it’s not.

[Brad McFadden is of a similar opinion writing in an article*** recently posted on SeekingAlpha.com that:There has been so much talk about the U.S. entering a recession and that, according to the ECRI at least, there is nothing that can be done to stop the onset of a recession. However, from the indicators that I look at (of which the Cass Shipment Indices are but one), there appears to be little or no evidence to suggest that the U.S. economy is sitting on the verge of contraction (entering a recession). If anything, it looks like growth in the US economy is about to pick up and this should be very positive for corporate cash-flows and ultimately stock prices.]

Bottom line:

Economic inflection points are seldom obvious but if we take the time to analyze all the data, there are at least [five] indicators that suggest another U.S. recession is not imminent.

- *http://www.wallstreetdaily.com/2011/10/14/two-more-charts-to-debunk-the-recession-talk/

- **http://www.wallstreetdaily.com/2011/10/07/these-two-charts-squelch-any-recession-chatter/

- ***http://seekingalpha.com/article/299894-the-cass-freight-shipment-indices-refute-recession-calls?ifp=0&source=email_authors_alerts

1. Risk of Global Financial System Contagion Increasing – Here’s Why

It is widely accepted that Greece is insolvent even though the higher echelons of euro-zone politics still hesitate to use the term, and default swap prices…give virtually 100% odds that Greece will default. The handling of the issue has heightened the perception of risk for other problem countries of the euro zone…such that investors now give 60% odds of default by Portugal…and 30%-plus odds for default by Italy… Even France, with its S&P AAA rating, is now rated more likely to default than Brazil! [In addition, the U.S. is facing the liklihood of a fiscal policy impasse in Congress that could well lead to a recession. As such, as we see it, the risk of contagion in the financial system around the world has risen dramatically. We substantiate our contentions below.] Words:1612

2. George Soros: a Great Depression-like Scenario Could Very Well Play Out – Here’s Why

Europe is on the verge of a collapse, and unless something gets done relatively soon, (perhaps as soon as the next few weeks), Europe is likely to experience their own 2008 scenario. The U.S. and Chinese economies are heavily dependent on exporting goods to Europe, and with Eurozone growth slowing as a result of the potential default in Greece, and then on to the rest of the PIIGS, a “Great Depression-like scenario” could very well play out. [In fact,] George Soros thinks we are headed towards another Great Depression and, you know what, he’s right! What do you think? Is George Soros right? Are we headed for another depression? Words: 530

3. Is the Financial World On the Verge of a Nervous Breakdown? These Signs Suggest So

Will global financial markets reach a breaking point during the month of October? Right now there are all kinds of signs that the financial world is about to experience a nervous breakdown. Massive amounts of investor money is being pulled out of the stock market and mammoth bets are being made against the S&P 500 in October. The European debt crisis continues to grow even worse and weird financial moves are being made all over the globe. Does all of this unusual activity indicate that something big is about to happen? Let’s hope not – but historically, the biggest stock market crashes have tended to happen in the fall. So are we on the verge of a “Black October”? Words: 1200

4. Nouriel Roubini: Bold and Aggressive Policy Actions Necessary to Prevent a Depression

The latest economic data suggests that recession is returning to most advanced economies, with financial markets now reaching levels of stress unseen since the collapse of Lehman Brothers in 2008. The risks of an economic and financial crisis even worse than the previous one – now involving not just the private sector, but also near-insolvent sovereigns – are significant. So, what can be done to minimize the fallout of another economic contraction and prevent a deeper depression and financial meltdown? [Below I recommend 8 ways that would do just that.] Words: 1641

5. Goldman Sachs Privately Telling Clients to Bet on Upcoming Economic Collapse!

The debt crisis in the United States is unsustainable, and the debt crisis in Europe is unsustainable. As such, we are facing a global debt meltdown and are heading for an economic collapse. You aren’t going to hear that truth from the media or from our politicians, however, because keeping people calm is much more of a priority to them than is telling the truth – and right now we are in the calm before the storm. Nobody knows exactly when the storm is going to strike (i.e. when the collapse is going to happen) – but it is definitely on the way — and now even Goldman Sachs is admitting [that that is most likely the outcome of the present situation. Here is what they had to say recently in a “secret” document that has just now been made public.] Words: 1147

6. Jim Sinclair Sees Economic Train Wreck Coming – Slowly but Surely!

James Turk, Director of The GoldMoney Foundation, interviewed Jim Sinclair recently at the GATA conference in London about his successful gold price predictions, the U.S. debt problems, how to ride the second phase of the gold bull and the gear change from arithmetic to exponential growth as public perceptions about the safety of the US dollar changes. Below is a heavily edited and paraphrased version of the interview to provide you with a fast and easy understanding of its contents. Words: 1318

7. Roubini, Schiff, Rosenberg and Whitney Agree: Another Recession Is At Hand! Here’s Why

Michael Spence, professor at New York University’s Stern School of Business and winner of the 2001 Nobel Prize in economics, believes there’s “probably a 50%” chance of the global economy slipping into recession. Noriel Roubini disagrees and says flatly that a recession is coming and that it is a mission impossible now to stop it. The Philadelphia Federal Reserve Bank places the odds at 85% of a recession. David Rosenberg, another very savvy economist, says that by 2012, the chance of a second recession is 99%. Peter Schiff, who with Roubini, correctly and accurately predicted the collapse on Wall Street and ensuing recession, thinks one is 100% certain. [Let’s take a look at why they hold such views.] Words: 829

8. These 10 Signs Point to Another Recession

The following 10 reasons give a foundation for why I believe we may be approaching another recession. Words: 903

You think the problems are bad now? You wait until we don’t have any more credit. You wait until the currency is collapsing. You wait until interest rates are going through the roof and inflation is going through the roof. It’s not going to be a pretty picture. There will be social unrest. [See below for the link to the interview.] Words: 477

10. Are We On the Verge of a Second Recession?

Is a second recession in so short of a time in the offing? It certainly seems that way. The hope for a continued recovery has grown dim lately as many of the economic indexes are moving towards contractionary territory… There are several concerns pressing the U.S. economy and, in the words of David Rosenberg, chief economist at Gluskin Sheff, “one small shock” could send us into a second recession. [We, for our part, believe that even] another round of Quantitative Easing by the Fed…may not be enough to offset the real problems facing the U.S. economy. [Let’s take a closer look.] Words: 1295

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money