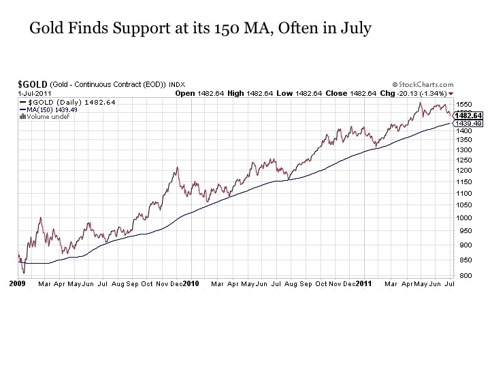

Gold: Once a Year Buying Opportunity Is Quickly Approaching

Since the beginning of its bull market run back in 2002…gold has enjoyed consistently strong technical support at its 150-day moving average…[only] testing this…support once or twice a year, at most…and in each of the last 9 years, the one time that gold has consistently tested support… [has been] during the month of July. [Furthermore,] in 7 of these last 9 years gold has rallied strongly from this July support level to post gains of +22% on average through the remainder of the year. As a result, it [is important] to capture these opportunities when they present themselves – and such appears to be quickly approaching in the coming days of July. Words: 458

So says Eric Parnell (http://www.gerringwm.com/) in an article* which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Parnell goes on to say:

It appears that we are seeing the same July retest setting up for gold in 2011. After rising above its 50-day moving average for most of the year, gold recently made a decisive break lower…

Focusing on the SPDR Gold Trust Shares (GLD), a further -3% pullback would have the price once again back at the 150-day moving average. Seeing such a move occur in the coming week, if not early the following week, would not be a surprise given the manner in which gold has retested this support level in the past.

Conclusion

In most years over the past decade, the pullback toward the 150-day moving average has been fleeting. This has been particularly true in recent years following the financial crisis. As a result, it is important to keep a close eye on the gold price in the coming days as we move through July. For once it touches its support at its 150-day moving average, it could be off to the races for the rest of the year… [Go here for the latest graph of exactly where gold currently is relative to its 150-day MA.]

*http://seekingalpha.com/article/277796-gold-once-a-year-buying-opportunity-is-quickly-approaching?source=email_macro_view

Related Articles:

- Gold’s Recent Price Action Suggests Ultimate Top of $5,000/ozt. https://munknee.com/2011/06/golds-recent-price-action-suggests-ultimate-top-of-5000ozt/

- Why Silver Could Drop Below $30/ozt. https://munknee.com/2011/06/why-silver-could-drop-below-30ozt/

- It’s Not Time to Buy the Gold Miners – Yet https://munknee.com/2011/06/its-not-time-to-buy-the-gold-miners-yet/

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

Gold

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money