With such a steep selloff in silver, but with still bullish fundamentals, the question of when to get back in on the long side is looming large in many commodity investors’ minds. We believe the time may be nearing for a number of reasons. [Let me explain.] Words: 916

So says Ananthan Thangavel (www.lakshmi-capital.com/) in an article* which Lorimer Wilson, editor of www.munKNEE.com, has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Thangavel goes on to say:

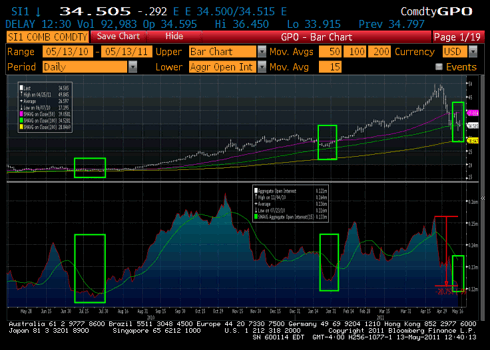

The following chart shows the price of silver on top – with the aggregate open interest on silver futures on bottom.

Understanding “Open Interest”

The aggregate open interest on silver futures… tracks the general interest level in the market, as well as shows the type of buying and selling occurring. For example, if open interest takes a big dive as price declines, this means that longs are liquidating their positions. On the contrary side, if open interest increases as price declines, this could mean that short sellers are driving the price down.

As can be seen [in the chart above], the notable valleys in open interest for silver over the past year coincide well with major bottoms, as follows:

- In July 2010, almost exactly as silver began its historic run and broke $20/ounce.

- In January 2011 during the January precious metals selloff.

- In May 2011 with open interest down 21% since the peak of silver’s run.

With open interest still at 120,000 contracts, it could always go lower, but it does appear that a bottom may be forming. Such a finding would seem to be supported by the Managed Money net long positions… on silver [which] are in the 32nd percentile of readings going back to 2007. Such a low net long position would seem to indicate that sentiment has taken a bearish turn, and could see renewed strength with only a small recommitment of Managed Money longs.

The Trend for Silver

The below chart shows the price of silver with the blue dashed line connecting the August 2010 low with the January 2011 low.

The long-term uptrend in the price of silver has not been broken. Rather than a “bubble bursting” scenario, this indicates a reversion to mean, as silver had obviously gotten way ahead of itself.

The bullish fundamentals driving the precious metals rally are still in place, and are only going to become louder as time goes on. However, volatility in silver is probably here to stay, as the market has received an outsized amount of attention compared to its size, and will most likely be in the spotlight for some time to come.

Trade Recommendation

As silver appears to be bottoming we recommend a bullish position in silver in a number of ways.

- The most aggressive position would be to purchase silver futures in the $30-32/ounce range. While the recent volatility may be over, we suspect that we may see a retest of the $30 level before this correction runs its course. However, in case the worst is already behind us, a more conservative stance taken simultaneously could also be profitable.

- We would also recommend selling the September 30 put for 1.672. Such a position would be profitable as long as silver is above 28.328 on August 25, 2011…While selling this put option would not be as profitable in a silver rally as an outright long position, it does offer a significant downside margin before incurring losses.

Conclusion

We view the $30/ounce mark as a hard floor on silver prices going forward due to the ongoing bullish fundamentals for precious metals, as well as the presence of the 200-day moving average around the $30 mark.

Editor’s comments on the above article:

Jeff Clark asks the same question as Ananthan in this article:

“At What Price Should We Begin Buying Silver Again?” www.munknee.com/2011/0…/

Here are 2 articles suggesting that silver may not yet have reached bottom with specific price “targets”

1. “Martin Armstrong Asks: Will Silver Crash (Further) in 2011?” www.munknee.com/2011/0…/

2. ““Three Peaks” Pattern Suggests Gold to Decline 17% into June!” www.munknee.com/2011/0…/

Pessimism aside here are 2 articles that see silver going up dramatically in the next month or so:

1. “Elliott Wave Analyst Suggests Silver to See $52.58 by Mid -June” www.munknee.com/2011/0…/

2. “Goldrunner: “$52.80 to $56 Silver by Mid-year” Update” www.munknee.com/2011/0…/

Andy Mickey is of the opinion that: “NOW is the Best Time to Buy Gold (and Silver) Stocks! Here’s Why” www.munknee.com/2011/0…/

That being said investors should seriously consider investing in some of the long-term warrants that are available. Warrants are usually priced 45% to 60% less than their associated stocks and always out-perform their associated stocks in any market upleg.

For details on which warrants are available and how to go about buying them read these 2 articles:

1. “The “Secret” World of Gold & Silver Company Warrants” www.munknee.com/2011/0…/

2. “Buying Gold & Silver Company Warrants is Easy & Profitable – Here’s How (and Why!)” www.munknee.com/2011/0…/

In conclusion, how high could silver go in the future? This article gives some insights from a historical perspective:

” Why Silver at $398.52 is a Realistic Parabolic Peak Price” www.munknee.com/2011/0…/

*http://seekingalpha.com/article/270582-the-right-time-and-price-to-get-back-into-silver

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

Silver

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money