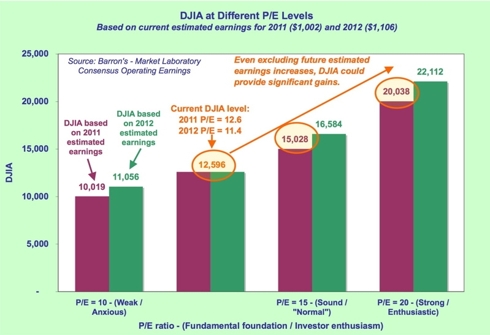

Most first quarter 2011 earnings reports are in and…over three-quarters exceeded expectations… [with] results showing a desirable combination of growing revenues, profitability and cash flow … [As such,] today’s stock market valuations are conservative compared to typical bull markets accompanied by investor enthusiasm. In the past, using 2011’s estimated earnings, the average P/E ratio could easily be 15 and…that would put the Dow Jones Industrial Average (DJIA) at 15,000 today – about 20% above today’s level. [Were we to] add in high optimism like the kind we’ve seen in other investments recently then a 20 P/E ratio would be possible – and the DJIA would be at 20,000 – 60% higher [than it is today! Let’s take a look at that possibility.] Words: 540

So says John Tobey (www.investmentdirections.com) in an article* which Lorimer Wilson, editor of www.munKNEE.com , has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Tobey goes on to say:

- Stock prices rose less than forecast earnings, making valuations more attractive.

- [Company] profit margins are being maintained by cost control, improved productivity and operating leverage…

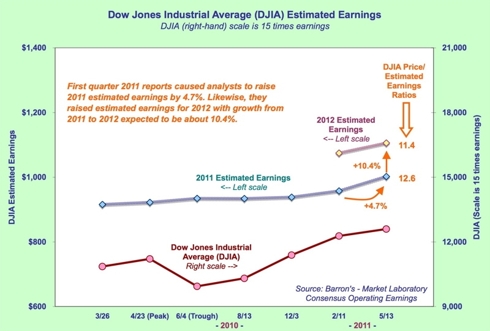

- Analysts’ 2011 earnings expectations are up 4.7% for the DJIA.

- The recent focus on “exciting” investments (e.g., silver) has caused U.S. stocks basically to tread water.

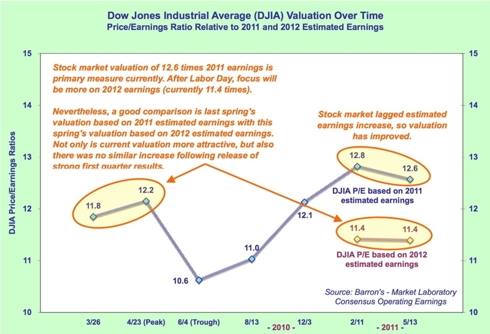

Here is the picture , first of estimated earnings, then of price/earnings (P/E) ratios:

No signs of speculation

An ongoing worry is that the stock market has risen too high and is due to drop. One way to answer that belief is to focus on the fundamentals, above. Another is to look at what is not present that would support the worry: Speculation.

Here are some key areas that illustrate the lack of stock market fever:

- The doubling since March 2009 is based on fundamentals…The reversal of the early-2009 emotional drop and the subsequent fundamental improvement produced the increase, not speculation and, therefore, investor worry that the end of QE2 will cause a stock market drop is unfounded.

- Every positive can be countered by a negative. This truism is visible in the media every day and this point/counterpoint situation is the description of a healthy market, not a speculative one.

- Valuations are sound. [As mentioned in the opening paragraph , and well worth repeating,] today’s stock market valuations are conservative compared to typical bull markets that are accompanied by investor enthusiasm…

Clearly, a 20 P/E would be a time to be wary buy today’s DJIA level of 12,600 (12.6 P/E ratio) is not something to worry about – it’s something to take advantage of.

Conclusion

With the first quarter earnings reports providing continuing good news for the stock market… [and] forecasts of more to come, U.S. stocks offer an excellent investment opportunity. Moreover, with alternative investment speculation suffering, the timing could be good [as well].

*http://investmentdirections.com/2011/05/16/dow-20000-how-it-could-happen/

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

yes and NO …. first we take a massive hit …. than some type of gold standard is re-introduced….. than the dow goes up