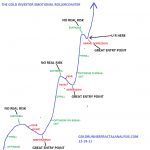

Since there is such a wide range of emotions, it might be helpful for you to do a ‘gut-check’ before you actually buy or sell any type of security. Knowing how you “feel” about investing might turn out to be just as important as knowing what you “know.”

actually buy or sell any type of security. Knowing how you “feel” about investing might turn out to be just as important as knowing what you “know.”

The comments above & below are edited ([ ]) and abridged (…) excerpts from the original article by Peter Hodson (sprott.com)

1. Fear and Greed

Most everybody knows that the stock market runs on two main emotions, fear and greed. If you have done any investing whatsoever, you likely will recognize these driving factors. Fear of losing money often causes you to sell at the exact wrong time, and greed often prevents you from taking profits appropriately.

2. Panic:

Certainly, the fall of 2008 brought out this emotion in many investors. The uncertainty over the collapse of Lehman set off a wave of panic in the industry. With the benefit of hindsight, though, how many investors regret their panicked actions at that time? How many sellers wish they had been buyers? Note that the common emotion of fear typically sets in after the initial panic — fear the decline won’t end.

3. Cynicism:

After a prolonged period of market decline, investor cynicism typically sets in. You might ask “Why should I buy anything? What’s the point? It will only go down anyway.”

Being cynical is a good trait to have as an investor. However, when it tends to dominate your thinking and becomes irrational, it does you a disservice. Cynicism will rob you of the opportunity to make money in irrational markets.

4. Invincibility:

Real-estate investors showed invincibility in the mid-2000s, and we all know how that worked out. Dot-com investors believed that a ‘new era’ had emerged, and normal valuations just didn’t matter any more. Technology stocks are still recovering from that one.

Depending on how 2010 plays out, you should be careful here. Markets have staged a stunning recovery, but it is not all based on economic fundamentals. If markets rise this year but the economic landscape doesn’t change, keep your invincibility feelings in check.

5. Optimism:

This comes before invincibility, of course…[and] has the potential to cause you to invest more and more money. Nothing wrong with that but, if you find yourself being too optimistic, it may be time to add a dose of cynicism back into the equation.

6. Realism:

This is likely the best trait to have as an investor, so we will end our emotional discussion here. In any type of market — good, bad, panicked, euphoric — you need to take a step back and examine what is really going on.

In the credit crisis, for example, many stocks plunged, but a check behind some of the stocks might have revealed companies with solid earnings, solid balance sheets and excellent long-term prospects. Were the stocks plunging due to company reasons, or an overall sell-off ? The buyers who stepped in at the bottom knew the difference.

Realism might be the only quality you need to be a successful investor. No matter what is going on in the world, or what the headlines say, take a look at the data and the underlying company before you buy (or sell). It might be a boring strategy, because it is far less exciting than getting “caught up” in the goings on of the market, but it is likely to be far more profitable, and far less stressful to boot.

Thanks for reading! If you want more articles like the one above visit our Facebook page (here) and “Like” any article so you can get future articles automatically delivered to your feed. You can also “Follow the munKNEE” on Twitter or register to receive our FREE tri-weekly newsletter (see sample here , sign up in top right hand corner).

Remember: munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money