There is a crucial component of the investment process that gets surprisingly little attention: our investment default settings. We can use them when we aren’t sure what to do, when we’re deciding what to do, when our circumstances have changed but our plan hasn’t (yet), or when we’re just starting out. Here they are.

attention: our investment default settings. We can use them when we aren’t sure what to do, when we’re deciding what to do, when our circumstances have changed but our plan hasn’t (yet), or when we’re just starting out. Here they are.

So says Bob Seawright (rpseawright.wordpress.com) in edited excerpts from his original article* entitled Establishing Your Top 10 Investment Default Settings.

[The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Seawright goes on to say in further edited excerpts:

The idea here is that we all have default settings — known and unknown, acknowledged and unacknowledged — and that those defaults greatly influence how successful we are and become…

What follows are my suggested default settings:

1. Save

One of the keys to overall success is the ability to delay gratification. Saving is crucial to developing that ability and imperative for anyone who wants to acquire and grow wealth.

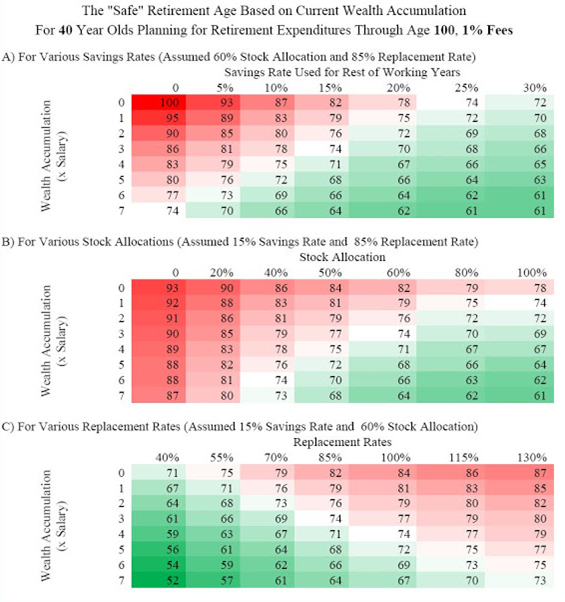

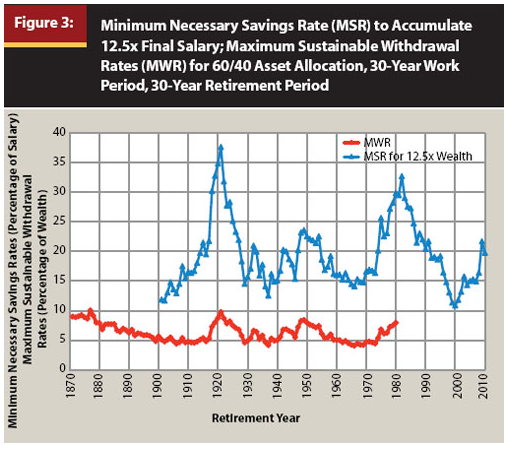

As investors, we tend to spend far more time on rates of return than savings rates. We shouldn’t. Beginning to save early, doing it consistently, and saving more are far more important over the long-term….As shown below, 15% seems to be a bare minimum savings rate with respect to retirement assuming 30 years of work. I suggest 20-25% as your default savings rate. I recognize that there are often multiple goals for saving (e.g., retirement, a house, children’s education) that are often in tension with each other and I also recognize that saving aggressively isn’t easy, but living with the consequences of not saving is far rougher. Investment success requires saving, saving consistently and saving aggressively.

2. Invest

…In the aggregate, cash generally produces negative real returns, thus holding more cash than would be needed as an emergency fund represents a major opportunity cost…”[i]n an ideal world, we could meet our future financial needs by investing in safe, liquid, short-term assets. Unfortunately, we don’t live in that world. To generate real returns, an investor needs to take on some risk.” …Have an investment plan, implement it and stick to it. Even if you don’t have a good plan yet, don’t wait to get invested.

3. Invest Passively

In the aggregate, passive investing will outperform active investment on account of lower fees. Passive outperforms active more specifically too and, in any given year, roughly 65% of active managers underperform…I believe that active management has a place, even a very important place in an investor’s arsenal of weapons, but the numbers suggest that passive investment be your default setting. Indeed, the vast majority of investors would improve their lot considerably by switching to a passive portfolio of low-cost index funds and sticking with them.

4. Invest 60/40 in Stocks & Bonds

Asset allocation is a really big deal. Your asset mix — how you spread your money across stocks, bonds, other investments and cash — has a far greater impact on long-term returns than your individual investments. For many years a portfolio consisting of 60% stocks and 40% bonds has been seen as the traditional or typical portfolio. An American investor with a 60/40 allocation (there are many ways to do this, of course) has received an average annual return of around 8.5% historically.

Advisers have been increasingly turning away from the 60/40 portfolio in favor of less traditional asset allocations…[as the] performance of the 60/40 portfolio over the next 10 years will likely underperform on account of high stock valuations and low bond yields today…[In addition,]research examining the performance of various assets…shows [in the past] that nearly all asset classes posted losses at the same time that stocks were plunging…but the raw data supports the idea that maintaining a basic 60/40 portfolio works well as an appropriate default setting, especially when effectively implemented.

5. Invest in Funds With Low Fees

It is axiomatic that all other things being equal, lower fees are better for investors than higher fees. Indeed, ranking investment funds according to fees (with lower fees being more highly rated) provides the best indicator we have of future performance. Fees matter, sometimes a lot. Cheaper should always be the default option.

_____

Save time! Here are 4 ways to access the best articles on the internet!

Sign up for our FREE Market Intelligence Report newsletter (sample)

“Follow the munKNEE” daily posts via Twitter or Facebook

Set up an RSS feed: It’s really easy – here’s how

_____

6. Invest Tax Efficiently

Experienced money managers routinely argue that you shouldn’t “let the tax tail wag the investment dog” and it’s true that a poor investment isn’t often salvaged by good tax treatment. However, the difference between having a $1,000 gain taxed at the long-term capital gains rate of 20% versus the income tax rate of 35% would save the investor $150 before considering state taxes and without even using the top income tax rate or noting that other new provisions could hit investment income as well…

Taxes matter a great deal. Moreover, tax efficiency has not generally hindered performance. According to Lipper, for example, over the 10 years ended December 31, 2012, tax-managed large cap core stock funds returned an annual average of 5.82% after taxes while the entire category (which includes hundreds more funds) returned 5.71% after taxes. Tax efficiency is the appropriate default setting.

7. Re-balance Your Portfolio

Re-balancing works and to a surprising degree. Doing so as a matter of regular practice should be de rigueur.

8. Keep Your Investment Strategy Simple

…A simple, albeit less than optimal, investment strategy that is easily followed trumps one that will be abandoned at the first sign of under-performance. Keeping things simple should be an obvious default setting.

9. Stay the Course

We are all prone to behavioral and cognitive biases that impede our progress and inhibit our success. We are prone to flitting hither and yon chasing after the next new thing, idea, strategy or shiny object. Don’t do it. One way to deal with these biases is to require a really good, data-based reason to change course. In a related matter…

10. Re-think Making Changes

Don’t be in a hurry to make changes even when you are convinced that they are warranted. Losses on account of delay will almost always be out-weighed in the aggregate by more careful and thoughtful analysis keeping you from taking action too soon and without sufficient reason.

Conclusion

Your investment process should include:

- intellectual curiosity,

- the ongoing pursuit of knowledge,

- the courage to communicate your views and findings openly,

- remaining amenable to constructive criticism, and

- a willingness to move in a different direction if and when the evidence demands it (but not before) and especially if the truths uncovered are at odds with conventional wisdom.

Starting with the appropriate default settings can help you get started and keep you headed in the right direction.

Do you have other or different investment defaults to suggest? Comment below.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

* http://rpseawright.wordpress.com/2013/02/05/establishing-your-top-10-investment-default-settings/

Related Articles:

Here’s my list of the most common errors investors make and some related maxims. Read More »

2. Self-manage Your Portfolio? Think Again! Here Are 10 Reasons You NEED a Financial Advisor

Irrespective of any active v. passive investing debate, good advisors are an absolute necessity. Here’s my top 10 list of reasons why Read More »

3. Here’s How to Crash-Proof Your Portfolio

With the stock market seemingly reaching new highs every day, should we worry about a crash that puts an end to the party? If so, how should investors prepare? Let us explain. Read More »

4. Portfolio Up? Here’s a Powerful Strategy to Protect Your Gains

Use a portion of your portfolio in the form of credit spreads to protect and drive income over the next nine months. It’s an extremely simple strategy to learn and arguably the most powerful strategy in the professional options traders’ tool belt Read More »

5. Using a Momentum Investing Strategy Is the Way to Go – Here’s Proof

In volatile markets you must be able to go to cash when markets become dangerous. That is exactly what the momentum selection model does well. It protects your capital on the downside and enables it to grow on the upside! If you insist on staying in the stock market at all times, even perfect foresight cannot protect you. The ability and willingness to periodically run away beats the macho strategy of holding on.

6. Yes, You Can Time the Market – Use These Trend Indicators

Remember, the trend is your friend and now you have an arsenal of such indicators to make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it. Words: 1579 Read More »

7. Ride the Market Waves With These 6 Momentum Indicators

It is hard to know what to buy or sell let alone just when to prudently do so. Thank goodness there are indicators available that provide information of stock and index movement of a more immediate nature to help you make such important decisions. This article describes the 6 most popular Momentum Indicators. If ever there was a “cut and save” investment advisory this is it! Words: 1234 Read More »

8. Use Market Strength Indicators to Time the Market – Here’s How

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on! Words: 974 Read More »

9. Is “Buy & Hold” the Way to Approach These Markets?

Assume that we are at a point corresponding to the beginning of 2007. How would our investing/trading techniques weather the same conditions represented by this most recent market adjustment? Would we be able to mitigate the losses (or even avoid them)? A traditional buy & hold, diversified investing strategy will be evaluated here.

10. Value Investing: The Practical Application of Benjamin Graham and Warren Buffett’s Principles

While the average amateur investor may be excellent in their own career field, it doesn’t mean they know what to invest in, or how to pick stocks. In fact being very good at your field can give you the false sense that whatever stocks you pick or your broker picks for you must be good, because after all, you picked them and you picked your broker — and you’re smart so, no doubt, those stock prices will go up. Unfortunately, the smart and talented stock-picking neophyte is not investing at all but speculating. Words: 924

11. Attn. Financial Advisors: How Much Asset Class Diversification Is Really Necessary?

[No one would argue that] diversification is not a sound investment practice but exactly how much risk reduction, in actual numbers, is obtained through application of this philosophy? This analysis is an attempt to quantitatively determine its relevance – [and you will be surprised by the answer. Read on!] Words: 1317

12. Follow Bob Farrell’s 10 Rules of Investing – or Suffer the Consequences

Individuals are long-term investors only as long as the markets are rising. Despite endless warnings, repeated suggestions and outright recommendations – getting investors to sell, take profits and manage…[their] portfolio risks is nearly a lost cause as long as the markets are rising. Unfortunately, by the time the fear, desperation or panic stages are reached it is far too late to act and I will only be able to say that I warned you [- unless you take the time to read, and study the contents of this article]. Words: 1945; Charts: 10; Tables: 1

13. THE 10 Most Dangerous Investing Mistakes

Protect your money by steering clear of these 10 most dangerous investing mistakes. Words: 716

14. Apply the Bell Curve to Your Portfolio Asset Diversification – Here’s Why

80% of my investable income is in cash, precious metals and a small number of stocks. That might seem crazy, but the Pareto Principle, Zipf’s Law and the bell curve have convinced me that it’s a waste of time and money to get any more diversified. [Let me explain why that is the case.] Words: 396

15. What You Should Know About the “Dogs of the Dow” Investment Strategy

The “Dogs of the Dow” is a simple and effective strategy that has outperformed the Dow over the last 50 years and generates almost 4% in yield. Here’s how it works. Words: 486

16. Asset Allocation: How Sound is the Foundation of Your Portfolio Pyramid?

Regardless of the size of your financial pyramid, without a core-holding foundation, you are building it on sand. Core holdings are for protection, not for profit. They function as insurance against a catastrophe. [Let me explain.] Words: 754

17. “Unlikely” Doesn’t Mean “Never”: “Rare” Events Happen Surprisingly Frequently in the Markets

By definition, rare events should seldom occur [and] applying that understanding to financial markets assumes that all market events follow a normal distribution or, in layman’s terms, a bell-shaped curve. More specifically, the statistics say that 99.7% of all daily movements should fall within three standard deviations of the mean, no more. Well, guess what? New research suggests that they clearly don’t follow such a pattern – that “unlikely” doesn’t mean “never”. [Let me expand on that.] Words: 1079; Charts: 1

18. Portfolio “Diversification” Can Kill Your Portfolio Returns – Here’s Why

Most investors don’t know anything more about diversification than you “shouldn’t put all your eggs in one basket” [but] spending some time trying to understand the ways you might be shooting yourself in the foot could seriously enhance your portfolio returns and stop catastrophic risk. [There are some advantages to diversification if you REALLY know what you are doing but the shortcomings can go a long way towards killing your portfolio returns. In this article we identify what they are and how best to avoid them.] Words: 1055

19. Warren Buffett: Diversification is Nothing More Than Protection Against Ignorance

NOT putting all your eggs in one basket makes intuitive sense to many investors. Indeed, evidence indicates that putting more eggs in your basket may actually crack your portfolio, not protect it. Words: 515

20. Your Portfolio Isn’t Adequately Diversified Without 7-15% in Precious Metals – Here’s Why

The traditional view of portfolio management is that three asset classes, stocks, bonds and cash, are sufficient to achieve diversification. This view is, quite simply, wrong because over the past 10 years gold, silver and platinum have singularly outperformed virtually all major widely accepted investment indexes. Precious metals should be considered an independent asset class and an allocation to precious metals, as the most uncorrelated asset group, is essential for proper portfolio diversification. [Let me explain.] Words: 2137

21. Recognize These 7 Emotions Before You Buy or Sell an Investment

Since there is such a wide range of emotions, it might be helpful for you to do a ‘gut-check’ before you actually buy or sell any type of security. Knowing how you “feel” about investing might turn out to be just as important as knowing what you “know.” Words: 737

One of the hardest things for individual investors to do is to know when to sell a stock. Many times, you might sell simply because a stock has gone up and you’ve made some money. More often than not, though, this is not a great reason to sell [because, as mentioned in the title of this article,] you will never – ever – have a 10-bagger if you sell a stock after a 2-bagger. That being said, what things should one consider before selling? Words: 912

23. 10 Timeless Investment Rules to Survive This Stormy Stock Market

Rules may be meant to be broken, but with investing ignoring the rules can break you – especially now. Investment rules are tailor-made for tough times, allowing you to stick to a plan just when you need it most. Indeed, a rulebook is important in any market climate, but it tends to get tossed when stocks are soaring. That’s why sage investors warn people not to confuse a bull market with brains. Here are 10 rules to survive this stormy stock market. Words: 769

24. Don’t Invest in the Stock Market Without Heeding These “Rules of Trading”

I’m not going to candy coat it for you: making serious money in the stock market is a ton of hard work. It takes patience, savvy, and a certain level of market smarts – and the cold, hard truth is that if you don’t have them, the big boys will drain your portfolio dry. Unfortunately, those are the three areas that most retail investors need to work on the most. Otherwise, they will simply end up in a cat-and-mouse game where they are the mice. Don’t fool yourself for one second into believing that your “due diligence” can be done by watching a show or two on CNBC. It just doesn’t work that way but if there is one voice from the markets that should grab your attention every time you hear it, it belongs to Dennis Gartman, founder and author of The Gartman Letter. He’s sort of a guru’s guru. [Here is] a glimpse into how he views and trades the markets. Words: 106

25. Investor Fear Gauge: What Everyone Should Know About VIX

VIX is the ticker symbol for the volatility index that the Chicago Board Options Exchange created to calculate the implied volatility of options on the S&P 500 index for the next 30 calendar days. The formal name of the VIX is the CBOE Volatility Index [and informally as the investor fear guage]. Below is some introductory material on the VIX offered up in a question and answer format: Words: 915

26. Conventional Stock Market Investing Advice Is Rooted in Myth! Here Are the Facts

The conventional stock market investing advice is rooted in myth – rooted in a false understanding of what the historical stock-return data says about investing for the long-term….Set forth below are five reasons why I believe that the conventional stock market investing advice must soon change. Words: 2067

27. Be Careful! Former Investment “Rules” Nolonger Work – Here’s Why

Investment “rules” that were relevant for a century are obsolete. They were based on a world where economies grew, people’s standard of living increased and outcomes tomorrow better than today. Arguably each of these conditions will not hold in the future but if they don’t, neither do the rules of thumb that guided investing last century. These guiding principles developed and worked in a world that that no longer exists but applying them in the future will result in devastating financial outcomes. [Let me explain.] Words: 1261

28. 12 Books that EVERY Financial Advisor – and Investor – Should Read

Bill Ackman, founder of Pershing Square Capital Management, believes the following books are essential financial reading. Enjoy the summer! Words: 235

29. Portfolio Down? Apply These Wise Sayings to Successfully Rebuild It

When the stock market reaches extreme levels of distress, the average investor – particularly those who have done their own research and made their own investment decisions – panic at seeing their savings diminish to such an extent. They often start questioning whether they should be making their own decisions and often their reaction is to salvage what is left and sell, sell, and sell some more. [Regretfully, that is not what one should do. Let me explain why that is the case and what you should be doing – NOW.] Words: 380

30. Words of Wisdom From the Most Brilliant Investors Ever

There’s a bewildering amount of advice on how to invest…so it’s worthwhile, especially in today’s volatile markets, to take a look at what has actually worked, as opposed to what people claim works. We’ve collected some of the finest wisdom on markets from the most respected and successful investors, past and present. Words: 865

31. Understanding Systematic Risk, Modern Portfolio Theory and the Efficient Frontier

Risk inherent to the entire market or market segment is referred to as systematic risk and modern portfolio theory says that a blend of investments has the potential to increase overall return for a given level of risk, and/or decrease risk for a given return that the investor is trying to achieve. The expected risk/return relationship is known as the efficient frontier. [If you have a portfolio of investments then you need to fully understand what all this really means and how you can apply it to your portfolio makeup to enhance returns under any circumstances. Let me do just that.] Words: 1325

32. Should Stocks Be the Cornerstone of Your Portfolio?

There is a common notion that stocks, at least if held for a long-time, outperform other assets [and, as such,] should be the cornerstone of any long-term portfolio. [While that is indeed true,] it is best to focus first on how much you are able and willing to lose (i.e. what risk you are able and willing to bear) when determining the optimal allocation for your portfolio. [Only] then [should you] think about what potential investment returns you might be able to capture. [Let me explain.] Words: 1503

33. Motivated Stock Pickers CAN Beat the Market! Here’s How

What hope can there be for motivated stock pickers – no matter how much they sweat and toil – to outperform the low-cost index funds that simply mechanically track the market? Well – in spite of the absurd rise of the Nobel-acclaimed, and highly promoted, Efficient Market Hypothesis that claims that individual investors can’t beat the market – it turns out there is plenty! Just ask Warren Buffett, for one. [Let me explain.] Words: 1574

34. Don’t Be Misled – There are Major Differences Between the HUI, XAU & GDX

The number, market cap and currencies of the constituents of the HUI, XAU, GDX, XGD and CDNX indices differ considerably from each other and, as such, each index presents a different picture of what is really happening in the precious metals marketplace. This article analyzes the make-up of each index to reveal the biases of each to arrive at the answer to the question in the title. Words: 1026

35. Don’t Invest in the Stock Market Without Reading This Article First

History has shown that investors who stick to disciplined, fundamental-focused strategies give themselves a good chance of beating the market over the long haul and James O’Shaughnessy has compiled data that stretches back to before the Great Depression, back-tested numerous strategies, and has come to some very intriguing conclusions. [Let me share some of them with you.] Words: 1325

36. Size Does Matter: A Look at Market Capitalization and What It Means for Investors

People choose certain stocks for many different reasons: business location; sector strength; product innovation, but some investors choose what to buy based on company size, or market capitalization [believing that size does matter. Yes,] understanding the difference between small-cap, medium-cap and large-cap companies is the first step to making the right choice. [Let me explain.] Words: 600

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money