Gold’s value should depend on the economic and political situation of the time. Right now there are fears of hyperinflation, collapse of the eurozone and even a collapse of the entire financial system. Gold should be worth more than its historical average, but how much more? Words: 3063

So asks Adreno (www.pokeritieto.com) in an article* posted on seekingAlpha.com which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Adreno goes on to say, in part:

I approach gold like any other volatile financial asset. First I want to estimate its value. If the disparity between price and value is big enough, I look into what kind of investment opportunities that creates. I attempt to time my entry and exit points based on catalysts that have historically matched turning points in the gold market.

Part 1. Common Misconceptions

Before going into the actual analysis, I want to challenge some common conceptions about gold by showing how they conflict with dictionary definitions. I’m using Wikipedia for my quotes, but you will find similar descriptions in any dictionary.

#1. “Gold is money”

Without question gold has a long history of monetary use. Gold coins and silver coins were commonly used. After the invention of banking, bank notes that could be exchanged for physical gold were used as money. But is gold money today?

Money is any object or record that is generally accepted as payment for goods and services

Physical gold is not generally accepted as payment for goods and services. Dollars (or bank notes of any major currency) are not redeemable for gold. Therefore, by definition, gold is not money.

#2. “Gold is always a safe investment”

Before we delve into the whole safe haven debate, this claim infers that gold is an investment. Let’s look at how Wikipedia separates investment from speculation:

Investment is putting money into something with the expectation of gain … high degree of security for the principal amount … within an expected period of time.

Gold does not produce anything. Any expectation of gain in a gold investment is based in the idea that someone else will pay more for the same stuff in the future. If the underlying fundamentals justify this assumption, gold could be an investment but fundamentals are rarely referenced in this context. More often you hear people extend the definition of investment into assets that are expected to safely maintain value.

#3. That safe haven debate

Many people buy gold because they expect it to maintain purchasing power for their investment horizon. A confusion between short term and long term risk shrouds this speculation. While gold price keeps up with the general price level in the long term, fluctuations can be huge. That means an unlucky timing can yield big losses. As a recent worst-case scenario, the USD gold price plummeted from a high of $850 in 1980 to a low of $300 in just over a year, a nominal loss of 65%.

Even more neglected than risk of loss, consider the costs of trading, transportation, storage, safeguarding and insurance. While the trading costs in paper gold are definitely lower than trading costs in physical gold, I would say holding costs are higher. Overall I’d estimate speculating in gold costs about 1% annually.

So we have an asset that fluctuates greatly in price and yields on average -1% real returns. People call it a “safe haven”. Let’s call things what they are: gold is a volatile financial asset, not money. Buying gold is usually speculation, not investing. Does this mean it’s stupid to ever buy gold? No. If gold correlates negatively with other financial assets, a small allocation can significantly reduce portfolio risk. Besides, some people make consistent profits by speculating in the financial markets.

Part 2. Fundamental Valuation

A. Factors that Affect Gold’s Supply/Demand Balance

1. Expansion of Paper Gold

Paper gold refers to investment vehicles which track the value of gold without necessarily being backed by actual gold. When part of the demand for gold is satisfied artificially, the effect on prices is the same as creating more gold: prices are suppressed. In this light the gold run of the past decade is even more spectacular. I wonder how high prices would be if everyone who wanted to invest in gold would buy physical gold?

While the birth of these vehicles goes back to the first banks, I believe the advent of computers and electronic banking really skyrocketed the creation of paper gold. I don’t pretend to understand all the ETFs, options, derivatives, futures, certificates, etc. so I’ll just say that some of the gold people own on paper doesn’t exist.3

How significant this problem is I don’t know. As the bull market for gold continues, there is more interest in gold investment. That means the demand for financial innovation and services in the gold market goes up. And when demand goes up, supply follows. A year from now you will probably have even more ways to invest in “gold”. What if the bull market ends? There will be less motivation to create new investment vehicles for gold, but the ones that exist aren’t going anywhere in years. Overall paper gold is creating downward pressure on gold price without upside potential.

2. Population growth versus production

Anything of unique properties and finite supply should appreciate in value as the amount of people who want it increase. Is this the case for gold?

Over the past 30 years the production of gold has essentially matched population growth.12 Mining and recycling produces 3500 tons/year, and is offset by 2500 ton yearly demand for gold (excluding investment demand). Jewelry can be recycled and gold isn’t really consumed, compared to oil for example, which is destroyed in use. Therefore, every year the amount of useable gold above ground increases by about 1.3%. However production has already peaked so any projections far into the future should incorporate a yearly diminishing production number.

Population growth is also slowing down, from 2.2% in the 60’s to 1.1% in 2009. It’s impossible to make reliable predictions far into the future, but at least for the next decade I would expect gold production to stay in line with population growth. It’s important to note this type of parity wasn’t always the case. For the last 4000 years gold production actually exceeded population growth, causing a 7x increase in the amount of above-ground gold per person.

B. 3 Indicators of Gold’s Intrinsic Value

1. Gold/silver ratio

Before man started digging for precious metals, there was about 17.5 times more silver than gold beneath the surface.

From 2000BC -> 300BC the amount of silver in circulation has been 10x the amount of gold while the gold price has been 15x the price of silver. Since both were utilized exclusively for jewelry and money, this 50% premium (over the 10x price you would expect) indicates gold has been perceived to be better. Gold is prettier and easier to transport or store.

From 300BC -> 1900AD large deposits of silver were extracted and the amount of above-ground silver in relation to gold rose from 10x to 16x. Because of mandated exchange rates, the price ratio remained around 15x until gold started to take off around 1873.

From 1900 -> 2010 the gold/silver price ratio has been extremely volatile, averaging at 43x. However, something fundamental changed after WW2: technological advances such as electronics started consuming masses of silver. Before this practically all silver and gold dug out of the ground still existed in a way that could be returned to the market.

In half a century we consumed over 90% of silver stockpiles that took thousands of years to build. The amount we have left equals about 1 year of silver mine production. If we count jewelry, silverware and silver coins, we have about 30 times that.

560M ounces of silver is consumed every year, representing 3/4 of yearly mine production. Since gold is not consumed, the ratio of above-ground silver to gold has come down from 16x to about 4x (my best estimate). That’s including silverware, coins, and jewelry. If we only count official inventories, silver is actually more rare than gold!

Industry demand for gold currently represents about 10% of yearly demand. It is possible that future technological advances would increase the industrial demand for gold, but currently it’s insignificant from the perspective of the individual investor. As silver use in photography is diminishing, the primary consumption comes from electronics and medicine. Silver is the best conductor of electricity, even surpassing gold, so I would expect this trend to continue.

Silver has more utility than gold and it is becoming increasingly rarer. All this begs the question: why isn’t gold priced closer to 4x silver? Even if we give gold a 30% premium for being pretty and light, and an additional 50% premium for having fewer underground reserves (arbitrary numbers, I know) we arrive at 8x valuation. At the very least, silver should be more valuable now than it was 300+ years ago when gold was valued at 15x silver. Despite all this gold is valued at 45x silver.

The obvious play to benefit from this would be to short gold and long silver, but until I understand why the ratio has gone berserk in the 1900’s I won’t be gambling on it. I suspect silver supply in a relatively small silver market creates this volatility: since most silver is mined as a by-product of gold, lead-zinc and copper, silver supply is affected more by changes in other commodity markets than the silver market itself.

2. Gold/CPI ratio and Gold/Real Estate ratio

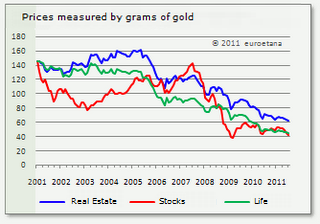

Since maintaining purchasing power is the main reason people buy gold, it’s crucial to look at gold’s purchasing power over the long term. First, a chart by euroetana, translated to English:

The blue line represents the Finnish housing market. A quick calculation from the graph shows gold appreciating 180% in real terms.

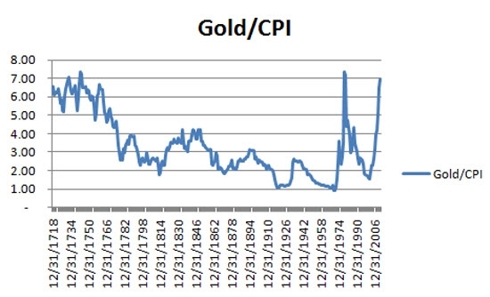

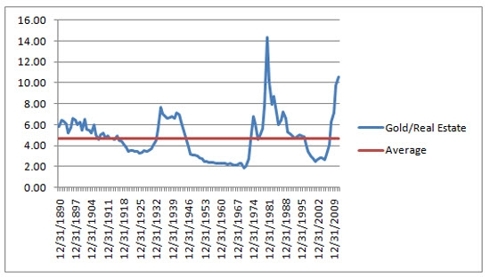

James Debevec charted gold price/core price index (purchasing power) and gold price/Shiller-Case index (real estate). Graphs below.

If gold would return to its average value in relation to real estate, it would trade at $614 according to Debevec’s calculations. Gold/CPI indicator sets “Fair Value Average” of gold at $734 and the “Fair Value Median” at $610.

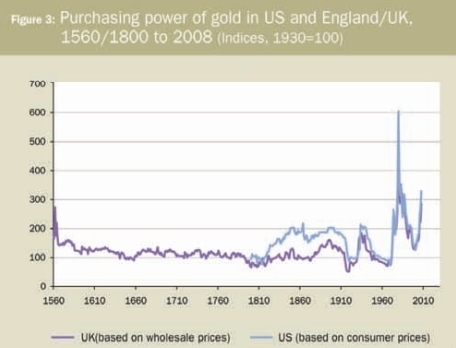

Here’s one more chart from Roy Jastram’s study “The Golden Constant”:

You can see the consistency in the above chart: gold’s purchasing power varies across time and it is currently far above the historical average.

3. Fair value of gold

It’s interesting how the gold/silver ratio supports the CPI and RE indicators: if gold was priced at the historical 15x silver level, it would be at $650. Exactly where do the CPI and RE indicators assign gold’s fair value! However, this is an average value over hundreds of years. Gold’s value should depend on the economic and political situation of the time. Right now there are fears of hyperinflation, collapse of the eurozone and even a collapse of the entire financial system. Gold should be worth more than its historical average, but how much more?

Let’s assume that gold will maintain its purchasing power over a financial collapse such as hyperinflation. Let’s also assume that the absence of a financial collapse will return gold to its average fair value of $650 (in 2011 USD). With these assumptions we can actually calculate what the gold market thinks of the probability of a financial collapse. I’m conservatively assuming the alternative to a gold investment is holding money under the mattress (makes the calculation much simpler: 0x – (1-x)*1150 > -1800x + (1-x)*0). Based on these assumptions the gold market thinks there is above 39% chance of an imminent financial collapse. If you replace “money under the mattress” with an alternative investment the percentage will be significantly higher.

Assessing how valuable gold is today in comparison to “average times” is entirely subjective. With that in mind I’m going to say an ounce of gold should be worth $700 – and man, would I love to hear someone explain what justifies a valuation of 180% above average.

Part 3. Timing the Gold Market

While the price of anything reflects fundamentals in the long term, short term price movements are mainly caused by changes in investor sentiment. Gresham’s law makes a pretty compelling case for generational cycles in the Dow/gold ratio. It is well documented that asset classes fall in and out of favor, but it’s questionable whether changes in investor sentiment toward asset classes can be predicted.

The majority of gold’s investment demand comes from emerging economies (mainly China and India). Actions of central banks and organizations such as the IMF can affect the gold price. Official sector currently holds 17% of above-ground gold. Central banks used to be net sellers but the trend has been slowly turning and they might turn out as net buyers in 2011.

Gold has been better in deflationary than inflationary periods. Jill Layland offers an explanation:

While at first sight it may seem strange from the perspective of the present day that gold lost value in times of inflation in the past, there is in fact a simple explanation. Gold was either money, or closely related to money, throughout this period. In times of inflation when prices rise the value of money falls. Hence it is entirely logical that gold’s purchasing power behaved that way in the past. But from 1971 the opposite is true and we revert to what we today consider the more normal situation of gold acting as a hedge against inflation, as in the 1970s, or the fear of inflation, as in recent times.

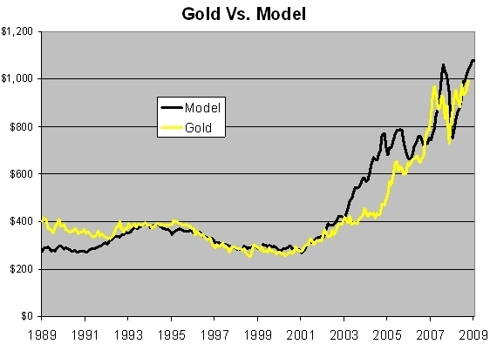

The cost of buying gold is essentially the opportunity cost of holding cash, bonds or stocks. Gold appreciates when the expected yield of other financial assets is poor. In particular, real interest rates have been good at predicting gold price. Eddy Elfenbein engineered a model for the price of gold based on the difference between short-term interest rates and inflation. According to the model, gold rallies when real short term interest rates are below 2% and retreats when rates are above 2%. [For an excellent article on the subject go here.]

This is how the model predicts gold’s yearly movements:

real short term interest rate / expected annual yield for gold

- +5% / -24%

- +4% / -16%

- +3% / -8%

- +2% / +0%

- +1% / +8%

- +0% / +16%

- -1% / +24%

- -2% / +32%

The model is based on academic research, but the 2%/8x relationship was discovered by datamining, so take it with a grain of salt. What’s relevant to the individual investor is that real interest rates are currently negative so gold will likely continue its bull run.

Part 4. Summary and conclusions

Fundamental indicators say gold needs a -65% correction from $1829 to be fairly valued.

- Gold is overpriced relative to silver. Its fair value should be between 4x-15x silver, but it is currently 45x. This indicates a potential downside of 66%-91% in relation to silver.

- Gold is overpriced relative to real estate. A 65% drop in gold price would return gold/RE ratio to its 1890-2009 average.

- Gold is overpriced relative to goods and services. If gold price would drop 60% its purchasing power would be returned to its 1718-2011 average.

My views regarding the current gold market:

- If the financial system doesn’t collapse, the gold price will

- Long silver, short gold could be a viable strategy

- Paper gold is suppressing gold price with no upside potential

I’m not shorting gold at the moment for the following reasons:

- Real interest rates predict gold’s run will continue

- The markets can remain irrational longer than I can remain solvent

- A bet against gold is essentially a bet for the strengthening of USD (or EUR depending on the instrument). If there was a way to short gold in terms of purchasing power, I would do it.

If real interest rates appreciate above 2% or if I see another potential catalyst for a correction I may take a short position on gold but as long as central banks keep interest rates near 0% and print money like it’s Zimbabwe, I’ll sit on the sidelines.

*http://seekingalpha.com/article/291328-gold-is-worth-700-but-a-correction-is-unlikely-in-the-short-term?source=email_macro_view

Related Articles:

1. The Future Price of Gold and the 2% Factor

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Furthermore, for every one percentage point real rates differ from 2%, gold moves by eight times that amount per year. So if the real rates are at 1%, gold will move up at an 8% annualized rate. If real rates are at 0%, then gold will move up at a 16% rate (that’s been about the story for the past decade). Conversely, if the real rate jumps to 3%, then gold will drop at an 8% rate. [Let me explain.] Words: 982

2. Gold Will Drop to $1390 By Year-end and $1000 by 2013! Here’s Why

A review of the gold price written by Robin Bew, chief economist at HSBC Bank, proposes that the gold price is in danger of entering bubble territory and predicts a sharp correction by year-end and reach $1,000 per troy ounce by 2013. [Let’s examine Bew’s views more closely.] Words: 725

3. Buy Silver Instead of Gold! Here are 10 Reasons Why

We are at the beginning of a major shift out of paper assets into real assets [and] those that are starting to come to this revelation have no real understanding what they are doing when they are buying gold…[they just want] to get out of paper assets. I bought gold as a gut reaction [but] the more I learned about silver, [however,] the more I realized that silver was the smart decision. [Let me explain.] Words: 2190

4. These 5 Situations Would Put An End To The Gold Bull Market

With gold’s ever increasing price and all of the bullishness out there today [I have identified] 5 different situations that would cause the gold trade to unwind. Two are more of the short-term correction variety, while three are more of the long-term new bear market type. [Let me explain.] Words: 831

5. Why Silver Provides Much Greater Upside Potential than Gold

The opportunities expected to arise from investing in silver now are even more pronounced than those of gold. [Let me explain why that is the case.] Words: 1367

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

If Gold and Silver are in a massive bubble then let it pop and we will stock up on more. They are SUPPRESSING the price of metals to prop up the dollar. That means they print more money to keep the price of Gold and Silver from shooting to the roof, which also means the dollar is massively being devalued. WHICH also means Gold and Silver are not in a bubble but rather the Dollar is. Hey if they try and fabricate a crash in Gold and Silver let them. If you know fundamentals, you would realize this article is “parroting” what is being said in main stream media.

wrong and pointless article…well chat when gold goes to $2500 and than to $5000 is it justified. Its the only currency that will hold it value, justified, gold ids not a commodity – wake up