Your past and future stock market gains actually have been, and will continue to be, absolutely nothing more than a mirage – a cruel illusion – unless you develop a drastic out-of-the-box investment strategy that is radically different from anything that currently exists. Here’s how to do so.

So says Daniel R. Amerman, CFA (www.danielamerman.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Amerman goes on to say, in part:

In my opinion, the greatest threat to long-term and retirement investors is the wealth-destroying triple combination of monetary inflation, asset deflation, and inflation taxes. Fully understanding these factors is absolutely essential for financial survival.

Inflationary Illusion Fooling Investors

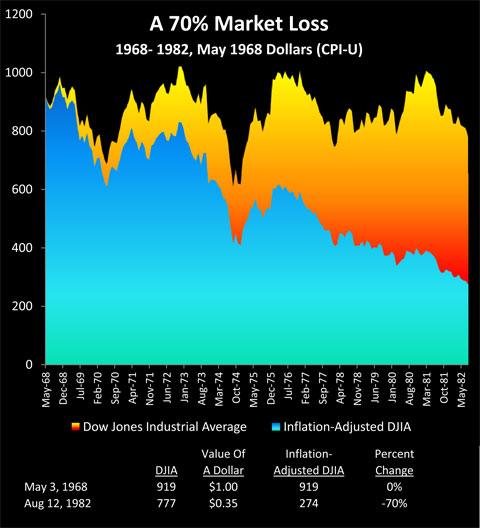

The last time the U.S. endured the combination of sustained high unemployment and high rates of monetary inflation 70% of stock investor wealth was annihilated…by three distinct wealth-destroying forces – asset deflation, monetary (price) inflation and “inflation” taxes…As shown in the graph below, in yellow, the Dow Jones Industrial Average reached 919 in May of 1968, and by August of 1982, had fallen to a level of 777, for a loss of 15% [but, given the decline in the value of the dollar over that 14 year period, had declined by 70% in inflation-adjusted terms – yes, -70%].

This 70% decline in the value of what our assets would buy for us was entirely real, but to this day, many don’t realize just how bad it was – because inflation in prices was hiding deflation in investment values. The 65% plunge in the value of the dollar “hid” the great majority of the 70% plunge in the value of stocks, with most of the surface value of the Dow index by 1982 consisting of dollars that were worth far less than what they had been before.

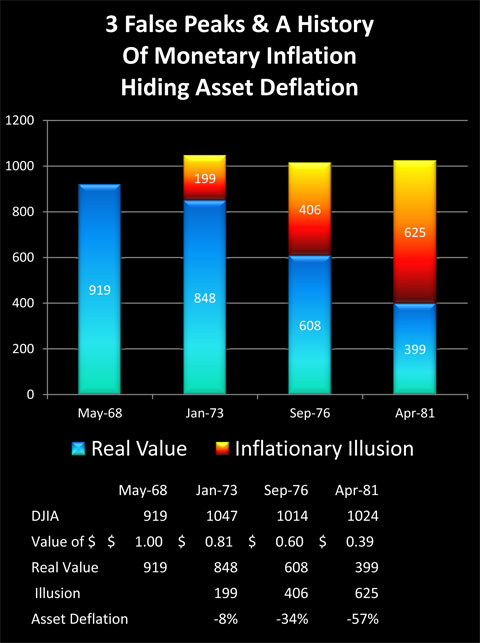

Even though long-term asset deflation of 70% (in real terms) was the result of the last time we had persistent high unemployment coupled with inflation, many investors and newspaper readers…may [only] recall three powerful bull markets when the Dow repeatedly flirted with the “magical” 1,000 mark. Each surge filled innumerable financial columns with the hopes that the good times and a long-term bull market had returned again, with those hopes being quickly dashed as the market repeatedly proved unable to sustain itself above the 1,000 level. The reality is that there never were three bull markets, but rather only an inflationary illusion fooling the public.

Indeed, when we look closely [at the graph below], instead of seeing three peaks, we will see three historical object lessons in how destroying the value of money can hide the destruction of the value of assets – and repeatedly fool the headline writers along with much of the investing public. The cold reality of the Dow adjusted for inflation is shown in blue. [As you can clearly see,] there aren’t three interim peaks, but merely a market moving steadily and powerfully down.

The “bull market” that peaked in January of 1973 when the Dow hit 1,047 – was in a reality a fall to Dow 848 (asset deflation in inflation-adjusted terms), that was masked by the dollar being worth only 81 cents when compared to May of 1968 (monetary inflation). Inflation had created an almost 200 point illusion in the Dow.

The “bull market” that peaked in September of 1976 at 1,014, really represented the Dow falling by over 300 points – translating to asset deflation of 34% – which was hidden from savers by the illusory profit created as a result of the dollar dropping in value by 40% (monetary inflation).

The cruelest illusion of all was the “bull market” of April of 1981, when the Dow finally reached 1,024 because the real value of the market had fallen to 399, and a 57% destruction of the purchasing power of investor assets was being entirely hidden by the 61% destruction of the value of investor dollars.

Three Wealth Destroyers vs “Perfect Timing”

In my opinion, the greatest threat to long-term and retirement investors is the wealth-destroying triple combination of monetary inflation, asset deflation, and inflation taxes.

One of the most common investor approaches to a truly difficult market is to attempt to “outrun” the problems [by making] better decisions than the rest of the public, and making so much money that the problems can be overcome and wealth kept intact – but it begs the questions: “How well does that work in practice and just how good do you (or your financial advisor) have to be?”

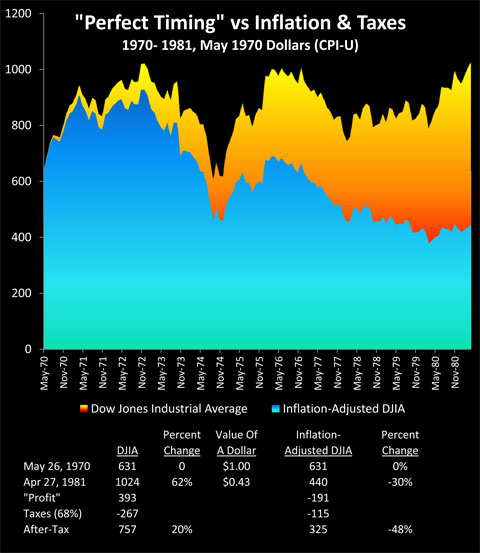

To answer the above question, we will go back in history and assume that through the use of a time machine (or peerless skill, or uncanny luck) we did a perfect job of long-term market timing during an environment of asset deflation and monetary inflation.

Aided by this time machine, we put every dollar we had into the market on May 26, 1970, when the Dow closed at 631. What makes this day remarkable is that 631 is the lowest level the Dow index closed at between November 20, 1962 and September 12, 1974. It was the single cheapest day to buy stocks over an almost 12 year time period, and at the time, the lowest that stock prices had been at in more than 7 years. Perfection.

Subject to the conditions that 1) as long-term investors we need to be in the market ten or more years, and 2) that we want to stay within the 1968 – 1982 period of sustained asset deflation and high monetary inflation, we instruct our time machine to find the best possible place to sell. This turns out to be April 27, 1981, when the Dow closed at 1,024.

April 27, 1981 was the single highest close for the Dow index between January 22, 1973 and October 19th, 1982. So we buy in on the exact day with the lowest stock prices in an almost 12 year period, and we sell everything out on the exact day with the highest prices over an almost a ten-year period. Double perfection!

So then, how did we do? As shown in the following graph which begins on our purchase date and ends on our sale date – our time machine allowed us to get the best possible results in a thoroughly bad market. If our returns had exactly tracked the Dow between when we bought and sold, our perfect timing would have taken us from 631 to 1024, for a 62% price gain in the midst of one of the worst markets in memory.

A whopping profit indeed before we adjust for inflation, that is, so let’s do that. A dollar on our sale date in April of 1981 was only worth 43 cents compared to what it was worth on our purchase date in 1970. When we adjust for what our assets will buy for us – we have Dow 440, not Dow 1024. So even the perfect timing delivered by our time machine leads to a 30% asset deflation loss in real terms, not a 62% gain.

The Internal Revenue Service did not “see” these losses, however, but on the contrary, was quite impressed by our remarkable investment prowess. Moreover, taxes were higher back then (when we confine ourselves to federal income tax rates, we truly are at a low-level now compared to much of the modern era). Assuming we were in the highest income tax bracket, and traded often enough to pay ordinary income tax rates, then given that the average top income tax rate over that period was 68%, this means that we would have paid out 267 in taxes on our 393 gain. These taxes on effectively non-existent income are known to economists as “inflation taxes”, and during times of high inflation, they can be devastating.

Subtracting out real taxes on imaginary income leaves us with Dow 757 in after-tax terms, and Dow 325 in after-inflation and after-tax terms. Thus, even with our quite unrealistic assumption of absolutely perfect market timing – which allowed us to radically outperform almost every other investor in the nation – we still lost almost half (48%) of the purchasing power of our net worth.

Lessons Learned & Implications For Today

The most important takeaway from our time machine scenario is not about 1970 or 1981, but about what investors face today. The world has changed immensely, and there are numerous reasons to fear that long-term asset deflation could become reality again. [In addition,] with the fight for survival of both governments and banking systems who are each effectively dependent on rampant monetary creation and deficits without end, the chances for major inflation have never been higher in the modern era.

History does show what can happen next for an entire nation with a deeply troubled economy. For more than decade, the markets and investor wealth can be dominated by the deadly combination of:

- a crippling destruction of the purchasing power of investment assets;

- a masking of this asset deflation by the destruction of the purchasing power of money; and

- this masking then generating illusionary “profits”, upon which taxes have to be paid, which then compounds the damage.

Moreover, history shows us quite clearly that when all three of these major wealth destroyers are working together in the real world then conventional investing methods cannot withstand the destruction of investor wealth that occurs across the nation and over the long-term. Even when we used the extraordinary assumption of perfection in timing – there was still a crippling asset price loss in real terms. Of course, real world investors who didn’t have the benefit of assumed perfect timing lost even more money.

There was very little one could do about it then – nor is there today – so long as conventional investment practices are followed. The placid and theoretical world of ever-compounding retirement investment accounts simply doesn’t have a chance when it runs into the real-world triple wealth destroyers that aren’t factored into the usual financial modeling assumptions.

Current Asset Deflation Risks

To illustrate the extent of the danger for today’s investors when the destruction of the value of money (price inflation) hides the destruction of the value of assets (asset deflation), let’s begin by assuming that the markets experience a 70% real loss, which is the same as what actually happened between the late 60s and early 80s. Using a round 18,000 for the value of the DJIA, that would translate to an index value – before inflation – of 5,400. However, we must keep in mind that much is different now when compared to this previous bout of asset deflation:

- Europe was not then on the verge of possible financial system failure, thereby endangering US export markets, jobs and corporate profits in a globalized world,

- Asia had not yet become the world’s global manufacturer, so there were still plenty of U.S. manufacturing jobs to be filled when the economy did turn around and

- there was an oncoming surge of free-spending young adults – the Baby Boomers – who as consumers and workers would turn the US economy around in the early 80s. This has now been reversed, with the Boomers becoming a retirement juggernaut who will be simultaneously selling massive amounts of investments into the markets, even as consumption drops with a graying population.

Given how much has changed between then and now, a mere repeat of that historical 70% decline might be considered a conservative assumption.

Deficits, Debt, “Printing” Money & Higher Inflation

As with asset deflation, when it comes to monetary inflation, there are powerful and unfortunate differences between the 1970s and now:

- The Federal government has had its credit rating downgraded because it is borrowing an amount equal to almost 10% of the total economy each year, with no end in sight, to fund ever-growing government promises…

- The global financial system is being kept from collapse only by the direct creation of trillions of dollars and euros which are being passed to financial institutions and other favored corporate insiders on non-market terms.

- Impossible promises to retirees and government bond buyers from effectively bankrupt governments are all too likely to be repaid with inflation.

Paying Whopping Taxes While Our Net Worth Is Destroyed

The illustrated “fiery” rise from Dow 18,000 to Dow 54,000 is spectacular indeed, and is likely to draw the full attention of a keenly interested party – a near bankrupt government that is starved for tax revenues.

It is government fiscal and monetary policy that creates inflation; however, inflation losses are not recognized under the tax code. So we owe taxes in full on the 36,000 point rise in the Dow – even though we actually lost 70% of the value of our investments in that rise.

Eventually, excessive borrowing and high inflation will restrict the government’s ability to use deficit financing, and either the spending must plummet as generations-worth of promises to retirees are broken, or taxes must be substantially increased – or both.

Unfortunately, “wealthy” investors who have been enjoying apparently “stratospheric” profits on their retirement investment accounts are likely to be all too tempting of a target, resulting in rising tax rates even while retirement tax shelters are restricted or eliminated.

Assuming a 50% tax rate, which while above recent rates, is still nowhere near the highest levels seen in modern history, paying $18,000 in taxes on a 36,000 point “profit” leaves us with the after-tax equivalent of a 36,000 Dow. When we adjust for a dollar being worth ten cents, we are left with Dow 3,600 – which is only 20% of what we started with.

As the chart shows, the illusionary “profits” caused by inflation allow the government to use inflation taxes to take a third of the value of the assets we had left after the 70% bout of asset deflation, leaving us with an 80% loss on our savings.

Alternative Assets

A very attractive alternative for many investors is to try to bail out of paper money and paper assets altogether, and to seek to preserve wealth through tangible assets such as gold, silver and real estate. Tangible assets can indeed form the cornerstone of successful investment strategies in difficult markets, but unfortunately (and ironically), most popular inflation hedges don’t take inflation taxes into account.

My article, Gold is NOT a Perfect Inflation Hedge! Here’s Why (1), explores how a combination of high inflation and rising tax rates can devastate what looks like a perfectly executed gold investment strategy, turning what on the surface appears to be spectacular profits into a major loss on an after-inflation and after-tax basis, with the government effectively ending up with much of the gold investor’s starting net worth. Precious metals are a great way to survive and even profit during financial turmoil – but inflation taxes have to be fully taken into account in the strategy.

The Triple Redistribution Of Wealth

Fortunately, there are solutions, but to apply them one must first recognize and understand the redistribution of wealth.

While the value of the paper dollar did fall by 65% between 1968 and 1982, and the inflation-adjusted value of the paper wealth that is the Dow did fall by 70% – the real wealth of the country as a whole did not fall by 65-70% because real wealth is not paper assets in a bank or brokerage account, but is goods and services. Real wealth is the economy and the collective standard of living.

The economy did not fall, but rather it grew by a cumulative total of 25% in inflation-adjusted terms over those 14 years, with an annual average real growth rate of about 1.6%. The 70s and early 80s were deeply troubled, and this real annual growth rate is about half of the long-term average for the modern era in the United States – but the sum total when it comes to real wealth was still positive.

Now, we know that tens of millions of savers who were relying on their savings to at least partially pay for their standard of living did necessarily see a fall in their standard of living – because what their dollars could buy for them did fall by 65%, and after-tax interest payments were not nearly enough to keep up.

However, this dramatic drop in potential standard of living was not experienced by the nation as a whole. Rather, there was a redistribution of wealth with:

- tens of millions of people benefiting (albeit accidentally in most cases) from the destruction of the paper dollar that was severely hurting tens of millions of savers

- millions of stock investors experiencing asset deflation which ravaged the purchasing power of their portfolios because the value of paper wealth in the form of stocks fell by 70% – while overall real wealth grew for the nation – there was indeed a major redistribution of the relative rights to enjoy this real wealth of goods and services and

- inflation taxes being the primary redistributor of wealth. Government economic policy creates inflation, while government tax policy pretends inflation doesn’t exist. Through taxes, massive illusionary profits are taken from savers and investors, and redistributed by the government.

When inflation is high, inflation taxes act as lead weights, pulling down and even crippling the performance of most inflation hedges and general investment strategies alike – until one realizes that they are created by government blindness to inflation. On a fundamental level, this blindness necessarily opens the door to out-of-the-box counter-strategies for achieving profits that are in plain sight – even if government tax policy doesn’t see them.

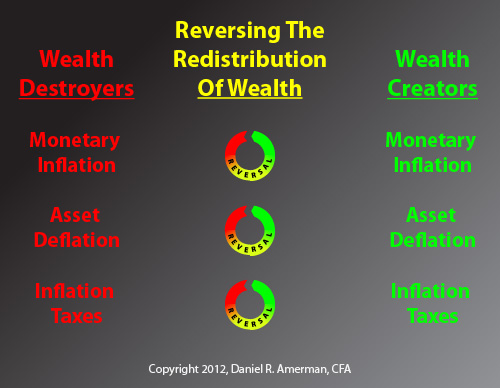

Turning Wealth Destroyers Into Wealth Creators

When we put the three wealth destroyers on the left column together – as has happened in the past and may be happening again in the near future – then conventional finance strategies simply can’t cope, certainly not once we look at results in after-inflation, after-tax and after-expense terms. The end result is the impoverishment of savers and investors by the tens of millions and, because the great majority of paper assets are held by older people, it will be the Boomers and their parents who pay the highest costs, as wealth is redistributed away from them.

I have spent many years studying these issues and exploring different possible solutions and over these years I have become convinced that the best answers can only be found by first finding the right questions to ask.

- The essential questions aren’t about how to achieve the best results within a conventional long-term investment approach because, as we saw with the “perfect timing” scenario, when broad and powerful wealth destroyers are moving against all investors, and on a sustained basis, then coming out ahead becomes excruciatingly difficult, and in the real world will likely only be achieved by a tiny fraction of investors.

- Instead, let me suggest that the better approach is to move to a more fundamental and holistic level, taking into account everything that determines our net worth and standard of living, and asking the three following questions:

- How can I personally and realistically change my financial profile and strategy so that monetary inflation redistributes wealth to me and the higher the rate of inflation, the higher my real wealth grows?

- How can I change my strategy so that asset deflation becomes a profit opportunity rather than a wealth destroyer?

- How can I take advantage of the government’s blindness to inflation and reverse inflation taxes, so that instead of paying real taxes on imaginary income, I am (perfectly legally) paying imaginary taxes on real income?

The above are not the usual questions but they are the essential questions because when we successfully answer all three questions, and reverse all three wealth destroyers, then we have three wealth creators instead. These wealth creators can then build upon each other, and transform our personal finances in a time when paper wealth is being destroyed all around us.

Finding the best answers means stepping well outside the usual approaches, and this will mean that our strategies may look radically different from those around us…

If sustained high monetary inflation, severe asset deflation and inflation taxes do return then those who do nothing to change their “normal” financial profiles will face year after year of pervasive and sustained financial pain, with declining wealth and potentially declining standards of living…

* http://danielamerman.com/articles/2012/Dow36C.html

Have your say on the subject via:

We’d like to know what you have to say.

Related Articles:

1. Gold is NOT a Perfect Inflation Hedge! Here’s Why

Almost any traditional inflation hedge [such as gold, silver as well as real estate, stocks or whatever,] has difficulty in reaching the break-even point on an after-inflation and after-tax basis when we take into account the pervasive problem of hidden “inflation taxes”…If our future is one of high inflation, then whether and how you deal with inflation taxes may be one of the biggest determinants of your personal standard of living for decades to come… Why? Because government fiscal policy destroys the value of our dollars and government tax policy does not recognize what government fiscal policy does, and this blindness to inflation means that attempts to keep up with inflation generate very real and whopping tax payments, on what is from an economic perspective, imaginary income. [Let me illustrate that fact with three examples and suggest some remedial measures.] Words: 3085

2. Stealth Taxation in the Form of Financial Repression is Coming! Here’s Why – and How

Financial Repression is a form of wealth confiscation and redistribution that is in some ways as effective as taxation – but the government never directly calls it that. It never appears in the budget (directly), and while it is dependent on a comprehensive network of laws and regulations – none of those go through the legislature with a stated intention of creating Financial Repression. So while the economic net effects are similar to a huge and comprehensive set of investor taxes being used to pay down the national debt, the “taxes” are never a campaign issue because voters and investors don’t understand what is happening – they only feel the results. [In this article I lay out for you what is slowly developing and expected to escalate dramatically in the next few years.] Words: 5800

3. Get Ready to be Financially Conscripted – and Face a Lower Standard of Living!

Get ready to be financially conscripted into a citizen army assembled for the greater cause of saving America from being swamped by a tsunami of debt as a new policy initiative known as “financial repression” takes hold. ‘Repression’ rhymes with ‘depression’ and that is what we may have to look forward to as rampant price inflation and permanently lower living standards take hold as a result. Let me explain. Words: 1797

4. Americans: Here’s How to Protect Your Retirement Assets From Coming Gov’t “Confiscation”

Mandatory IRAs as proposed by the Obama Administration is just the 1st step in stealth nationalization and forced investment of our retirement benefits to support the treasury debt market! [As such,] every American with substantial retirement assets must [begin now to] protect themselves from having to become buyers of last resort for US treasury obligations. [Let me explain.] Words: 6349

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money