We had previously speculated that the 30-year bond rate would continue downward to around 2% based upon a number of very long-term charts. Short-term charts, however, are showing strong technical evidence that interest rates may be turning up in the long term. Words: 267; Charts: 2

So writes Carl Swenlin (www.decisionpoint.com) in edited excerpts from his original post on the Pragmatic Capitalism web site* under the title Are Interest Rates Turning Up?.

![]()

This article is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Swenlin goes on to say in further edited excerpts:

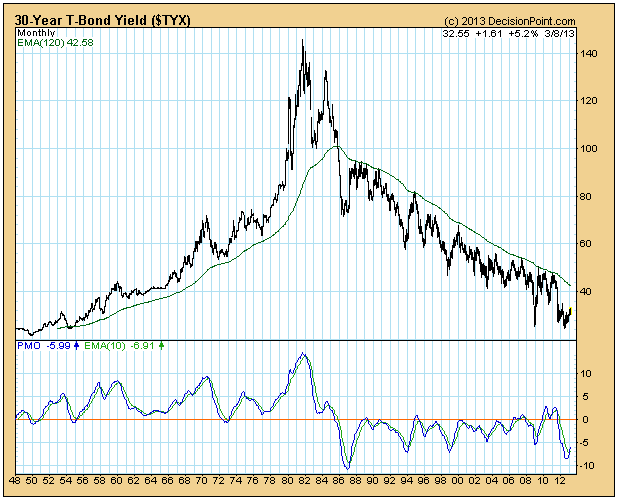

The monthly chart below shows bond rates going back to 1948, at which time long bond rates were about 2%. After the 1981 peak, rates have trended downward toward, we assumed, the historical low. Now it appears that the bottom is in and that rates are heading higher.

Note that the monthly PMO has turned up from its second most oversold level in 50 years, and has crossed up through its 10-EMA, rendering a PMO buy signal.

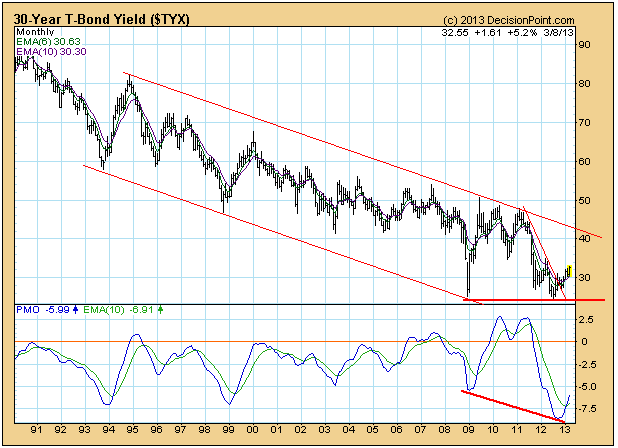

Zooming in on a 23-year monthly chart we can see a long-term double bottom (2008 and 2012). This compares with the lower PMO low, which sets up a reversal divergence (bullish). We can also see that yield has broken above a declining tops line drawn from the 2011 top, confirming the double bottom. The most important thing that needs to happen next is for yield to break above the declining tops line drawn from the 1994 top.

Conclusion

We think that interest rates are making a long-term turn to the upside. The long-term double bottom in yield, plus the monthly PMO bottom and upside crossover are very significant events, indicating that a long-term bottom is in place.

If rates do continue to rise, that will have an extremely negative effect on just about everything.

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://pragcap.com/are-interest-rates-turning-up (© Copyright 2013 — PRAGMATIC CAPITALISM. All Rights Reserved; Subscribe to Pragcap)

Related Articles:

1. No Threat of Inflation This Year – Here’s Why

On the surface, policy settings around the world look very inflationary with large fiscal deficits and aggressively easy monetary policies yet it is hard to see inflation gaining any traction [with] global activity so weak and the monetary transmission process so impaired in many countries. There is more of a deflationary than inflationary tone to the economic environment and it does not look as if this will change any time soon.

2. What Will Cause Interest Rates to Rise? Will That Be Good or Bad?

Don’t get too worked up over interest on the national debt or what will happen when interest rates rise because, by then, we’ll likely be talking about ways to cool down the economy. [Why?] Because interest rates on US government debt are really a function of economic growth. If the economy is weak the Fed will pin short rates to stimulate the economy and if rates rise it’s going to be a function of better days ahead. Words: 525

3. A Rise in Interest Rates Would Derail An Economic Recovery – Yes or No?

[While]… I am not currently predicting an acceleration in inflation [I believe]…that the risk of interest rate instability is very real [given that] core inflation is already above a key benchmark that the Fed has staked its credibility on,. It should be of concern to investors that, despite economic growth being so anemic and overall resource utilization being so low (including human resources), there is currently very little margin for error on the inflation front. [In this article the author evaluates the danger that rising interest rates could potentially have on the U.S. economy.] Words: 2050

4. Soros Sees Interest Rates Soaring Soon – What Does That Mean for Bonds & Gold?

The U.S. economy is picking up steam and the Fed’s quantitative-easing approach is helping and as a result investors should watch out for a possible spike in interest rates once growth is well under way (later this year) warns billionaire financier George Soros. It has been suggested that this would adversely affect bonds but not everyone agrees. Read on!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money