The developed world is swimming in debt in a proverbial sea of sharks without a life raft anywhere to be found.

to be found.

If we have learned nothing about ourselves since 2008 we should now, at bare minimum, know that there are really only two viable options or outcomes to the furtive policies of our central bankers and the governments of the developed world:

- global economic melancholy or

- very high inflation

and it is our contention that the policymakers have preselected door number 2 and that over the following years we will experience the anguish of severe inflation. Here’s why.

The above introductory comments are edited excerpts from an article* by Darren V. Long (guildhallwealth.com) entitled A Sinking Boat Without A Life Raft In A Sea Of Sharks

– Can You Survive?.

Long goes on to say in further edited excerpts:

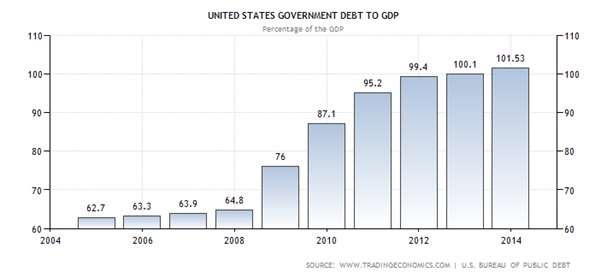

U.S. Government Debt

The basic premise for this argument is a simple one:

- The U.S. government, “arguably” still the largest economy in the world, is staring at total obligations of US$115 trillion with a debt-to-GDP ratio which is off the charts, at last check over 101%.

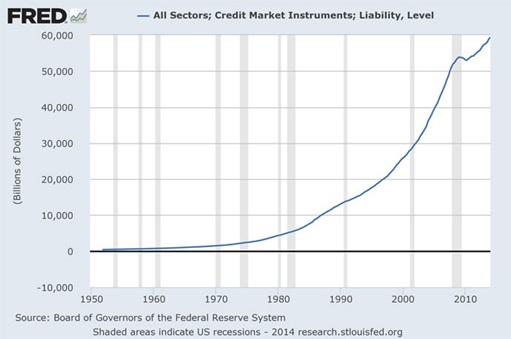

American Public Debt

The American public is also swimming in debt. Total U.S. debt at the end of the first quarter of 2014, on March 31st totaled almost $59.4 trillion – up nearly $500 billion from the end of the fourth quarter of 2013, according to the data.

Total U.S. Debt

By comparison, total debt (the combination of government, business, mortgage, and consumer debt) was merely $2.2 trillion 40 years ago.

Under this scenario, it is arguable that the U.S. will try to reduce this debt through the usage of a sustained increase in the money supply, more commonly referred to as “monetary inflation”.

- Growth In National Debt Is 86% Correlated to the Price of Gold! Got Gold?

- There’s debt, Then There’s Debt, Then There’s U.S. DEBT

U.S. Monetary Base

If you have any reservation whatsoever, take a look at the chart below, which captures the incredible expansion in the U.S. monetary base.

As you can see [in the chart above], over the past six years, the monetary base in the U.S. has expanded from approximately US $848 billion, in January of 2008, to a bewildering US $4.1 trillion and, believe it or not (by the way I am certain this sideshow will be posted in a Ripley’s museum at some point in the future), until now, this surge in the monetary base has not produced a highly visible inflationary impact…yet that is.

- Monetary System Collapse Guaranteed – Here’s Why & How to Invest & Insure Your Wealth Accordingly

- A Crash of the Financial & Monetary System Seems Inevitable. Here’s Why & How to Prepare

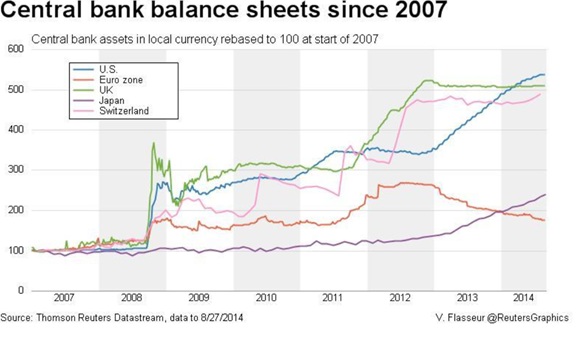

Major Central Bank Balance Sheet Growth

It is also noteworthy that the U.S. is not alone in pursuing inflationary policies. All over the world developed nations are printing money and debasing their currencies. In this era of globalization no country wants a stout currency and as a result many of these very countries are betrothed in competitive currency devaluations as we speak. This massive money and debt creation will cause an inflationary explosion over the coming years at some point.

In fact, those who believe fallaciously that deflation is more likely should consider the chart below, which highlights the mind-boggling expansion in the balance sheets of various central banks.

As you can see, there are several nations participating in this economic calamity of sorts by printing copious amounts of money; many of which have been in the same race since 2008.

- The Currency War: Which Country Will End Up With the Fastest Currency in the Race to the Bottom?

- Gold Has a Clear Advantage in Developing Global Currency War – Here’s Why

Inflation vs. Deflation

Despite this clarity many prominent commentators remain steadfast on calling for deflation. “After all,” they argue, “how can inflation be a problem when bond yields are so low?” Well, these deflationists seem to be missing the point because the US Treasury market is no longer an entirely free market and hasn’t been, along arguably with many other markets like silver and gold, since 2008 and perhaps much before that.

Excessive Money Printing = Inflation

The Federal Reserve’s intervention, in the form of good ole’ dirty and excessive money printing, is largely accountable for keeping bond yields artificially low while at the same time leaving the impression that the stock market and, for that matter many other markets, are witnessing substantiated rebounds.

However, over the past several years the Federal Reserve itself has purchased most of the net new issuance of Treasuries. This is a desperate act which the central bank in the U.S. uses in order to keep interest rates low. However, it is buying these Treasuries by creating currency (paper money) out of thin air. This is inflationary (either now or long term) and those that do not accept this premise are, with all due respect, daft.

- Inflation Will Become a Huge & Growing Problem Beginning In 2015 – Here’s Why

- High Inflation IS Coming – It’s Just A Question Of When – Here’s Why

If our assessment is correct then, somewhere in the near future, the Federal Reserve will lose its battle and T-bond yields will soar. As more and more bond investors wake up to this impending inflationary hazard, they will start demanding a higher rate of return on their money. When that happens the dyke will burst and the Federal Reserve will become superfluous.

Gold & Silver

Inflation would certainly make U.S. debt more manageable but it would also water down the purchasing power of the U.S. dollar even more so then is happening already. Of course, this inflationary agenda is not a secret and this is why many creditor nations with huge reserves are beginning to diversify away from the U.S. dollar and into assets such as gold and silver; it should come as no surprise that the largest holder of U.S. debt is also now arguably about to become largest holder of physical gold in the history – unless, of course, you still believe that Fort Knox holds the gold they claim to have been keeping for decades.

- United States Gold Bullion Depository: Fort Knox or Fort NOT?

- Gold Rush Is On In China (to replace USD with a gold-backed Renminbi?)

Conclusion

In the past, when chapters of inflationary stories have been written, the ending has always been the same; a spiraling out of control for a period of time and a momentous growth in the value of hard assets [such as gold and silver]. This trend is expected to continue. Furthermore, on a comparative basis, we expect precious metals and commodities to outperform all other asset classes.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://guildhallwealth.com/a-sinking-boat-without-a-life-raft-in-a-sea-of-sharks-can-you-survive/ (©2014 Guildhall Wealth Management Inc.)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. United States Gold Bullion Depository: Fort Knox or Fort NOT?

If you believe the government routinely lies or covers up its actions, we can’t simply laugh off the idea that there’s no gold in Fort Knox. Until an audit is done, the facts provide more questions than answers. [This article explores the situation, implications and possible ramifications.] Words: 892 Read More »

2. Gold Rush Is On In China (to replace USD with a gold-backed Renminbi?)

China consumed, mined and imported the most gold ever in 2013. Does this mean that the PBOC in Beijing plans to eventually back its currency, the Renminbi, with gold with a view to replacing the U.S. dollar as the world’s reserve currency? Here are the details. Read More »

3. Inflation Will Become a Huge & Growing Problem Beginning In 2015 – Here’s Why

A temporary period of deflation will result from the end of the Fed’s massive asset purchases followed by a period of inflation that will make the ’70s seem like an era of hard money. Here’s why. Read More »

4. High Inflation IS Coming – It’s Just A Question Of When – Here’s Why

There have been many econoblog posts of the form, “ha, ha, the people predicting inflation have been wrong so far, when will they give up?”. Let me try to explain why we know high inflation is coming eventually. Read More »

5. U.S. Gov’t Ensnared in a Debt & Interest Rate Trap – Here’s What It Means For Gold

Should the Fed raise interest rates at some point in the future, as is widely expected, such higher interest rates might bring far worse consequences than can be achieved by simply staying the course. While some small, even token, rate hike would be tolerable, a return to historical norms could reap consequences in the general economy far beyond the direct effect on the federal government’s fiscal status. The fact is that the federal government is ensnared in a debt and interest rate trap of its own making from which it will be difficult to extricate itself. Read More »

6. What Affect Will Rising Interest Rates Have On Inflation & the Future Price of Gold?

Though the stock, bond and currency markets, at the moment, are preoccupied with the question of when the first interest-rate increase will happen, the real story lies in where interest rates are ultimately headed because that answer defines where stock, bond and currency prices are ultimately headed and the reality, dear reader, is that the Fed simply cannot — and will not — allow interest rates to crawl very high. Why is that you ask? Read on! Read More »

7. What Does Current Money Velocity Say About A Future Rise In Interest Rates?

With all of the things in the world to worry about, how much should we worry about a sudden sharp increase in UST yields? The short answer is not much and here is why. Read More »

8. Inflation or Deflation: Are We Approaching the Tipping Point?

Might our Inflation-Deflation Watch be suggesting a breakout in asset price inflation is about to take place? Could it, in fact, be presaging the start of John William’s hyper inflationary depression in which prices rise exponentially even in light of massive unemployment and bankruptcies? This article analyzes the situation. Read More »

9. The Currency War: Which Country Will End Up With the Fastest Currency in the Race to the Bottom?

We believe that we are in the “competitive devaluation” stage presently [see graph below] as country after country is printing money in order to lower rates and doing whatever possible to devalue their currency – to have the fastest currency in the…race to the bottom – in order to export their goods and services. [The next stage will be protectionism and tariffs. This article gives an update on the race to debase.] Read More »

10. Gold Has a Clear Advantage in Developing Global Currency War – Here’s Why

There is an increasingly disorderly currency war going on out there, and the advantage of gold is clear– they can’t print it, they can’t default on it, and there will always be demand for it. Simply put, in the global currency wars, owning gold is like abandoning the battlefield altogether. Words: 270; Charts; 2 Read More »

11. Monetary System Collapse Guaranteed – Here’s Why & How to Invest & Insure Your Wealth Accordingly

Our monetary system is guaranteed to collapse. The central banks prints money like there is no tomorrow. The governments spends like a drunken sailor and yet inflation is benign and interest rates sit at generational lows. Banks are gaining in profitability while their bad debts are being erased by rising asset prices. What’s not to like? Plenty! This article goes into the details of the money creation process to understand how and why this is happening, what the future implications will be and how to best invest to protect oneself from these eventualities. Read More »

12. A Crash of the Financial & Monetary System Seems Inevitable. Here’s Why & How to Prepare

A crash of the financial and monetary system seems inevitable. This presentation connects the dots between issues like currency wars, rigged markets, central bankers’ interventions, statistics manipulation, monetary mismanagement and financial repression in a factual way that is also easy to understand. Read More »

13. Growth In National Debt Is 86% Correlated to the Price of Gold! Got Gold?

The correlation between the gold price, silver price and the debt growth has been amazingly accurate since 2001. Government spends too much money to perform a few essential services and to buy votes, wars, and welfare, and thereby increases its debt almost every year, while gold and silver prices, on average, match the increases in accumulated national debt. Read More »

14. There’s debt, Then There’s Debt, Then There’s U.S. DEBT

The next time someone says, “The U.S. is the richest country on Earth” correct them and state that “The U.S. is the most bankrupt and indebted country in the history of the world” because that’s reality. Let me explain. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I really like what you guys tend to be up too. This kind of clever work and coverage!

Keep up the awesome works guys I’ve included you guys to

my own blogroll.

Meanwhile, we will experience the severe anguish of those deep into the precious metals market who hope severe inflation will bail them out.