Gold is in a bull market and, [believe it or not,] so are the gold stocks despite their struggle as a group to outperform gold… but [neither] is anywhere close to a bubble, nor the speculative zeal we saw in 2006-2007. Thus, it begs the question” “What lies ahead and when can we expect the initial stages of a bubble?” To figure this out we first need to get an idea of how long the bull market will last and then where we are now based on various indice analyses. [Below I do just that.] Words: 785

Gold is in a bull market and, [believe it or not,] so are the gold stocks despite their struggle as a group to outperform gold… but [neither] is anywhere close to a bubble, nor the speculative zeal we saw in 2006-2007. Thus, it begs the question” “What lies ahead and when can we expect the initial stages of a bubble?” To figure this out we first need to get an idea of how long the bull market will last and then where we are now based on various indice analyses. [Below I do just that.] Words: 785

So says Jordan Roy-Byrne (www.thedailygold.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has further edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Who in the world is currently reading this article along with you? Click here

Roy-Byrne goes on to say, in part:

Where We Are Now in the Bull Market in Gold

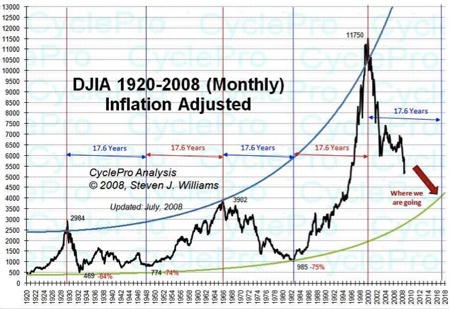

Below is a great chart from Cycle Pro Outlook. It uses John Williams’ CPI, which is consistent over time. Interestingly, Steven Williams of Cycle Pro has found a 17.6-year cycle between equity bull and bear markets. It fits fairly well with the alternation between equity and commodity bull markets.

In nominal terms the last two commodity bull markets lasted about 15 years and 18 years [each]…from 1960 to 1980 [and]…from 1923 to 1937 [when using] Homestake Mining [as] a proxy for the ancient past. [As such,] are we looking at something closer to 15 or 20 years? The following chart should answer that.

Why spend time surfing the internet looking for informative and well-written articles on the health of the economies of the U.S., Canada and Europe; the development and implications of the world’s financial crisis and the various investment opportunities that present themselves related to commodities (gold and silver in particular) and the stock market when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read.

Sign up here to begin receiving munKNEE.com’s FREE Financial Intelligence Report

[The chart below] is the Barrons Gold Mining Index, courtesy of sharelynx.com…[which] shows that the 1980 high is roughly equivalent to the 2008 high. The gold stocks broke to a new all-time high [earlier in the year] but it won’t be confirmed until they sustain the breakout and make new highs [and that has not happened as yet although] eventually the breakout will be confirmed with the next leg higher. The point here is that it is too soon to expect this secular bull market to end four or five years after a major multi-decade breakout…- far too soon.

A look at the Nasdaq [chart below shows] some similarities. The Nasdaq had its initial rise from 1982 to 1987. Following 1987, it would be four years until the market was able to breakout to sustained new highs. That was nine years into the bull market. The bubble began just before the 13th year of the bull market, in 1995. The circle shows where I think we are now based on various indices, which includes my proprietary gold and silver indices.

Bull Market in Gold Will Reach Bubble Proportions No Sooner Than 2014 and Burst No Later Than 2018

The early conclusion is that the start of the bubble is at least a few years away. Based on the price action we are likely to have a major breakout and a few years of strength which will set the stage for the start of a bubble perhaps in 2014. As you can see in the chart below the gold stocks…have not sustained a new all-time high for quite a while [and, as such,]…are ripe for a breakout and a powerful move higher.

[As mentioned previously] most bull markets last 15 to 20 years and they end in an accelerated fashion [and the current bull market run is only in its 12th year]. Based on our research, [therefore,] we believe this bull market will end close to 2020 (say 2018)…

Editor’s Note:

Sign-up for Automatic Receipt of Articles in your Inbox or via

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet edited for clarity and brevity to ensure you a fast an easy read.

2. Relax! Gold, Silver and HUI Index to Bounce Back to Major Highs in Early 2012

With the present major correction in gold, silver and the mining sector it is important to look at the big picture and see what the charts are saying from a technical fractal relationship with what happened back in 1979 when the last truely major bull run occurred. To date the situation is, frankly, no different than it was back then unfolding just as it should. As a result we can expect MAJOR upward price action in physical gold and silver and in their mining (producers, developers, explorers and royalty streamers alike) in the next few months on their way to their respective parabolic peaks in the years ahead. Read on. Words: 1265

The price of gold is still in the “Plunge” phase of the “Three-Peaks and a Domed House” pattern [and is projected to drop to the lowest price of the enitire pattern which is $1,300 per troy ounce. Yes, $1,300! Words: 868

4. Will Gold Drop as Low as $1,200 Before Spurting to $2,000?

In the long run developments in the financial markets and around the world seem to conspire to whip up a perfect storm for the gold price, taking it up towards $2,000 and further. That new upleg, however, could very well start from a much lower level than now. There are quite a few developments that could easily send the gold price lower in the coming months. Is $1,200 gold in the cards? Words: 739

5. Update of Alf Field’s Elliott Wave Theory Based Analysis of the Future Price of Gold

The Elliott Wave Theory (EW) gives superb results in predicting the gold price. [While] it is a complicated system with many difficult rules [which] I explain in simple terms in this article, [I have determined that] once this present correction in gold has been completed it should [undergo] the largest and strongest wave in the entire gold bull market. The target for this wave should be around $4,500 with only two 13% corrections on the way. [Let me explain how I came to that conclusion.] Words: 1924

6. Situation is Ultra-bullish for Gold & Silver Bullion and Stocks! What are You Waiting For?

The technical situation is ultra-bullish for both gold and gold stocks. Sentiment indicators…continue to show [that] the dollar is poised for a serious decline and the MACD on the gold chart is giving one of the most powerful buy signals in the history of the bull market. The GDX should reach $75 a share by year-end and gold should push to new highs in the $2000 area by January of 2012 [while silver] could possibly be the best investment opportunity available to investors for many years to come! [Let me explain and back up my comments with an array of charts.] Words: 781

7. Don’t Delay a Day Longer! NOW is the BEST Time To Purchase Gold

What’s the best time to buy gold on a seasonality basis? November! Over the past 40 years (basically since gold became legal for private ownership in the U.S.) November and December accounted for almost HALF of the year’s gains for gold…If this year is anything at all like the previous 40, we’ll see about 44% of the year’s gains in November and December. That’s huge. [That being said: Don’t delay a day. NOW is the BEST time to purchase some gold.] Words: 700

8. History Says Silver Could Become the Next 10-Bagger Investment! Here’s Why

If you concur with the 159 analysts (see below) that maintain that physical gold is going to go parabolic in price in the next few years to $3,000, $5,000 or even $10,000 or more then you should seriously consider buying physical silver. Why? Because the historical gold:silver ratio is so way out of wack that silver should appreciate much more than gold as it goes parabolic in the years to come. Indeed, silver could easily reach $100 – $200 per troy ounce, maybe even $300 and conceivably in excess of $400 depending on how high gold goes. The aforementioned may be hard to believe but an analysis below of the historical price relationship between silver and gold suggests that such will most likely occur if gold does, indeed, go parabolic. Take a look. Words: 1423

9. Is Gold On Its Way to $3,000, $5,000, $10,000 or Even Higher? These Analysts Think So

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money