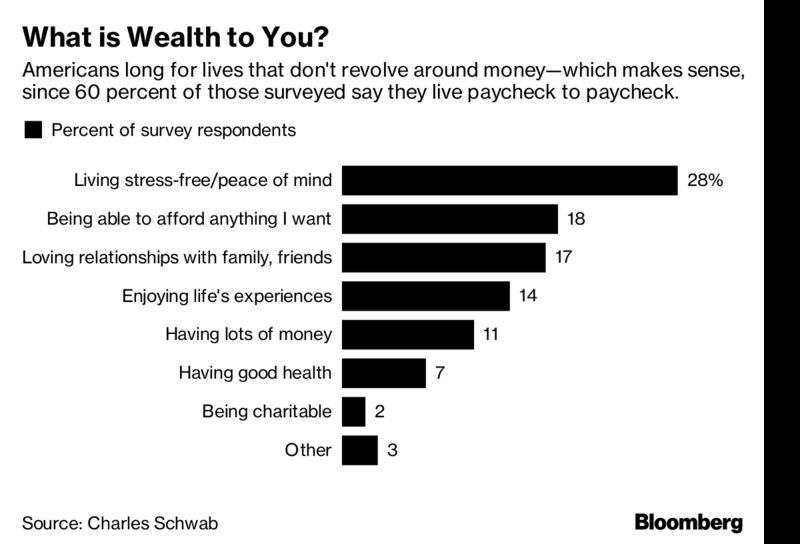

What does it mean to be wealthy to you? For many Americans, it can mean being able to leading a life that is stress free, while having “peace of mind”. Sounds pretty good, right? On the surface, that doesn’t sound too much like money is the focus. However, it could also be said that that same money, or perhaps, a lack of it, can lead to a certain stress factor.

stress free, while having “peace of mind”. Sounds pretty good, right? On the surface, that doesn’t sound too much like money is the focus. However, it could also be said that that same money, or perhaps, a lack of it, can lead to a certain stress factor.

The original article has been edited here for length (…) and clarity ([ ]). For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE tri-weekly Market Intelligence Report newsletter (see sample here)

According to Bloomberg, many Americans do not feel the need to admit that assets are able to purchase happiness. A mere 11% of those who were surveyed for Charles Schwab’s second annual Modern Wealth Index selected “having lots of money” as what it means to be wealthy…

That being said,

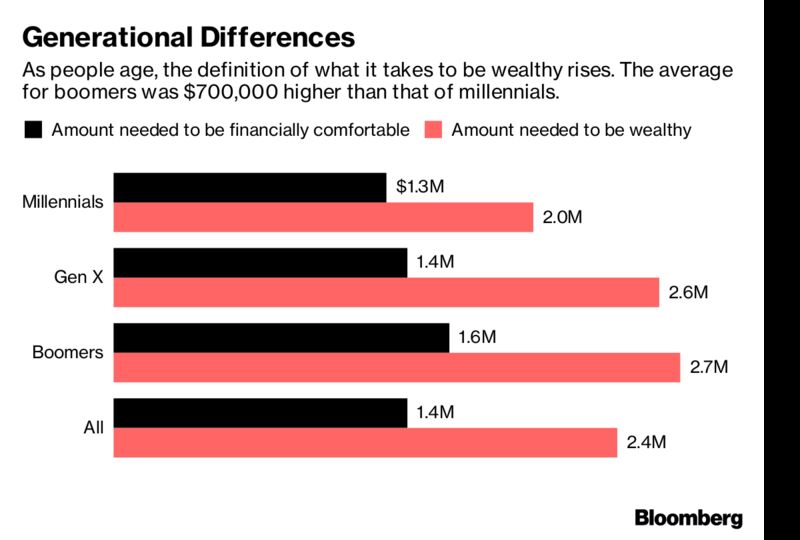

- to be financially wealthy and comfortable in America today requires an average of $1.4 million, which is up from $1.2 million a year ago, per the survey…

- the net worth needed to be “wealthy” would be an average $2.4 million, which is the same as last year in the online survey of 1,000 Americans between age 21 and 75.

All You Need Is “Wealthy” Love?

With that, there were some other positive findings in the results.

- Despite 18% having defined being wealthy as being able to afford anything they wanted,

- 17% mentioned that it was “loving relationships with family and friends,” as the true meaning of wealth and fortune…

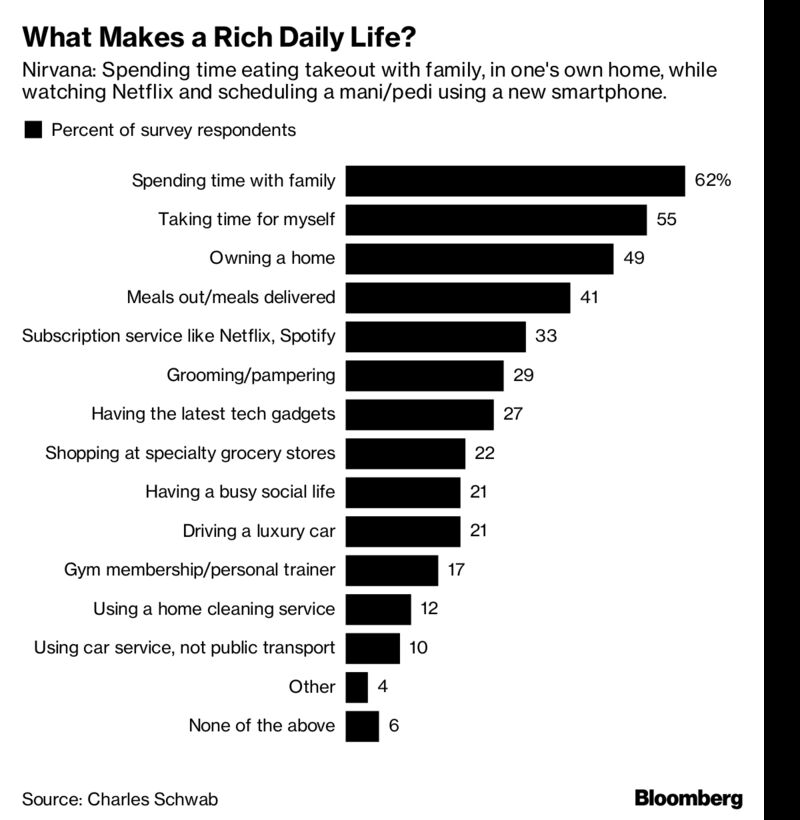

The survey also asked respondents to select which of the below statements came closest to their personal definition of being wealthy. When asked about what made respondents feel “wealthy” in their daily lives, the survey found that:

- 62% cited family time was most commonly cited, at 62% overall.

- 55% cited “taking time for myself.”

Alas, it can be rough to accomplish either “wealthy” feat without having some money to go along with it.

You Can’t Be Wealthy Without a Little Luxury, Right?

Not surprisingly, it was found that the little things can matter, too, especially when it comes to luxury. The numbers found that:

- 41% of people decided that having meals out or food delivered made them feel “wealthy” in their daily lives.

- Services such as Netflix, Spotify or Amazon Prime were able to help make 33% of respondents feel richer, particularly millennials at 44%, compared with 29% for Generation X and 23% for baby boomers.

- Some of the write-in comments for what made people feel “wealthy” included “access to healthcare,” “being able to help close friends and family financially” and “just waking up in the morning.”

Is It “Luck”? Or “Hard Work”?

For all the bashing that millennials may sometimes receive, it can’t be discounted that their young optimism was clearly visible when thinking about their finances.

- A large 64% of 20 and 30 somethings feel that they will be wealthy, when it comes to money, at some point in their lives, versus 22% of baby boomers.

…The survey underscores that those with a written plan for their finances feel more stable, period, yet…52% of baby boomers mentioned they didn’t have a plan in place because

- they didn’t have enough money to need a plan.

- they had…trust issues with financial people, especially after the 2008 crisis”

- and “all my information has been compromised by criminals.”

Optimistically, the survey found that:

- 49% of people said that saving and investing is “the key to wealth,”

- 40% said it was the result of…“hard work.”

- The remaining 11%? Luck.

Support our work: like us on Facebook, follow us on Twitter, or share this article with a friend. munKNEE.com – Voted the internet’s “most unique” financial site! (Here’s why)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money